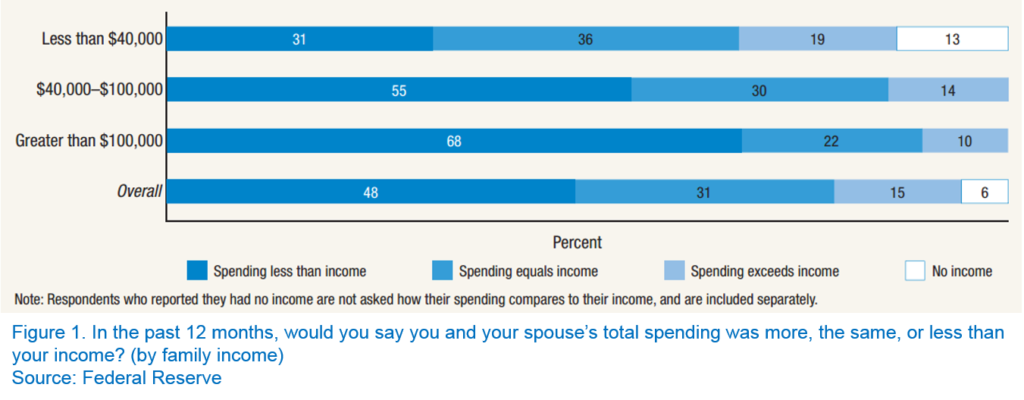

Take a look at the following graph. It shows how American households spend their income broken down into three broad income groups.1

While it is normal for spending to become less problematic the more income a household makes, close to a third of respondents in the $100,000+ income category still spend more than they make. Overall, 1 out of every 2 American households struggles to make ends meet. That leads to financial insecurity. Living paycheck to paycheck, amassing credit card balances, taking out pay-day loans etc. happen far too often.

So how can you get yourself out of that hole? Although there are numerous helpful tips, I believe mastering the following three ideas will go a long way toward securing your financial freedom.

- Change Your Mindset to Save-First

Saving needs to come first and be habitual. I admit it is easier said than done, but it has to be done. What usually comes to your mind on payday or upon receiving a bonus? A gadget? A night out with friends? Amazon.com? Or are you setting it aside for a bigger goal such as your first home or a comfortable retirement? It is entirely up to you. Being able to spend now produces a good feeling, but it is short-lived. Knowing that your future will be brighter because of your prudent choices will have a long-lasting impact.

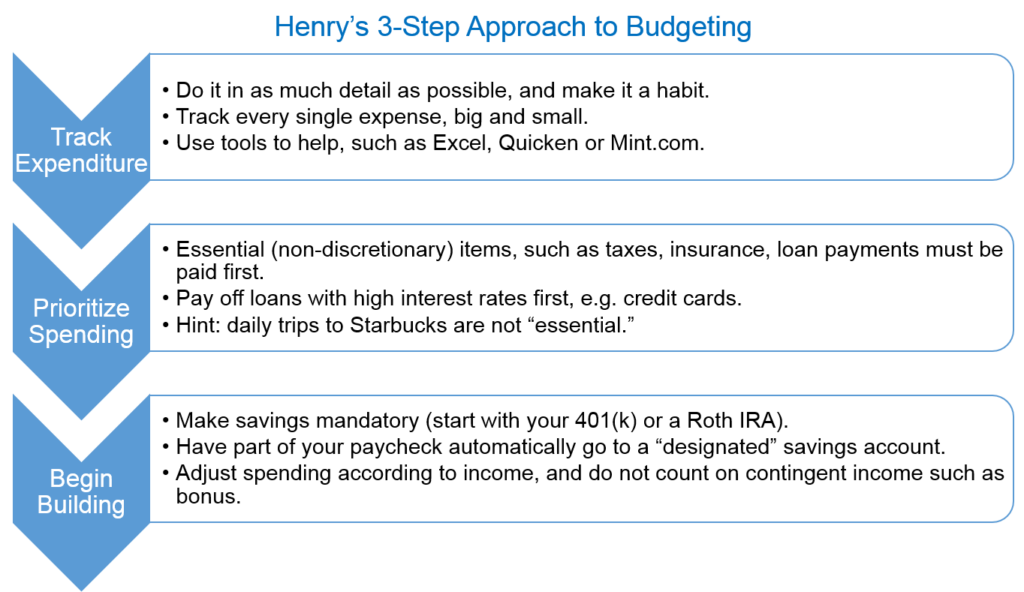

The next question becomes how you should approach saving. Knowing your spending is the very first step, because it is not about how much you make, it is about how much you spend (and save). Follow this 3-step approach to get started (I have personally been using it for years).

Just look around and observe. The “hidden” millionaires are usually the ordinary people in your life. Folks who live in upscale homes or drive luxury cars may not be as financially secure as their image projects. On the contrary, retirees who have a comfortable lifestyle have usually been avid savers during their working days. The story of a 92-year-old janitor leaving over $6 million to charities at death ought to inspire you.2 Choices are in your hands.

- Be the Center-of-Influence

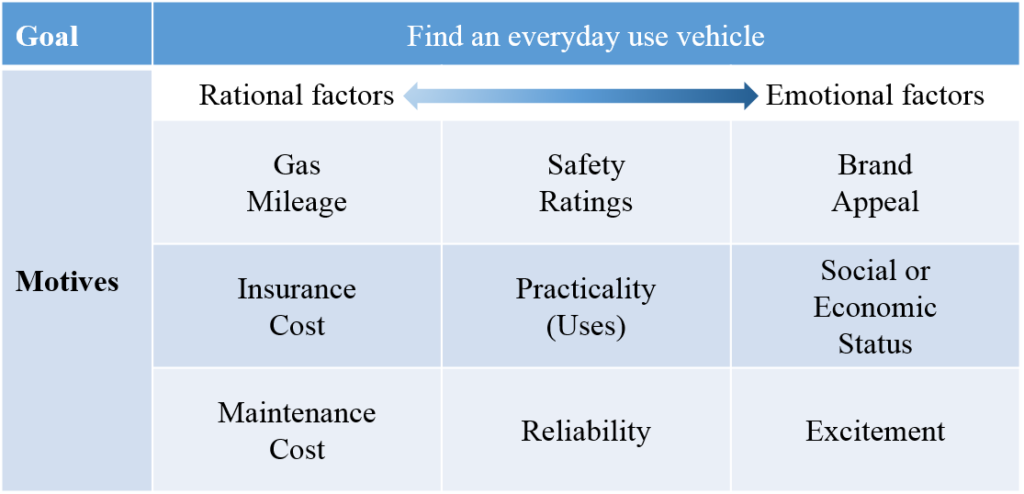

Peer pressure is often our No. 2 enemy (No. 1 being ourselves). If your friends are extravagant, you will feel compelled to keep up with them. Understanding the goals and motives behind each expenditure will enlighten you in a profound way. For example, buying a car is arguably one of the most important purchases in our lifetime. Our rational side tells us to choose something reliable, practical and economical. But often it is our “feel-good” side that dominates the entire purchase process (refer the table below and see what factors you place higher value for your own car-buying experience).  Yet, from a strictly financial point of view, a car, like many other personal use assets, is a depreciating one, i.e. it loses value every day. It makes little sense to pay up for something that loses value. You need not feel ashamed when your friends make fun of your boring car; instead, educate them about your thought process and how much you are saving from something boring. Be that center-of-influence and exert positive impact on others.

Yet, from a strictly financial point of view, a car, like many other personal use assets, is a depreciating one, i.e. it loses value every day. It makes little sense to pay up for something that loses value. You need not feel ashamed when your friends make fun of your boring car; instead, educate them about your thought process and how much you are saving from something boring. Be that center-of-influence and exert positive impact on others.

It is also a good idea to have a partner giving you the necessary support or mutual benefit. My wife and I have made a pact that we ask each other one simple question before making a purchase: Is it necessary? Trust me, it works! If that partner seems impossible to find, just look to us. We are thrilled to be that financial partner of yours.

- Take Your Time but Don’t Waste Your Time

That was the advice Philip Wang delivered to the graduating students at the Revelle College, University of California, San Diego, earlier this summer.3 I could not come up with something better, so I am simply stealing and using it here.

Take your time – cultivating good financial habits takes time (and perseverance). It is similar to quitting smoking. It will frustrate you from time to time; there will be urges to revert back to old habits, putting all the efforts at risk; and it may seem like no one else understands you. That is okay; because time will prove you made the right decision. So do take your time, and proceed at your own pace.

But do not waste your time – in finance perhaps the most important concept is “time value of money.” What does it really mean? Two things, simply:

A dollar saved today is worth more than a dollar in the future. Invest wisely and you will be rewarded handsomely. The Forever stamps are the perfect example nowadays.

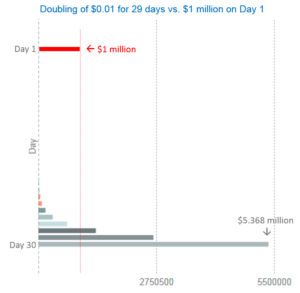

A dollar saved today is worth more than a dollar in the future. Invest wisely and you will be rewarded handsomely. The Forever stamps are the perfect example nowadays.- The power of compounding interest. Exactly how powerful is this? Suppose you are given the following two choices: A. $1 million today, or B. a penny today, and over the next month, the amount doubles every day. What would you choose? Without getting into details, the amount on Choice B grows to over $2.6 million by day 29, and there is one more doubling left (see graph on the right)!

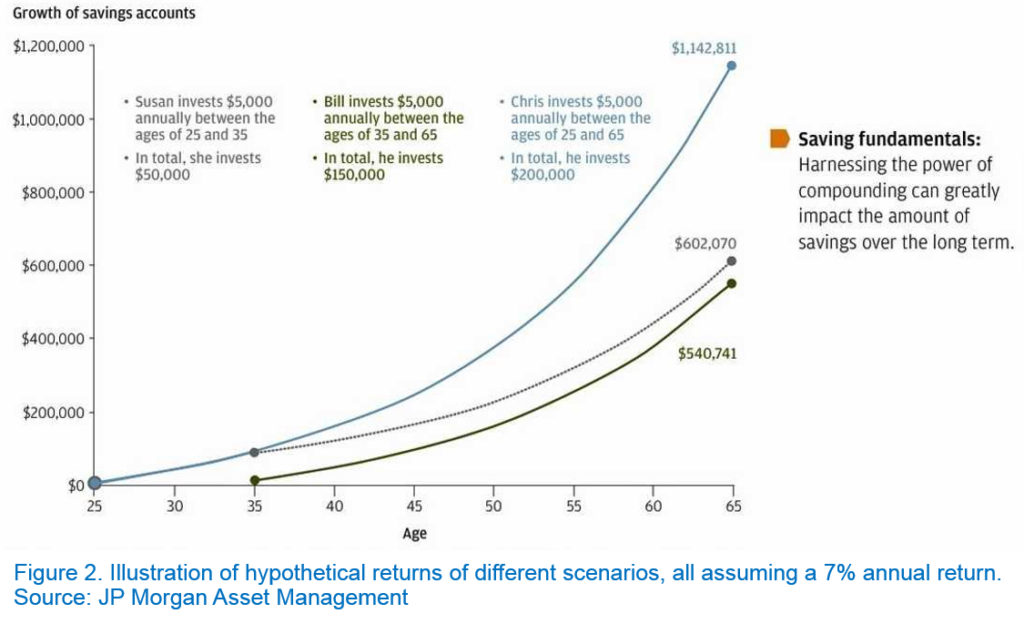

That is the most important message behind compound interest: there is no time to waste. Take a look at the Figure 2 for a visual illustration, which brings out another crucial idea. The effect of compounding on a large amount is mind-boggling. A 7% return on $100 ($100 x 7% = $7) may seem trivial, but the same return on $1 million equals $70,000!

Financial literacy and security is not far-fetched. In the end, using common sense, looking ahead, having a long-term plan, and making rational, educated decisions will help master your personal finance!

Be sure to check out our blog for more ideas!

Footnotes:

1 Full report at http://bit.ly/2dBPJc4

2 http://on.today.com/1GAnyyn

3 Full speech transcript at http://bit.ly/2e3etLg