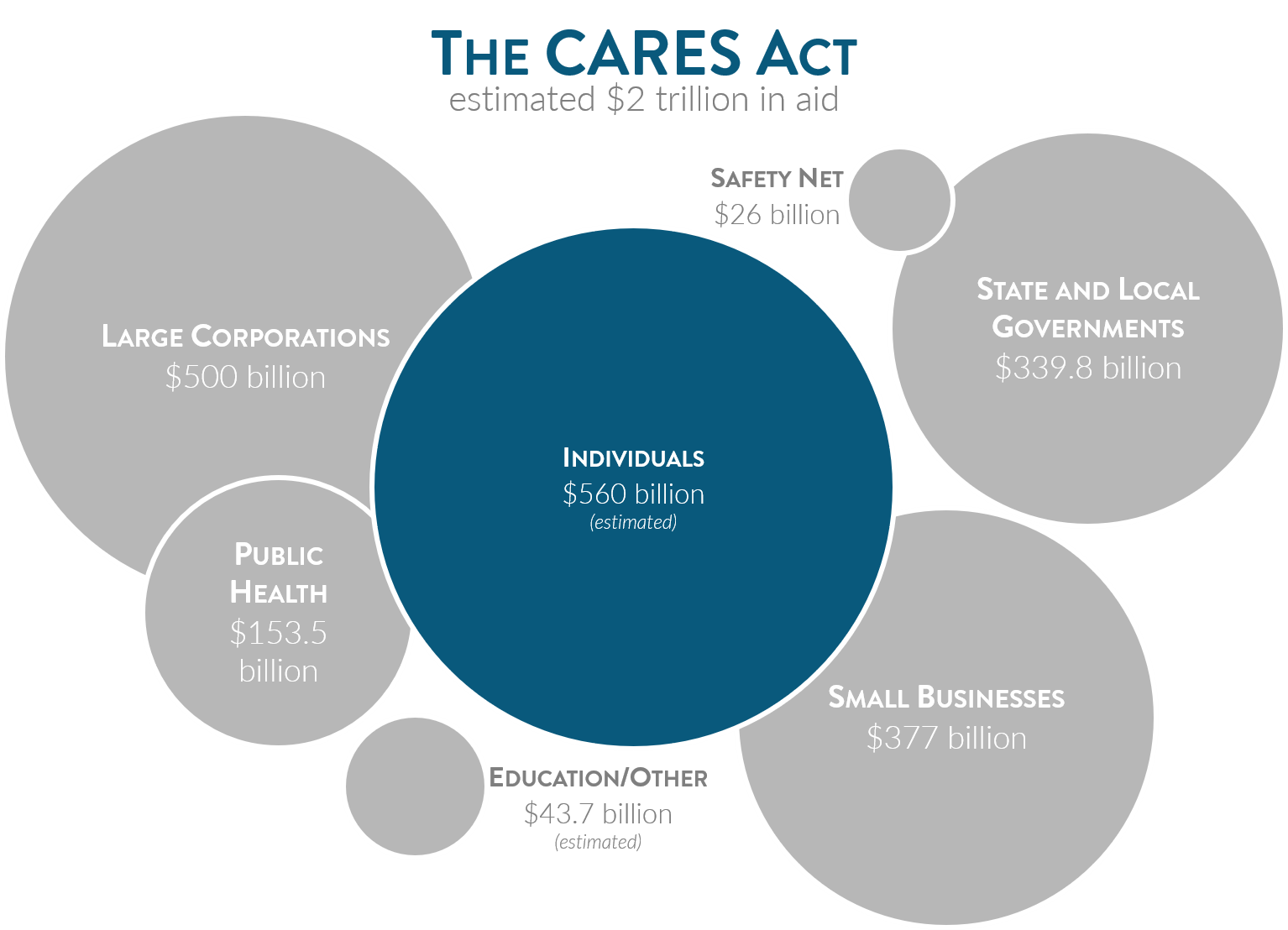

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on Friday, March 27, 2020. This legislation provides relief for individuals and businesses negatively impacted by the coronavirus pandemic.

Though the scope of the package is extensive, we will focus on a few key points for individuals. Below is a summary of some changes that may affect you.

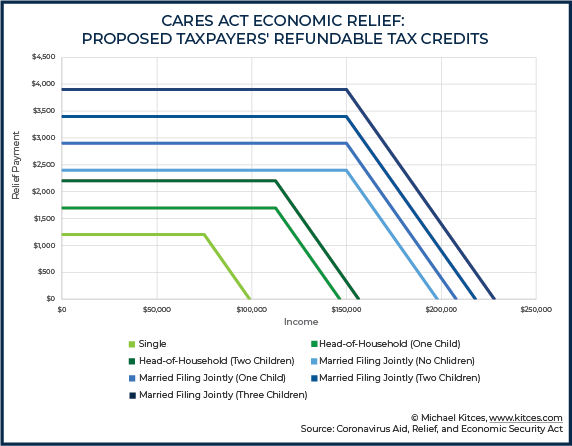

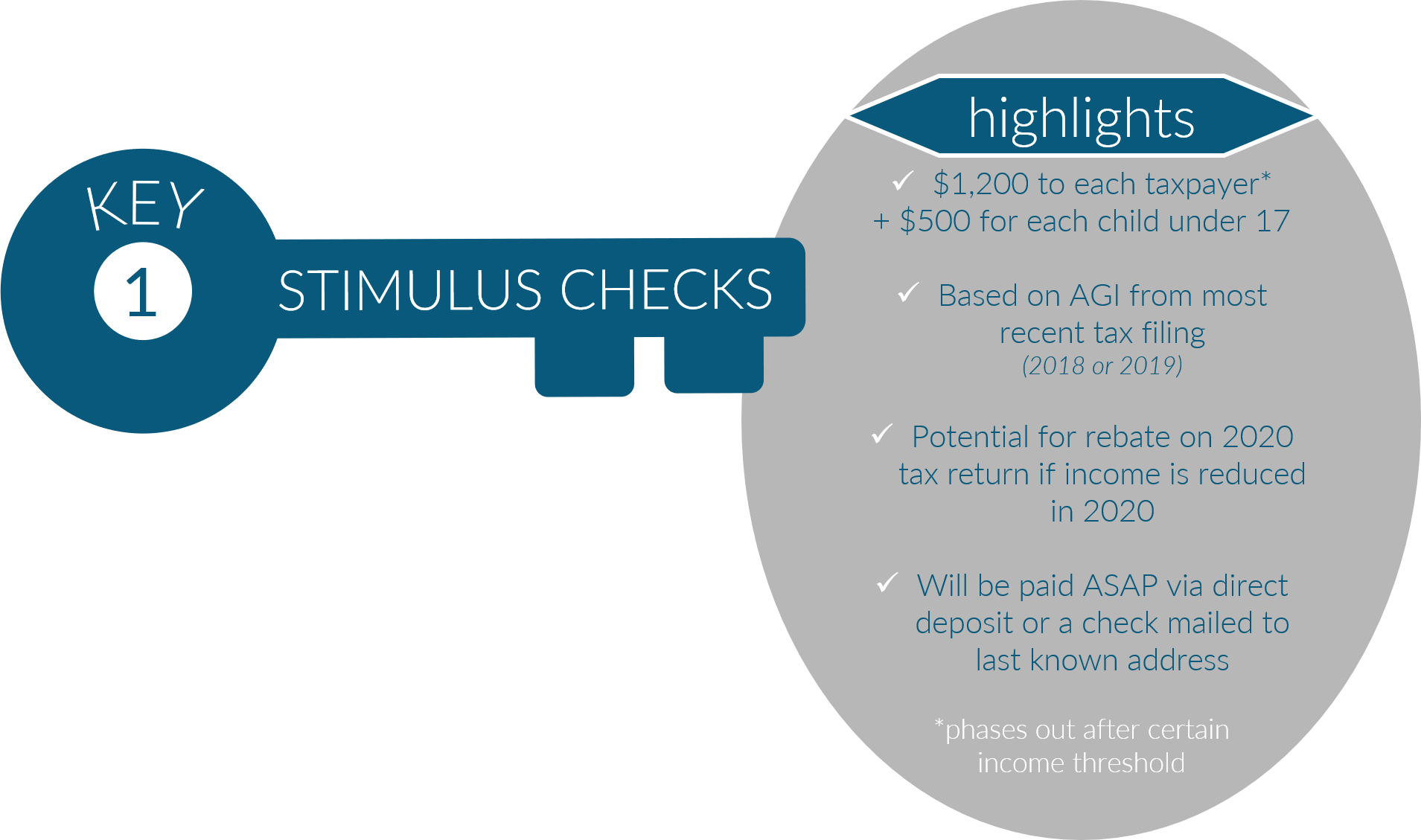

Stimulus checks begin at $1,200 for each taxpayer, and an additional $500 for each child under the age of 17. See the chart below for an example of how the phase-out works.

The amount you receive will be based on the AGI from your most recent tax return. Practically speaking, if 2019 was be a more favorable tax year (lower income) for you than 2018, you should escalate your tax filing before the Treasury readies the payment (currently there is no information available on when the “drop-dead” date will be, so best to get it done ASAP)!

Click on the check below to calculate how much you will receive.

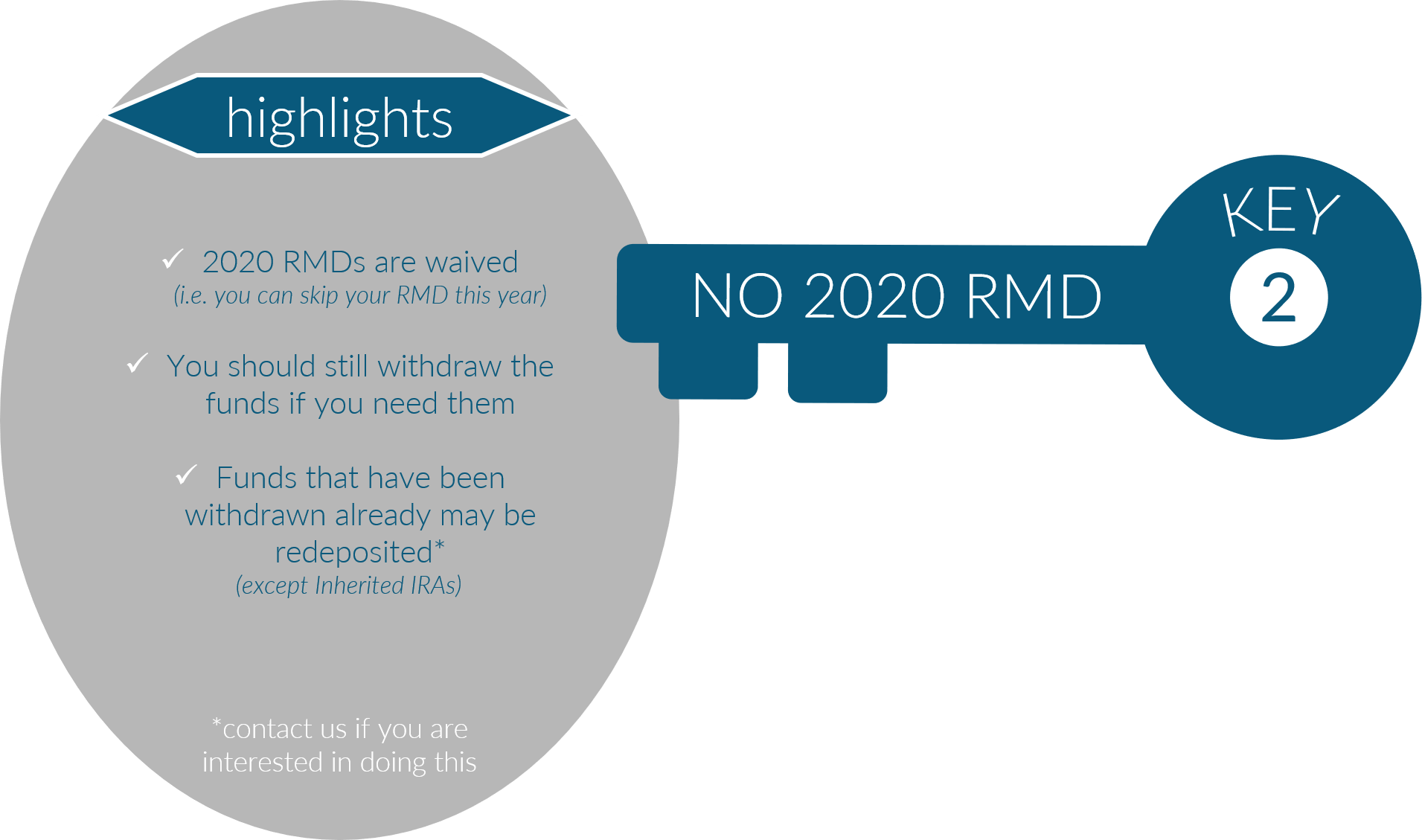

Required minimum distributions (RMDs) are waived for 2020 from IRAs (including inherited IRAs) and retirement plans such as 401(k). If you need the funds, you should still take however much you need.

Please contact us immediately if you wish to stop recurring distributions coming from your IRA. Those who have already withdrawn part or all of their RMD for the year are able to redeposit the funds. However, this process can be complicated, so if you’re interested, please contact us. Unfortunately, Inherited IRAs are the exception to this rule – funds are not permitted to be redeposited under any circumstances.

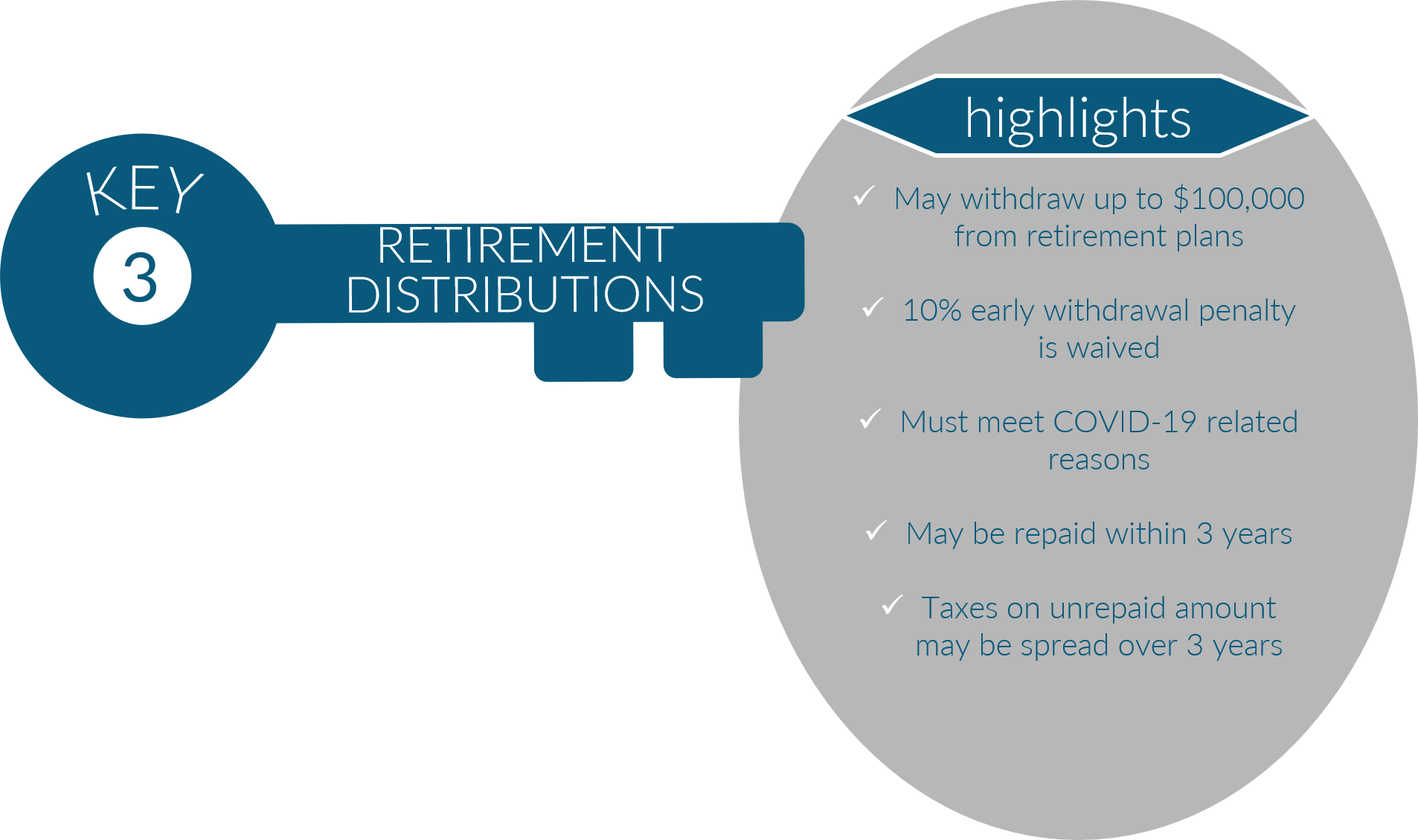

Ordinarily, distributions from IRAs before age 59½ incur a 10% early withdrawal penalty in addition to income taxes. The CARES act, however, allows for early withdrawal of up to $100,000 in 2020 with no penalty for those affected by COVID-19 (click here for more details on who qualifies). Income tax is still due on the funds withdrawn, but may be spread over three years. Additionally, the funds may be redeposited into the account within three years.

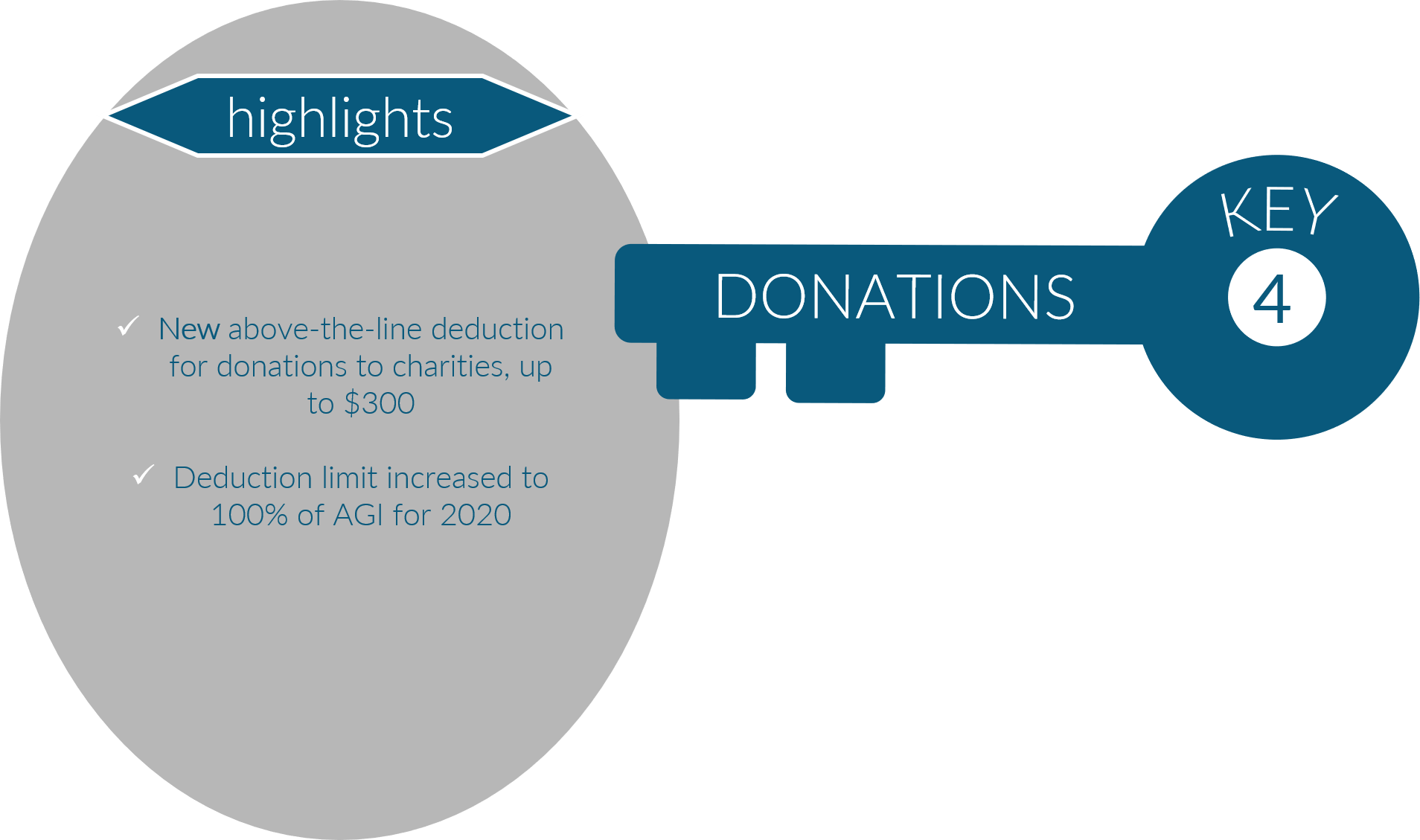

Normally, cash donations can be deducted up to 60% of Adjusted Gross Income (AGI). The CARES act increases that limit to 100% of AGI in 2020, making it possible for a $0 income year.

In addition, the CARES act creates a new temporary provision for a $300 above-the-line deduction for cash donations to a 501(c)(3) charity.

Please contact us for more details on how to take advantage of these changes.

Bonus Keys:

- Student loan payments are deferred until September 30,2020 (no interest will accrue)

- The federal government will fund additional unemployment compensation

For more information, please visit the following resources:

- Read the CARES Act in its entirety

- Analyzing the CARES Act by Michael Kitces

- Summary of the CARES Act by Investopedia

- What’s in the CARES Act and How it Affects You by Kimberly Amadeo

- Summary and 10 Takeaways from the CARES Act by Foley and Lardner LLP