![]()

An old Zen parable tells of two monks, sitting in the courtyard of their monastery, observing a flapping pennant. “The wind is not moving,” opined the one monk, “it is the pennant that is moving.” “No,” said the other, “the pennant is not moving the wind is moving.” The oldest and wisest Zen master of them all, happening by, heard this colloquy, and said, “The wind is not moving. The pennant is not moving. Your minds are moving.”[1]

What is going on in our minds is even more important than what is happening in the markets, the economy and the world. Few investors can calmly sit back and watch their portfolio market value bounce around. Humanly speaking, investors despise it when a bear market appears to be crouching at the door. Yet, the bear market is not as important as how we respond to it. It should not surprise us that asset values fluctuate. Humans build economies that first overshoot, then undershoot the long-term trend line. The market simply reflects this cycle.

Chicken Little was in the woods.

A seed fell on his tail.

He met Henny Penny and said,

“The sky is falling.

I saw it with my eyes.

I heard it with my ears.

Some of it fell on my tail.”

He met Turkey Lurkey, Ducky Lucky, and Goosey Loosey.

They ran to tell the king.

They met Foxy Loxy

They ran into his den,

and they did not come out again.

In this abbreviated story, Chicken Little overreacts to a perceived danger; so much so that he misses the clear signs of a real danger in the person of Foxy Loxy. Additionally, Chicken Little was successful in panicking all of his friends and putting them into mortal danger. As this story aptly illustrates, investors must make an accurate assessment of perceived market danger and remain self-controlled even when those around us panic.

In times of uncertainty, investors can create danger in their minds. One way we do this is by mistaking minute possibilities for statistically substantiated probabilities. For instance, there is a possibility that Iran will bomb Israel and put the whole world into a tailspin for a decade. However, in reality, the probability is low that such a dire prediction would materialize. By contrast, the bear market always ends. The most likely probability is that the market will rebound as it has every time in history. In fact, statistically speaking, the market is in an upward trend 80% of the time.

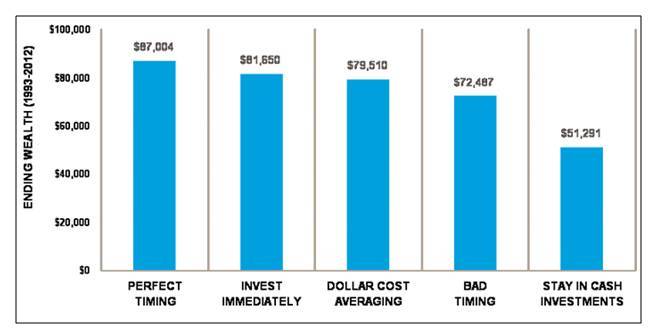

Consider research on the performance of five hypothetical long-term investors following very different investment strategies. Each received $2,000 at the beginning of every year for the 20 years ending in 2012 and left the money in the market, as represented by the S&P 500 Index. Check out how they fared:[2]

THIS is why it pays to be fully invested! As Foxy Loxy knew, the sky is NOT falling! All an investor needs to do is keep your “mind from moving,” as the wise monk instructed, and, in the end, the bear will amble into hibernation.

THIS is why it pays to be fully invested! As Foxy Loxy knew, the sky is NOT falling! All an investor needs to do is keep your “mind from moving,” as the wise monk instructed, and, in the end, the bear will amble into hibernation.

Footnotes:

- Murray, Nick. Behavioral Investment Counseling, p. 181.

- Full article at http://www.schwab.com/public/schwab/nn/articles/Does-Market-Timing-Work