The following information has been updated for 2021 and 2022.

Before the busy holiday season is in full swing, now is a great time to do some year-end planning, especially for items that have an expiration date of December 31. There are several simple and smart actions you can take between now and the end of the year (and beyond).

Income Tax Mitigation

By this time of the year, you should have a good idea of your total household income, as well as anticipated expenses (property tax, insurance dues, holiday gifts and donations, traveling plans, etc.).

Some workers may have received unemployment insurance and the Pandemic Unemployment Assistance (PUA) authorized in the CARES Act of 2020 and extended by the American Rescue Plan Act in 2021. Regular unemployment benefits and PUA have provided a much-needed safety net during the coronavirus pandemic, especially for self-employed, freelance, and part-time workers. These benefits are considered taxable income and must be reported on your federal and state income tax returns.

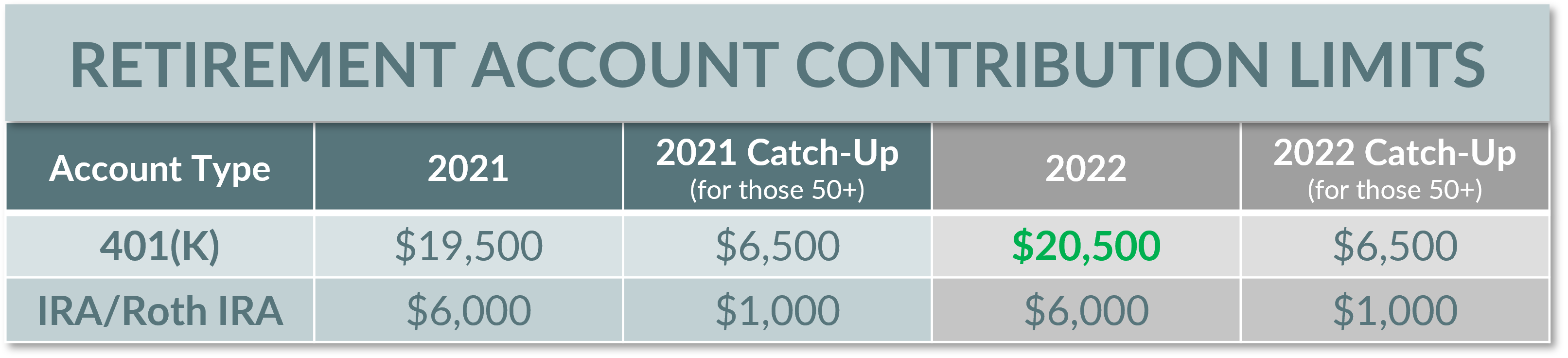

If your work situation is stable and household expenses are predictable, maximize retirement savings by looking at your cash flow situation. Then find ways to contribute into a retirement-savings vehicle, whether that is a 401(k) or other plan offered by your employer, or an individual retirement account (IRA). IRA contributions can be made up to the tax-filing day (April 15), but 401(k) deferrals must go into your plan account by the end of the calendar year for them to count towards 2021. Limits on those contributions are $6,000 ($7,000 for taxpayers 50 and above) and $19,500 ($26,000 for participants 50 and above) for IRA and 401(k), respectively. In 2022, the contribution limit for 401(k)s will increase to $20,500, while those over age 50 will be able to contribute up to $27,000. The contribution and catch-up limits for IRAs will remain at $6,000 and $1,000 in 2022. See the table below for a summary.

For those covered by a high-deductible health plan (HDHP), you can contribute tax-free into your health savings account (HSA) with no income phaseouts. The 2021 limits (including amount from your employer) are $3,600 for single taxpayers and $7,200 for families. Limits will increase to $3,650 (single) and $7,300 (family) in 2022. There is also a $1,000 catch-up for primary plan owners 55 and above. Distributions used on qualified medical expenses are tax free. HSAs receive tax-free treatment on contributions, growth, and distributions, making them a top-notch savings vehicle.

Flexible spending account (FSA) owners need to look at their account balances now. Generally, any unused funds are forfeited at the end of the year. This year, however, workers can carry over their entire balance into 2022. Be sure to check whether your employer opted into this change. If your FSA has a large balance, consider changing next year’s contribution amount. For ideas on how to spend down your FSA, read 42 Ways to Spend FSA Cash Before the Year-End Deadline. The federal government has made several changes to expand what FSA funds can be spent on during the pandemic.

For those covered by Medicare, annual open enrollment (currently open until December 7) allows you to review options and sign up for a new or different plan if desired. We have a local Medicare agent who can help members in Oregon and SW Washington, contact us for more information.

Charitable Gifts

In general, there are two ways to be charitable: giving assets and giving time. This year (2021) is especially “tax-friendly” for cash donors, thanks to the American Rescue Plan Act passed in March of 2021.

- If you do not itemize (the case for most taxpayers), you can deduct up to $300 per person from your income on cash donations made a public charity. For more details, check out this Kiplinger article.

- If you do itemize (roughly 1 out of 10 tax returns), the 60% deduction limit against adjusted gross income (AGI) is suspended and you are able to deduct up to your entire AGI. For example, if your AGI in 2021 is $50,000 and you write a check for that amount to the American Red Cross, your taxable income would be $0. If you are in a position to be philanthropic, now is the time to make use of this unprecedented benefit, which may not be available in the future.

Here are some other general charitable donation guidelines.

- For gifts under $500 – cash donations are effective for smaller gifts. Some of these don’t get acknowledged by the receiving charitable organizations. A good example is the Salvation Army red kettles outside a supermarket during the holiday season. Be sure to keep the receipts and a list of used items donated to Goodwill for tax purposes.

- For gifts $500 and above – we won’t stop you from giving cash if that is what you want to do. Some charities are set up to only accept cash or checks anyway. But if your favorite ones can – and most do – accept securities such as stocks, you should take a look at your investment portfolio and see which route may be better for you. Giving appreciated stock is very tax effective because you avoid realizing capital gains and paying tax on them while doing good!

Available only to IRA owners who are over 70½, the $100,000 tax-free qualified charitable donations (QCDs) can reduce your required minimum distribution (RMD) amount while lowering taxable income, dollar for dollar and up to the limit. More and more taxpayers are taking advantage of this! However, it’s important that you follow the rules in order for the donation not to be recognized as income. Also, if you take a distribution satisfy your RMD before doing a QCD, the donation will still be tax-free but the distribution you took first is considered taxable income. In other words, if your goal is to minimize a taxable RMD, be sure to process QCDs first.

Check out our recent blog post for more details and ideas on how make the most of your charitable donations.

Personal Gifts

Instead of cash, sometimes it may be wise to give appreciated investments to family members, particularly those with little or no income. Tax on long-term capital gains is omitted (0%) for married couples with taxable income up to $80,000 (singles $40,000). (Note: When gifting stocks, always gift stocks with long-term gains. Short-term gains are taxed as ordinary income and it’s a bad idea to gift stocks with losses.) Gifts under $15,000 do not have to be reported to the IRS and gift recipients do not incur gift tax either.

Workplace Benefits

Now is also an excellent time to re-evaluate your employment benefits and make adjustments if necessary. Many companies are currently accepting changes during their annual open enrollment period, which usually ends in mid-November. A few of the common benefits to review include:

- Group health plans – if you have big plans in mind for the upcoming year, it’s wise to align the benefits available to your needs.

- Group life insurance – is generally cheaper than individual policies and doesn’t require a medical exam.

- ESPP, or Employee Stock Purchase Plan – allows employees who work for a publicly-traded company to buy the company stock at a discount (typically 15%).

- Company discounts and wellness programs – it pays to read through your employee benefits packet for discounts that can help improve your wealth and health!

Check out this recent WSJ article on How to Make the Most of Open Enrollment for why you should be thorough in reviewing your benefit options rather than making the quickest, simplest choice available.

If there are any items (whether covered in this blogpost or not) that you would like to discuss, do not hesitate to let us know.