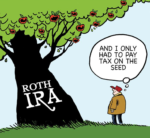

In recent months, news that early PayPal investor Peter Thiel’s Roth IRA was worth $5 billion caught the attention of people everywhere, particularly those on Capitol Hill. Many have reacted with outrage, because the original Roth account of $2,000 grew to $5 billion and that account will never be taxed. To my knowledge, Mr. Thiel’s […]

Fantastic Tax-Free Incomes and Where to Find Them

As part of retirement planning and cash-flow analysis, income sources and tax management are key components to a successful plan. While it may be hard to keep taxes low during your working years, retirees can enjoy certain “tax-free” income within the tax code (not loopholes). In this newsletter, we will be looking at some popular […]

The Dynamic Financial Landscape: Is Your Financial Advisor Adapting to the Changing World?

While I was doing research for this quarter’s newsletter, an IRS statistic on tax-filing composition caught my eye and prompted me to start over. Indeed, as I went deeper, it became clear to me that the financial industry is ever-changing, because the environment in which it lives never stops evolving. Therefore, financial professionals must learn […]

Post-COVID-19 Planning: Three Trends That Will Likely Stay

Suffice it to say that the COVID-19 pandemic has changed every aspect of our lives – hand-washing best practices, shopping on phones, school at the dining table, and sporting events in empty stadiums (I sincerely hope that the latter are only temporary). From a personal financial-planning perspective, there are three “COVID changes” that I believe […]

The Biden Tax Proposal: Three Trillion, Two Magic Numbers, and One Seismic Wave

By the time you are reading this, we are about two weeks away from what is expected to be the most contentious (and even potentially controversial) presidential election in recent history. Polls are pointing to a victory for Joe Biden, along with a “blue wave,” but as we have learned over the last few years […]

IRA Planning in the New Era: Things Account Owners Should Be Aware of When Naming Beneficiaries

Passed and signed into law in last December, the Setting Every Community Up for Retirement Enhancement Act of 2019, or SECURE Act, fundamentally changed how qualified account owners should approach naming beneficiaries. What are qualified accounts? Most of us have at least one type of qualified account, which provide us with certain tax advantages and […]

- 1

- 2

- 3

- …

- 6

- Next Page »