What are Roth Conversions? And why use them? Before digging into the answers to those questions, lets take a quick look at the difference between a traditional IRA and a Roth IRA.

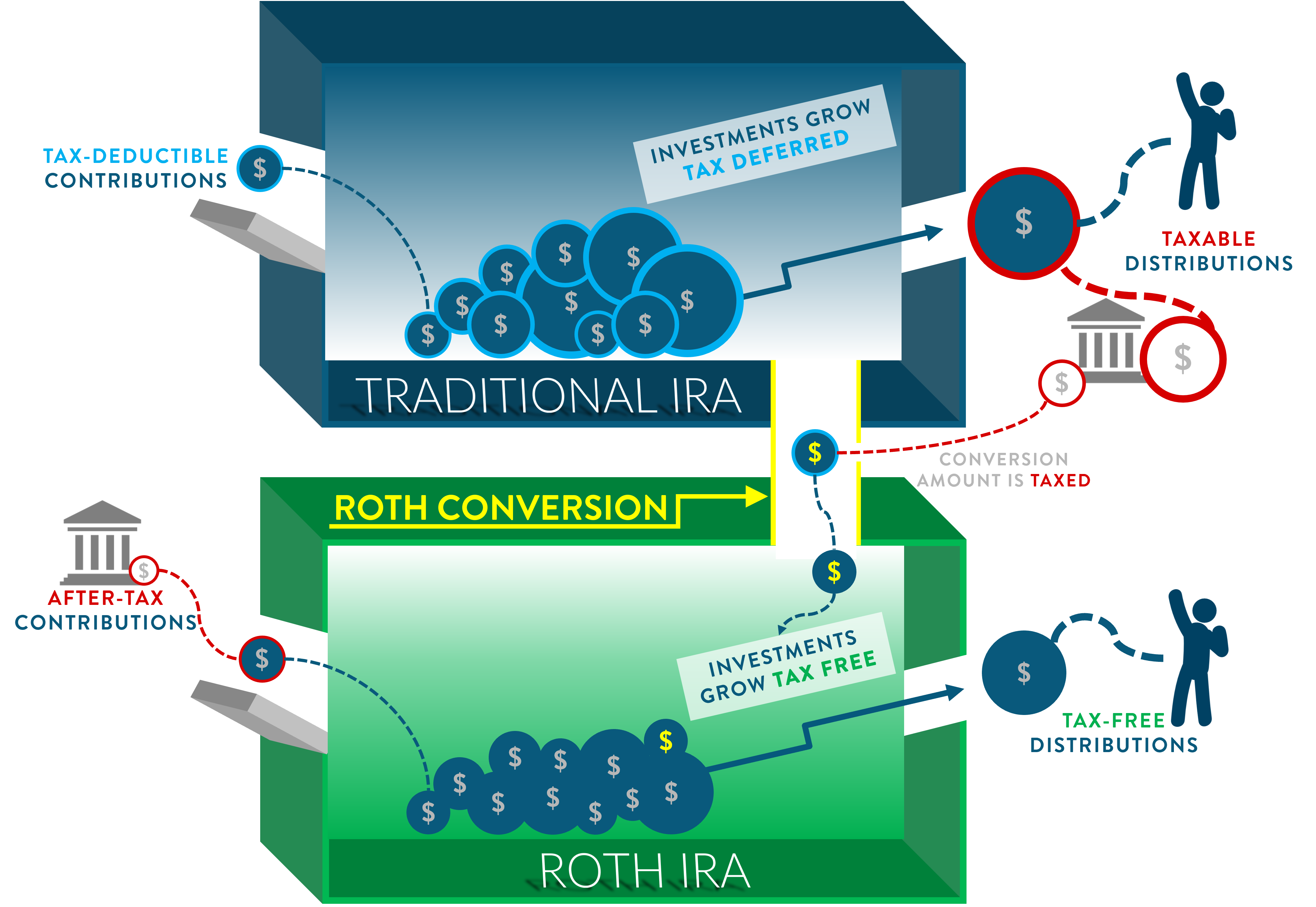

Contributions to a traditional IRA are tax-deductible, however, when the funds are later withdrawn from the account, the account holder will have to pay taxes on (hopefully) a larger sum than what was initially contributed.

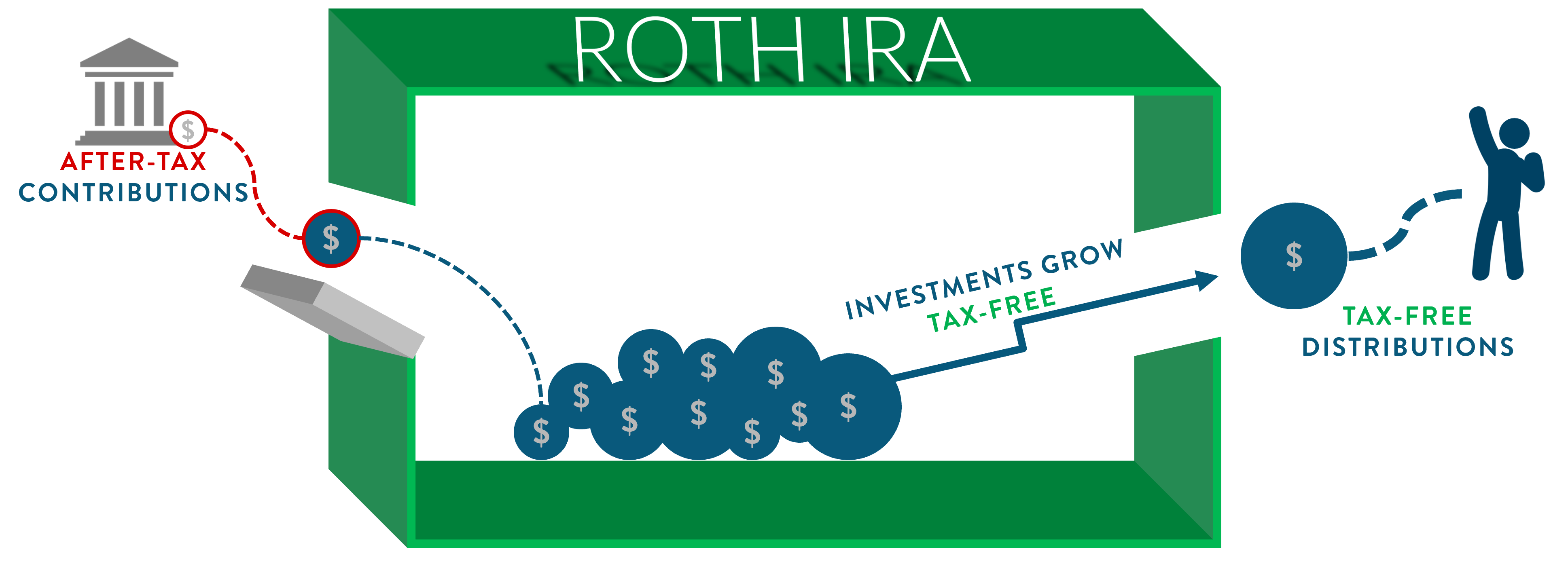

When contributing to a Roth IRA, on the other hand, the account holder pays taxes up-front on the contributions, but later distributions are tax free entirely!

The account holder never owes taxes on investments bought or sold inside of either a Traditional or Roth IRA.

When a Roth conversion takes place, the account holder selects a particular investment or dollar amount to transfer to the Roth account, and pays taxes on that amount.

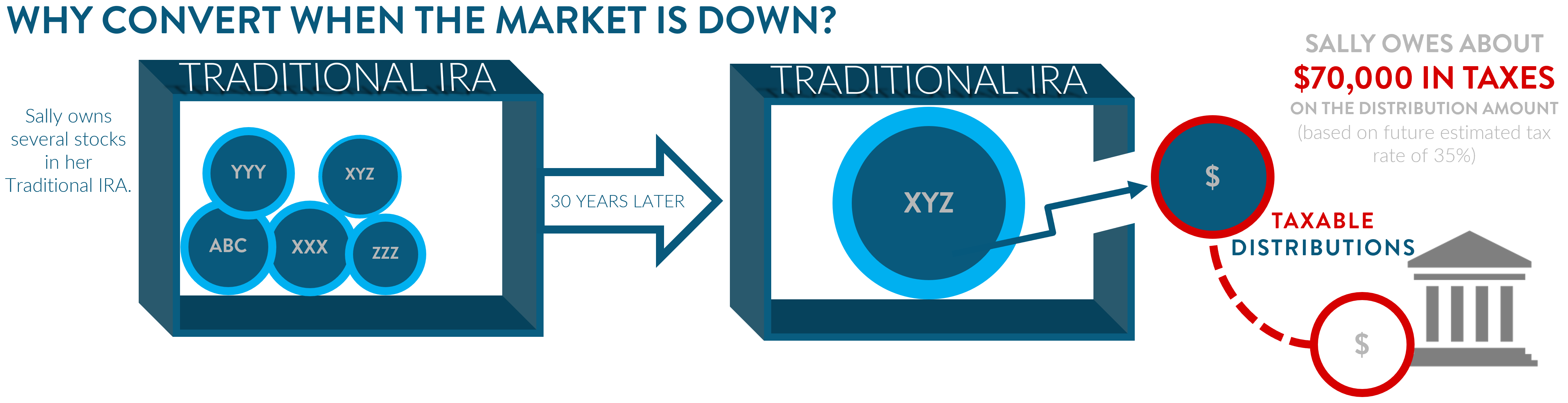

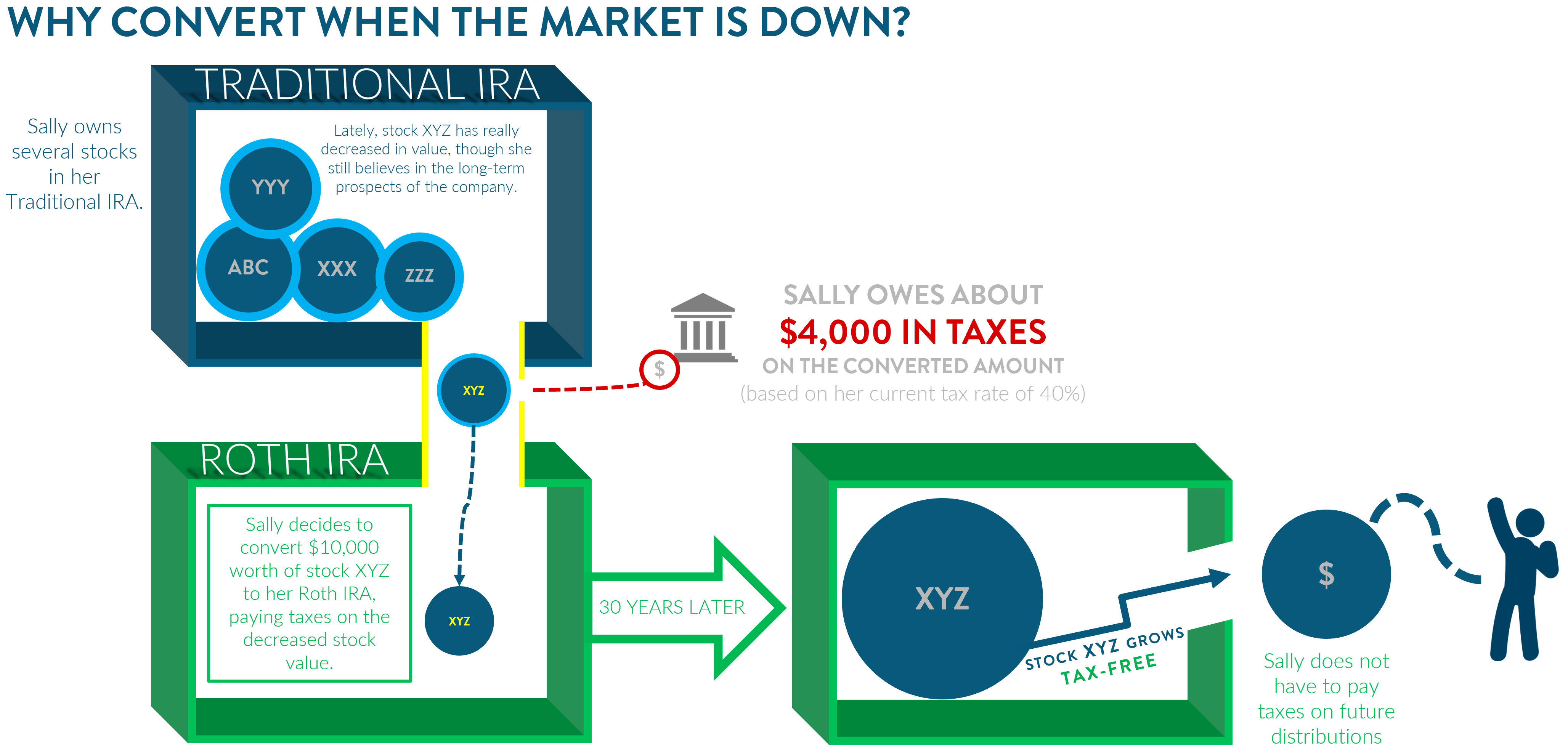

Let’s take, for example, Sally, who owns several stocks in her IRA, including XYZ company. XYZ has recently dropped in price and is worth $10,000 today, but by the time Sally is required to start taking distributions from her Traditional IRA 30 years from now, XYZ has made a dramatic comeback and is worth $200,000. When Sally withdraws that $200,000, she will have to pay ordinary income tax on that amount. Suppose her future tax rate was 35% between federal and state – she’d owe $35,000 in taxes!

Let’s suppose, however, that when XYZ dropped to $10,000, Sally decided to convert it to her Roth IRA. In doing so, she had to pay $4,000 in taxes, because her current tax rate is 40%. However, when Sally withdraws those funds in the future (even after XYZ rebounds and is worth $200,000), she will not have to pay any taxes at all!

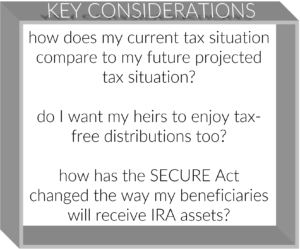

Would strategic Roth Conversions be helpful for you? Talk to us to find out more or to learn how we can help you with the process.

Click here to download this blog post.