Every day we take risks. For “adrenaline junkies” it may mean jumping out of an airplane at 10,000 feet, riding the steepest roller coaster in the world, or swimming with sharks. But even those of us who are more risk-averse take some risks – like driving a car or playing sports. Approximately fourteen auto-related accidents[1] and six sports-related injuries[2] happen every second in the U.S., yet motor-vehicles remain the primary means of transportation and sports are a normal part of many peoples’ lives.

Why? Because the reward makes the risk worth it. We skydive for the views, beauty, and thrill. We ride roller coasters and swim with sharks for the joy and adventure that comes with it. We prefer driving over less risky options to get from Point A to Point B, and we’re willing to risk getting injured playing sports because of the pleasure they bring.

Game-show contestants take chances, knowing that they could lose everything, because the reward, or winning, outweighs the risk. They understand that, in order to win the ultimate prize – a big pile of cash, a dream vacation, a car, or all of the above – they must take some risk. The bigger the prize, the bigger the risk, usually.

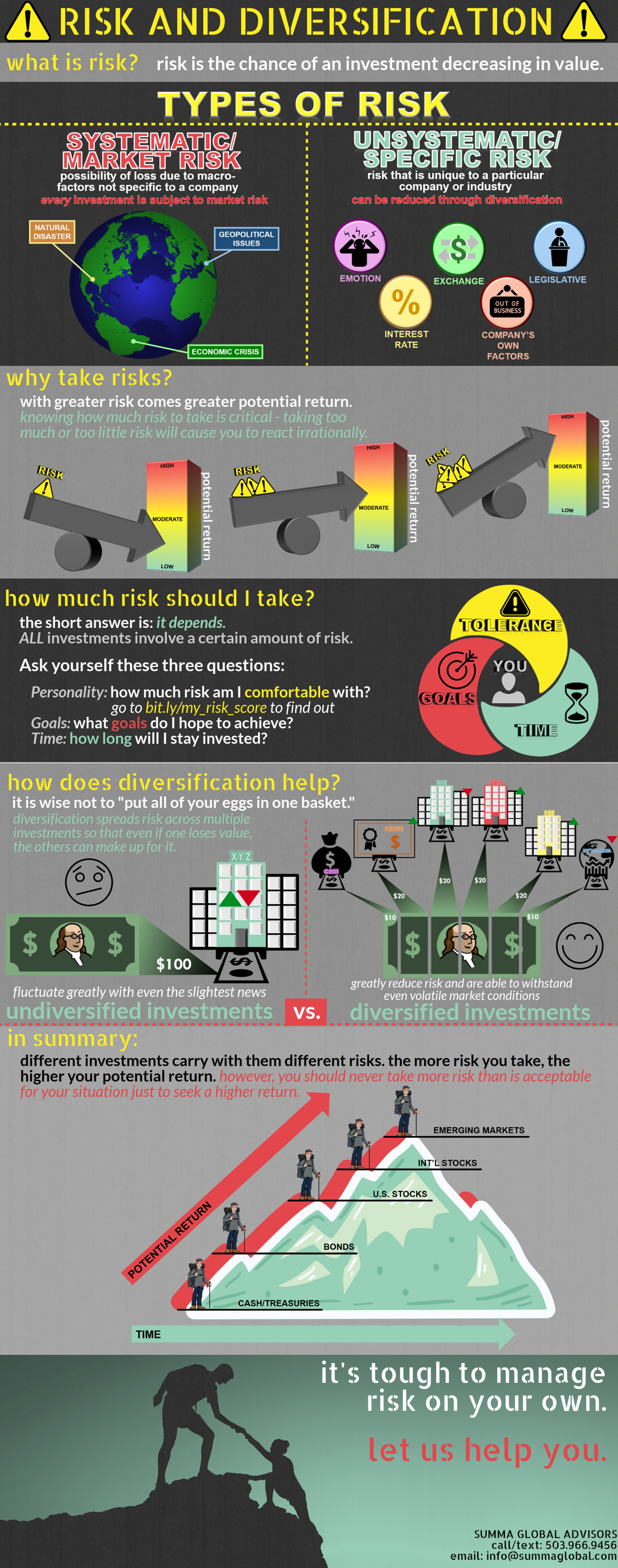

Investing is similar to these examples. Just as every activity involves risk, so does every investment – some more than others. A good understanding of risk and reward and their relationship to one another is essential to investing.

In this prescription, we try to give you a high-level view of risk, dissect the risk inherent in stock investing, and help you understand why taking on risk when it comes to investing (and reaching your goal) is not scary at all! Wherever your Point B may be, we can get there together!

Footnotes:

[1] U.S. DOT, NHTSA Traffic Safety Facts. DOT HS 812 501. March, 2018. https://crashstats.nhtsa.dot.gov/Api/Public/Publication/812501

[2] National Health Statistics Reports. Number 99. November, 2016. https://www.cdc.gov/nchs/data/nhsr/nhsr099.pdf

View other posts in the series: