The Golden State Warriors stormed to their second NBA championship in the past three seasons, topping the league in both offense and defense. The Warriors’ accomplishments in recent years have been remarkable, and it seems likely that we will be witnessing an era of continued dominance by this incredible team.

What I have found most interesting from watching the Warriors play are the implications that can be drawn from their style and applied to our investment philosophy – a long-term solid and balanced approach.

Does it surprise anyone that a championship team is built with a balanced formation, with versatile firepower as well as dependable defensive mentality? They do not necessarily have the “best” and most talented players. Remember the Oklahoma City team with Durant, Harden and Westbrook? Similarly, a solid investment portfolio cannot be all growth and aggressive (the best stocks are not always the ones with the most “hype” around them); there is a place for diversification and defense as we will see from the comparison.

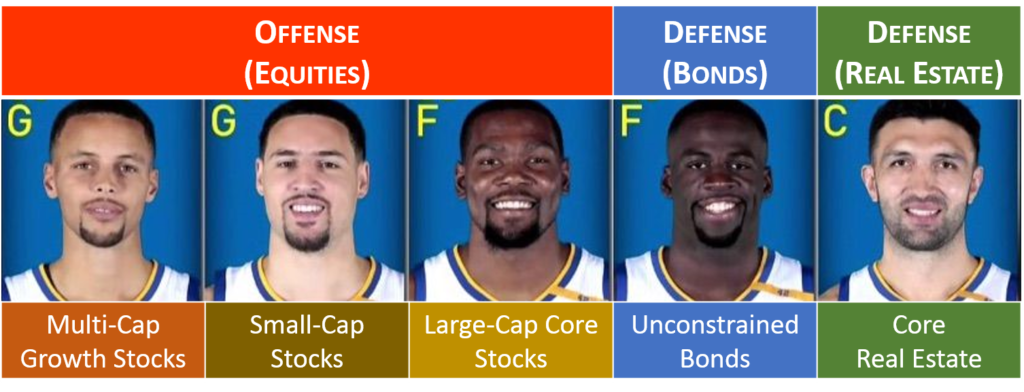

Equities Provide Offense

Undeniably the Kevin Durant acquisition proved to be Golden State’s missing piece. I would equate him to large cap value/core stocks: The economic stalwarts that are reliable, well-established, and capable to weather any storms. It is the McDonalds’, Proctor & Gamble’s, and Johnson & Johnson’s. No explanation necessary.

Another core component of an investment portfolio is the presence of growth stocks (across cap-size), which can be represented by Stephen Curry. These investments are nimble and versatile to provide firepower from different angles (through re-investing capital in themselves) and still can play defense in tough times as leading growth companies are capable of redefining and changing an industry to stay ahead of the herd, evident in Amazon.com’s dominance in recent years, or the way people watch TV since the debut of Netflix.

Rounding out our equity portion is small-cap stocks (emerging market stocks can be included too). These are the three-point-specialist stocks, equivalent to Klay Thompson. How so? Smaller companies are more volatile, but they are capable of outperforming the broader stock market when times are good. Thompson’s spectacular 60-point game this season should prove the point. And yet, there are also times when these stocks behave miserably, especially during recessions and market pull-backs.

Defense Comes from the Opposite Side

Bonds are best and simplest to defend against equity volatility, as their performance has little to do with company profitability. But just like equities, fixed income investing comes in many different flavors too. Core, high-yield, Treasury, mortgage-backed, corporate, and much more. To me, Draymond Green is everything that the bond market has to offer these days. Think about an “unconstrained” bond portfolio. Mr. Green can rebound (core bonds), block shots (municipals), ignite counter-attacks (high yield and emerging market bonds) and also build team morale (Treasuries). In rare occasions when emotions take over, he can make irrational decisions and get thrown out of the game, much like a small percentage of junk bonds that default.

Zaza Pachulia, to a certain extent, acts like the real-estate allocation. He, first of all, provides literal “real estate” presence with his size on both ends of the court. He is a dependable and consistent player. His ability to rebound and pass the ball is similar to the steady cash flow that most income-generating real estate investments generate, something very valuable to the overall health and integrity of a portfolio.

Winning teams have one thing in common…

Championship teams, regardless of the competition, all have a common but unsung hero behind them—their coach. The ability to sub in bench players, make crucial decisions, and rally the team from the sideline could not be more important. Likewise, a bona fide portfolio manager or financial counselor is key to success: someone who is well-educated, true to the task, not easily swayed by market noise or emotions, able to make critical decisions and build the portfolio with purpose.

There are many great teams, many talented players, but only a handful of coaches who can put all the pieces together and bring home the prize. There are no secrets or shortcuts to success, whether in the NBA or the financial world. How does your team look? Do not hesitate to call us today if you would like to assess your asset allocation (teammates) further.