Fear dominates headlines and can keep us up at night.

It seems to be the business reporters’ job to assess all possible downside scenarios. If these negative headlines never materialize, people are happy. If they do materialize, the listeners cannot say they were not warned. And the cycle goes on and on and on……

Is all the time spent prognosticating and worrying effective or productive? Humans are risk averse by nature. When things are too good for too long, we get nervous – waiting for the next shoe to drop. We want to avoid pain. We try to avoid losing what we have (at least on paper).

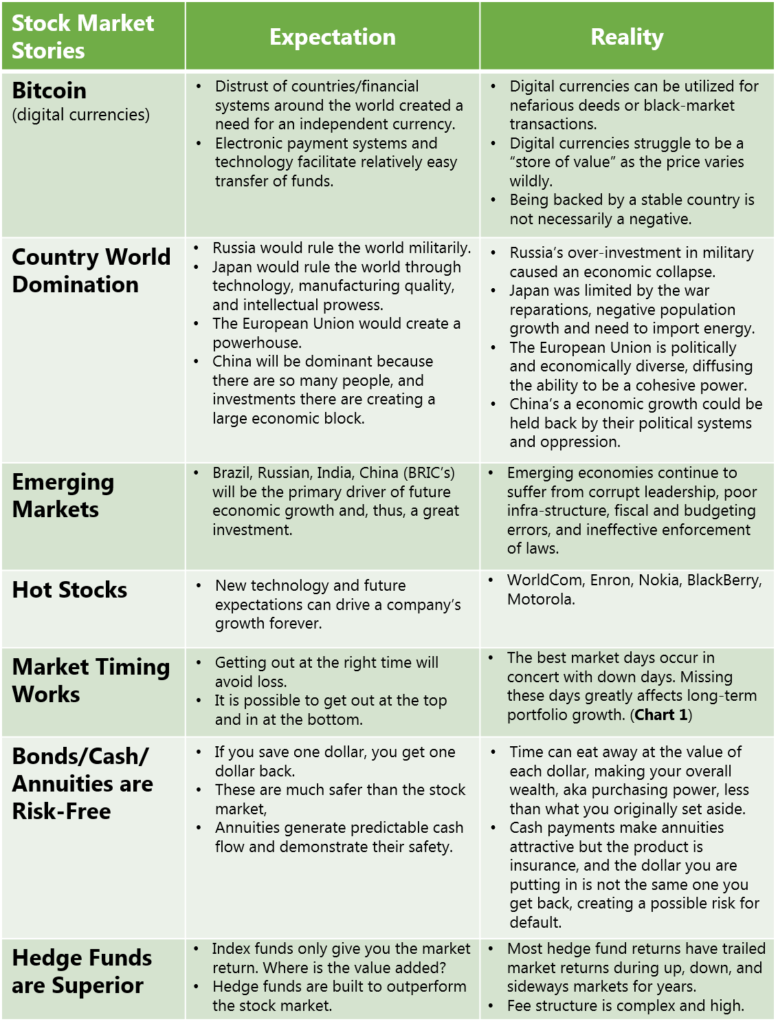

The stock market is a great place to observe all types of risk-taking and risk-avoiding behavior. A short review of market themes can be enlightening (see table on next page).

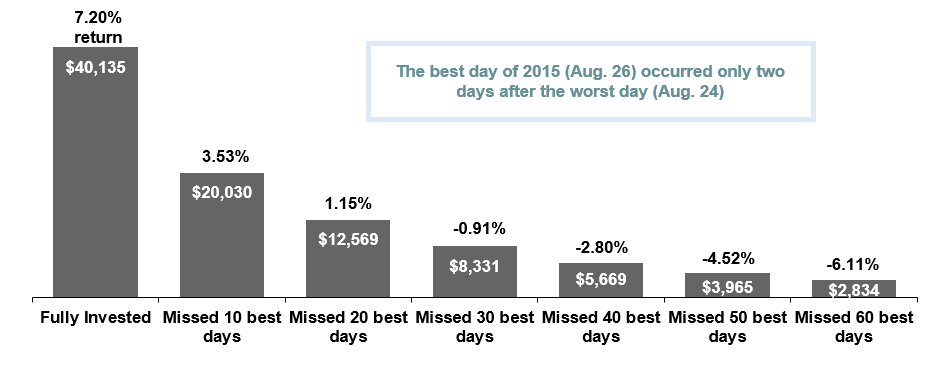

As you can see, much of what investors worry about or hope for never materializes. It is best to stay the course and invest prudently in low-cost investments. Planning carefully to avoid unnecessary taxes and strategically placing assets into taxable or tax-exempt accounts is a fool-proof way to add purposeful, predictable value to your investable assets.

Source: JPMorgan Asset Management