As part of retirement planning and cash-flow analysis, income sources and tax management are key components to a successful plan. While it may be hard to keep taxes low during your working years, retirees can enjoy certain “tax-free” income within the tax code (not loopholes). In this newsletter, we will be looking at some popular tools and how to utilize them.

Investment Income

Municipal bonds, or munis, are issued by state and local governments to fund various public projects such as renovating schools, building parks and community centers, etc. Most munis are backed by the issuing governmental body’s power to tax its residents—for example, property tax—in order to pay back the bondholders. Because municipalities are not-for-profit, they offer lower interest rates on munis compared to corporate bonds. In return, municipal bondholders enjoy tax-free interest income. If you hold bonds issued by your domicile state, most of the time the interest is also exempt from state and local taxes (double tax-free).

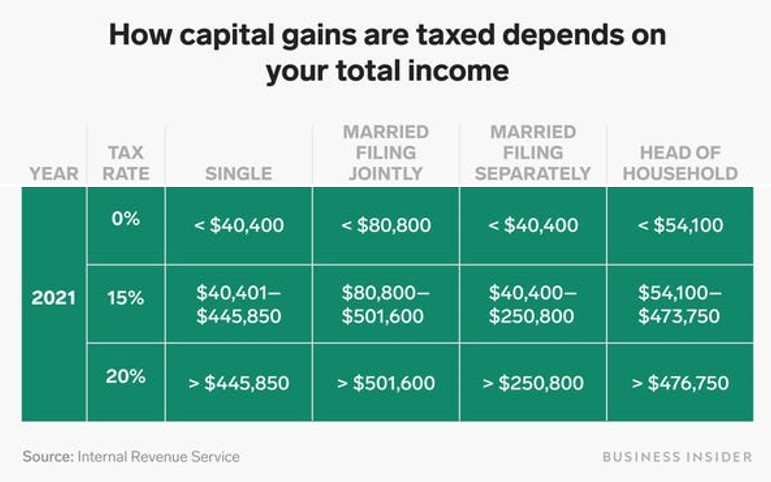

If you own dividend-paying stocks, or buy and sell investments, chances are you owe taxes. However, qualified dividends and long-term capital gains are subject to a different set of tax rates that are more favorable than ordinary income rates. If your income is under a certain threshold, both of these can escape federal income tax altogether. To get a clearer picture, refer to the table. (Suggested reading: What are Qualified Dividends)

Master limited partnerships (MLPs) are another investment vehicle that can provide significant tax advantages. Because of their organizational structure, most of the distributions are tax-deferred and considered return of capital. Suppose that you invested $100 in an MLP and received $10 in distribution during the year. That $10 was not taxable but reduced your cost basis to $90. When you eventually sell the MLP, figuring out the tax bill could be a challenge.

The $250,000 home-sale exclusion has been the cornerstone for many homeowners to build wealth and can be an importance source of retirement spending. The exclusion amount doubles to $500,000 for married couples.

Retirement Income

A traditional IRA (individual retirement account) gives a taxpayer a break (deduction) when contributing to it. However, distributions are taxed as ordinary income. On the contrary, though taxes are owed on funds going into a Roth IRA, withdrawals from a Roth IRA are completely free of tax, as long as certain requirements are met (most importantly, that you must wait for at least five years from the first contribution before withdrawing funds).

What is the importance of tax management, i.e. keeping taxable income low? For retirees, lower taxable income has a number of benefits, such as:

- Keeping Social Security benefits off of the IRS’ radar (see details on Social Security website and note that muni interest income is added back into the calculation).

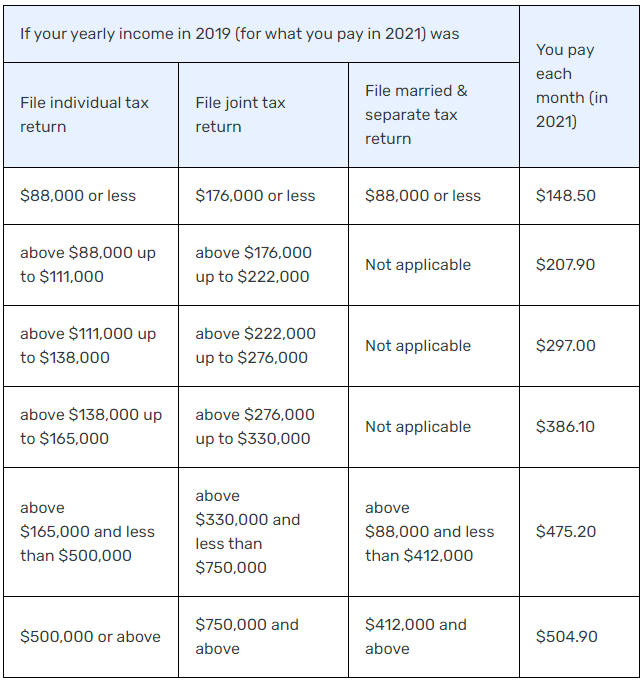

- Avoiding Medicare Part B premiums surcharge, which is based on taxable income from two years ago.

- Making it easier to claim qualified medical expenses, which tend to be significant for seniors. Eligible expenses in excess of 7.5% of a taxpayer’s adjusted gross income (AGI) can be claimed as a deductible item.

Insurance

Speaking of medical expenses, a health-savings account (HSA) can be used to pay for medical expenses tax-free. However, you are not allowed to use HSA savings and claim a medical deduction at the same time. For common HSA-eligible items, refer to this list. As an added bonus, at age 65, Medicare parts A, B, D and Medicare HMO premiums become eligible medical expenses.

If you hold life insurance policies, particularly the permanent ones, sometimes it is sensible to borrow from the cash value or surrender the cost-basis—not a taxable event—without giving up all the benefits. In a viatical settlement, in which a terminally ill insured sells the policy to a qualified company, the settlement proceeds are exempt from income and capital gains tax, thanks to HIPAA. However, the complexity of a policy, coupled with a wide array of viatical settlement terms, makes this strategy extremely confusing and should only be considered as the last resort if no other viable options are available.

As you can see, tax-free incomes exist in various forms. It pays to do some basic planning to take advantage of them. After all, it is your hard-earned money and you deserve to keep as much as possible. Let us know if you would like to further review any of these strategies.