2014 seems to have gotten off to a shaky start—and I am not referring to the stock markets! From the downing of the news station-chartered helicopter in downtown Seattle, to the sweeping landslide in Oso, Washington, to the mysterious disappearance of the Malaysian jetliner, one thing we can be sure of is that humans are really at the mercy of Mother Nature. Tragedies happen every day and some feel much closer to home than others. There is very little humans can do to prevent or avoid them.

While loss of life is extremely difficult to deal with and no amount of money would even come close as a replacement, do ask yourself this: What would happen to the people you love and care about if something happened to you? Better yet, what would you like to happen to them if something happened to you?

Like many of your fellow Americans, you probably realize that you need to get insurance but there are other obligations that come in ahead of insuring your life. In fact, fewer than half of U.S. households have individual life insurance while the average coverage amount has decreased to $167,000 in 2013.[1] Now, can you relate this to your own life experience? Does this all sound too familiar? Can you easily tell a few stories in which someone you know could benefit from life insurance?

It is also true that many of us are only prompted by life events to consider purchasing life insurance. I am no exception; I bought my first policy upon getting married and a second one after our first child was born.

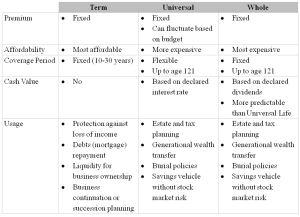

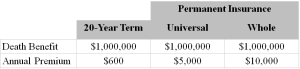

Other than the common excuses, I happen to think that the complex array of insurance products, along with the inconsistency of agent quality and integrity, makes the entire research and purchase decision extremely difficult and frustrating. For instance, term life policies, the purest form of life insurance, will satisfy most Americans’ basic life insurance needs, thanks to its simple and low-cost structure.

Permanent life policies (whole and universal), on the other hand, will stay effective for as long as the premiums are paid. In addition to the death benefit, these policies also have an “investment” component—a.k.a cash value—where payment in excess of the insurance cost will be earning a return. This is where things begin to get murky and tricky.

Source: Woodruff-Sawyer & Co.

Although insurance agents’ pay is tied to the value of the products they sell, permanent policies can still be attractive as a wealth, estate and tax planning tool. The current federal estate tax exemption of over $5 million for individuals (and $10 million for married couples) is more than sufficient for many Americans, but some states such as Oregon still have not kept up with that and have a much lower exemption threshold. Asset ownership determines what goes onto the estate tax bill. If Mr. John Doe, with a $1,000,000 life insurance policy, passes away, the $1,000,000 payout value will be part of his taxable estate along with other assets under his name, and his estate is likely to have a tax liability at the state level.

This leads to more sophisticated estate and tax planning, especially for people with illiquid assets such as their small business worth several million dollars. The use of life insurance can provide much-needed liquidity for various postmortem expenses, in addition to wealth protection and inheritance. Seamless coordination between trusted advisors—attorneys, accountant, financial advisor, and knowledgeable insurance agent—can help family assets stay in loved ones hands. My friend, David Richter with Woodruff-Sawyer, has generously shared his thoughts on the different life insurance types and their merits (Table 2).

Table 2. Different types of life insurance and their characteristics.

Source: Woodruff-Sawyer & Co.

For three years now, we have been stressing, advocating, and encouraging friends and family to create a solid estate plan. Tools and strategies are available, depending on your unique situation and needs. So, think about it. Do you have a family and people you care about? If the answer is a “Yes,” then give us a call to get the ball rolling.

[1] LIMRA’s Facts of Life (2013) http://www.limra.com/uploadedFiles/limracom/Posts/PR/LIAM/PDF/Facts-Life-2013.pdf