Globalization is a trend that continues full speed ahead. Because they consider it an important piece of data, economists and governmental agencies measure money flow between countries by tracking foreign investing.

There are two types of foreign investments: direct and indirect. Indirect is the one observed every day as investments flows between countries’ equity and bond markets. A foreign direct investment (FDI), on the other hand, is an investment made by a company or entity based in one country, into a company or entity based in another country. To qualify as a direct investment, a company must own at least 10% of the entity. Entities making direct investments typically have a significant degree of influence and control over the company into which the investment is made. As you might surmise, open economies with skilled workforces and good growth prospects tend to attract larger amounts of foreign direct investment than closed, highly regulated economies. [1]

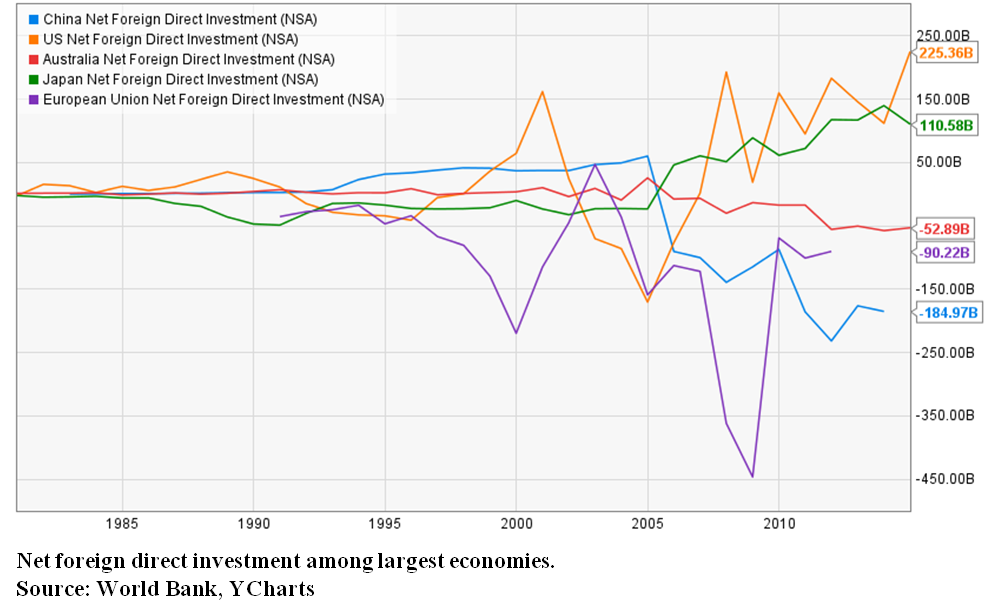

By definition, FDI is a vote on the future of a country as assessed by corporate decision makers. Below are graphs that show recent FDI flows. In spite of a very strong dollar, the U.S. has recently become the country of choice for FDI (see chart below). Why this tsunami in positive sentiment? What do foreign companies find attractive about the U.S.?

Energy sufficiency – the arrival of fracking as well as other cost-effective methods of extraction has not only brought down the price of oil but also made the U.S. more energy independent.

Transportation infrastructure and distribution system – road networks, trucks, trains, airplanes, power grid, distribution centers, warehouses and the port system. Access to this network enables companies to move goods and people in a cost-effective manner.

Land resources – efficient and safe agricultural resources. Abundant commodities are also available. Scientific advances for growing crops and raising cattle, advanced farming equipment and increased yields per acre have transformed farming. The U.S. is a major exporter of agricultural products.

Just-in-time technology – American companies have perfected the systems and software necessary to minimize inventory and storage needs. Additionally, technology costs continue to plummet as hardware, software and the mobile workplace become more common.

Business regulations – The U.S. has a long history of pro-business regulations. Although there is no guarantee of this in the future, personal ambition and hard work makes America a breeding place for entrepreneurs and investors.

Ethics – Strong ethics laws and courts that uphold individual rights as well as business rights creates an environment for businesses to thrive.

Emerging markets did not become powerful hubs of commerce because some of these core factors are missing. Other developed countries have not blossomed because of numerous laws and regulations that eat away at profits. Additionally, many countries are crowded and have limited ability to produce agricultural products.

In this volatile market, foreign investors have chosen the U.S. as the top dog! What a compliment!

Footnotes: