Download the PDF version.

March 2022

Summa Global Advisors, LLC, (“Summa,” “we,” “us,” “our”) is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. Brokerage and investment adviser services and fees differ, and it’s important for you to understand the differences.

Free tools to research firms and financial professionals are available at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing.

What investment services and advice can you provide me?

Our standard service includes comprehensive investment management and financial planning. No two accounts are ever the same, since every portfolio is customized to meet your individual needs and preferences. We continually monitor your portfolio to watch for changes in the holdings, in the market, or in your financial situation. You are charged one fee, a percentage of your assets, for management and financial planning.

Infrequently, we consult on specific investment and financial planning issues for a one-time fee when ongoing monitoring is not necessary or desired.

Your assets will be held at a discount broker-dealer (custodian) who has the obligation to report the value of your account directly to you. Online access to your accounts is a standard feature offered by your custodian. Holding your assets at an unaffiliated custodian is an additional safeguard for you.

We generally manage accounts on a discretionary basis. When you sign an advisory agreement with us, we’re allowed to buy and sell investments in your account without asking you in advance. Any limitations will be described in the signed agreement. We retain discretionary authority until the agreement is terminated by you or us. Any restrictions must be documented in writing and accepted by us. We do not restrict our advice to limited types of products or investments. If you do not provide us with discretionary authority, you will make the ultimate decision regarding the purchase and sale of investments.

Our stated minimum account size is $500,000, but we reserve the right to waive the minimum.

For more detailed information about our services, please refer to our Firm Brochure, which is available at https://adviserinfo.sec.gov/firm/summary/148713.

What fees will I pay?

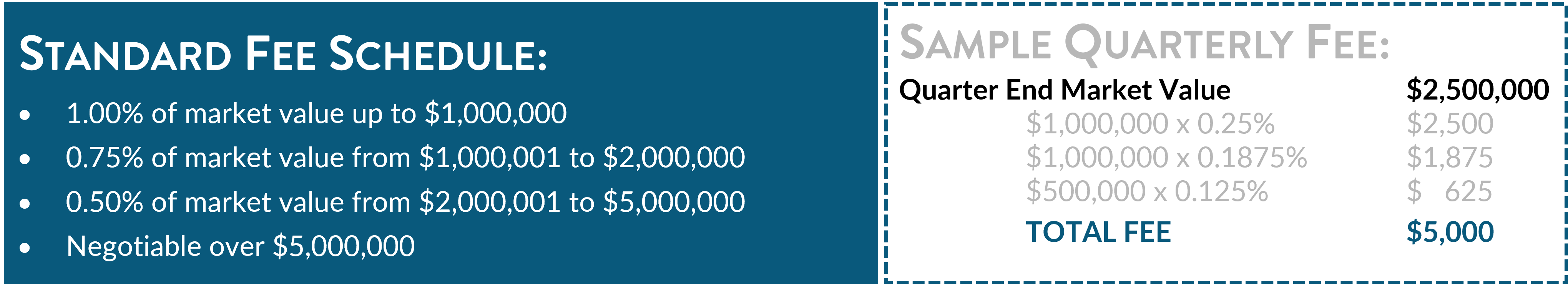

We charge an annual fee based on a percentage of your assets. You are billed quarterly, in advance, based upon the market value of your assets at the end of the previous quarter. Our standard fee schedule is as follows (rates are annualized):  Summa consults on investment and financial planning issues at an hourly fee ranging from $250-$500.

Summa consults on investment and financial planning issues at an hourly fee ranging from $250-$500.

When we buy or sell an investment for you, your custodian may charge a transaction fee. These transaction fees are in addition to Summa’s fees for our investment management service. The custodian may also impose charges for certain investments and maintaining your account. Also, some investments, such as mutual funds and exchange traded funds, charge additional fees that will reduce the value of your investments over time.

You will pay fees and costs whether you make or lose money on your investments. Fees and costs will reduce any amount of money you make on your investments over time. Please make sure you understand what fees and costs you are paying.

Since our fees are based on a percentage of your assets under management, we are incentivized to increase those assets.

For more detailed information about our fees and your investment costs, please refer to our Firm Brochure, which is available at https://adviserinfo.sec.gov/firm/summary/148713.

What are your legal obligations to me when acting as my investment adviser? How else does your firm make money and what conflicts of interest do you have?

When we act as your investment adviser, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we make money creates some conflicts with your interests. You should understand and ask us about these conflicts because they can affect the investment advice we provide you. Here are some examples to help you understand what this means.

As a fee-only advisor, a conflict of interest may exist anytime we recommend that you keep your assets under our management rather than moving them elsewhere. For example, recommending that you roll over an account into an account managed by our firm or recommending that you keep assets in your account rather than satisfying a debt obligation would involve a conflict of interest.

Since our fees are based on a percentage of your assets under management, we are incentivized to increase those assets. This could lead to risk-taking for the sake of chasing additional fees.

We work primarily with two custodians: Charles Schwab and Fidelity. These firms may, on occasion, provide discounts on various practice management tools, including seminars and software. However, these services are provided by the custodian, to us, at no extra cost to the client.

For more detailed information about our conflicts of interest, please refer to our Firm Brochure, which is available at https://adviserinfo.sec.gov/firm/summary/148713.

How do your financial professionals make money?

Our financial professionals are paid a salary and a discretionary bonus based on the revenue our firm earns from advisory services. Our financial professionals receive no product sales commissions or other forms of payment.

Do you or your financial professionals have legal or disciplinary history?

No. Visit Investor.gov/CRS for a free and simple search tool to research us and our financial professionals.

For additional information about our services, visit summaglobal.com or see our Firm Brochure. You may also contact us or request a copy of this relationship summary through our website.

If you would like additional, up-to-date information or a copy of this disclosure, please call 503.636.2022.