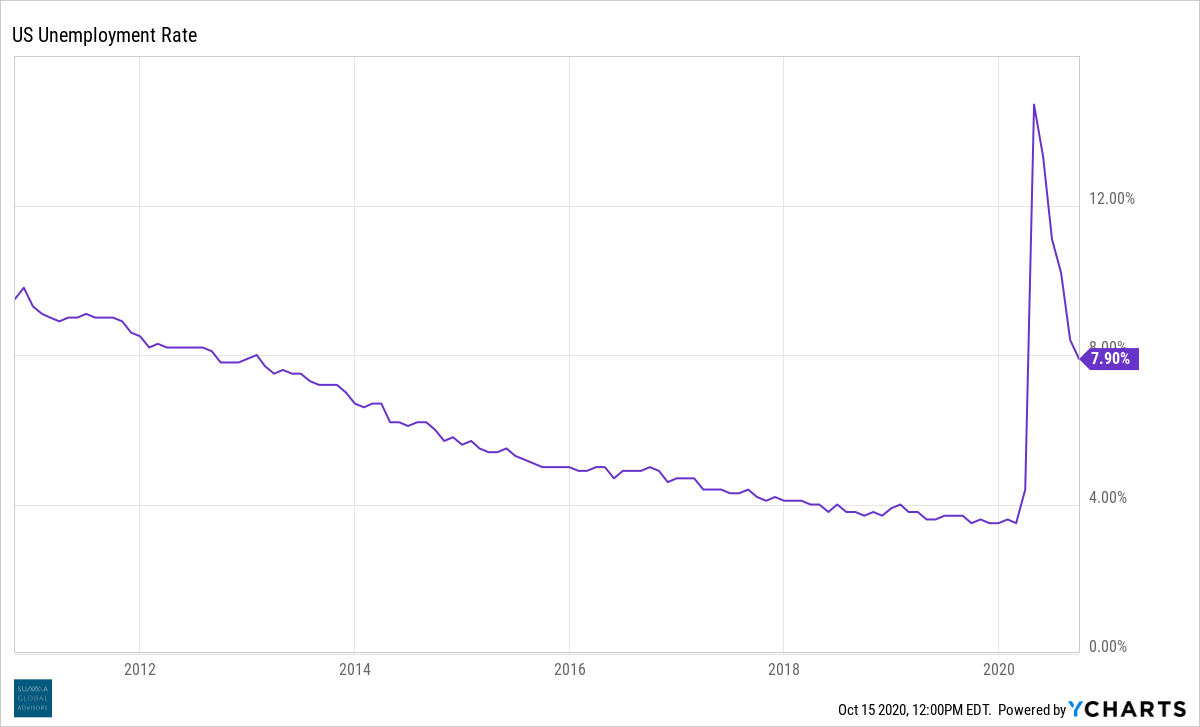

In early 2020, the unemployment rate was at all-time lows. When the coronavirus arrived in the U.S., immediate layoffs occurred as companies promptly changed plans. Congress quickly pushed through the CARES Act, a stimulus package to prop up the economy. This stimulus package had a profound effect on the job market as well as the speed of the economic recovery.

Employees who qualified for unemployment benefits were granted an extra $600 weekly payout from March until July 31. This offer was available to self-employed workers as well. Many of these employees around the U.S. ended up with more cash during unemployment than they had while gainfully employed. Before the July 31 deadline, it became difficult to coax employees back to work when they could make more money by collecting unemployment benefits.

Another part of the CARES Act, the Paycheck Protection Program (PPP), gave employers access to loans so that they could continue to pay workers through June 30, 2020. As long as those loans were used to support payroll, they would be turned into grants. This program was extended once to August 8.

The stimulus package, to some extent, was just delaying the inevitable. Businesses crippled by the COVID outbreaks could limp along until their regional economies opened back up. But this was not enough for some businesses that were already stretched thin – mainly specialty retailers and restaurants. Many well-known names were forced into bankruptcy – JC Penney, 24 Hour Fitness, California Pizza Kitchen, Hertz, Chesapeake Energy, and others.1 Additionally, though more difficult to track, the impact on some types of small businesses has been exponentially worse.

School closures and schedule changes created another issue for those families with young children. It is difficult to work from home or return to a job when your young children are still studying at home. This change led to some parents dropping out of the work force permanently. It also led to stress in the educational job market. Some educators decided to take early retirement or pursue other employment altogether.

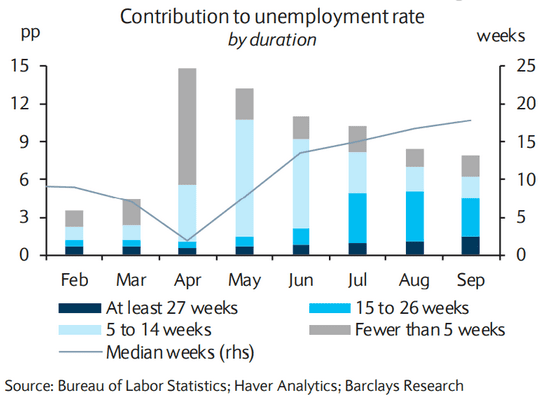

As time under pandemic stress drags on, some layoffs which were originally thought to be temporary are becoming permanent (see chart).

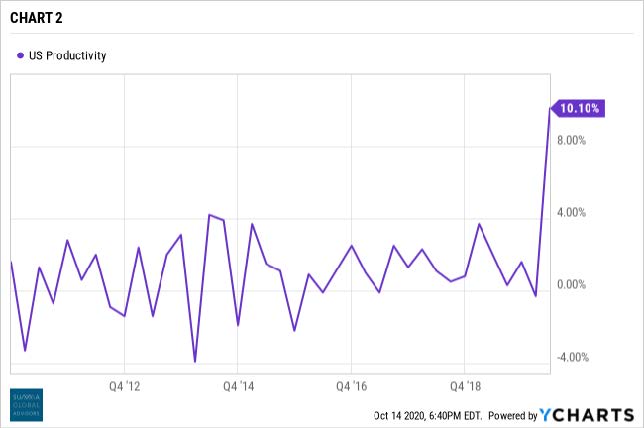

Shifts in consumer habits and spending are creating new opportunities for nimble businesses. As technology becomes smarter and more capable, some workers will, unfortunately, be displaced. Businesses are taking this opportunity to pare down their workforce, retaining workers who are the most productive (see chart below).

Because of this, it is likely that the unemployment rate will remain elevated for quite some time.

To be sure, jobs have been lost across many industries, especially the airline, lodging, restaurant, personal care, and entertainment/sports sectors. On the flip side, there has been a hiring boom in workplaces like home improvement stores, distribution/shipping centers, and retail grocery stores. Admittedly, many these jobs do not require specialized skillsets or advanced education, only good attitude and willingness to work hard.

The employment picture is changing before our eyes: some stay-at-home parents will drop out of the workforce, teachers will be retiring, retail and entertainment services will move online, and the travel and entertainment industries will take some time to rebuild. Employers continue to adjust to new habits formed as a result of the intersection of government mandates and convenient access to goods and services. One thing is for certain, when we finally emerge from this pandemic slowdown, the job market will have shifted substantially. New opportunities await!

Footnotes:

1https://www.bloomberg.com/graphics/2020-us-bankruptcies-coronavirus/