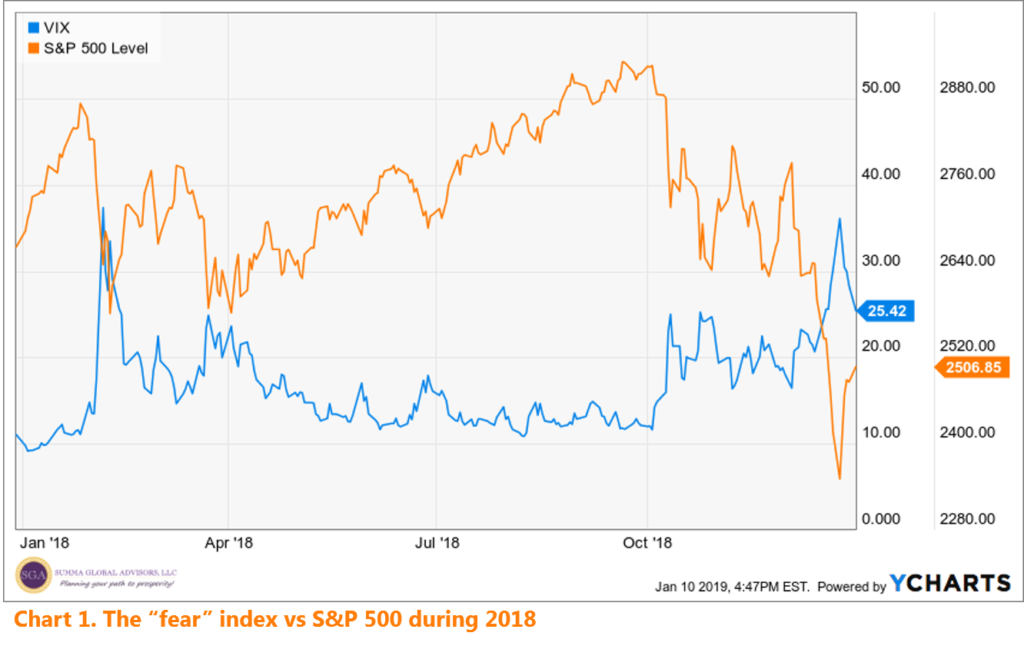

After an unprecedented period of calmness in the stock market, volatility reared its ugly head with full force in the last quarter of 2018, evidenced by spikes in the “fear” index (Chart 1). Investors received a rude awakening as many high-flying stocks that were perceived to have little downside risk plunged substantially, prompting these investors to re-think their risk tolerance and portfolio allocation or even choose to abandon stock investing altogether.

As a long-term investor and professional investment advisor, our approach to dealing with market volatility may seem counter-intuitive. Once you understand the reasoning, however, it will help you better weather the market storm with confidence and conviction.

As a long-term investor and professional investment advisor, our approach to dealing with market volatility may seem counter-intuitive. Once you understand the reasoning, however, it will help you better weather the market storm with confidence and conviction.

Psychological Perspective: understanding stress and fear

First and foremost, if the market stresses you out, it really is best to avoid watching market news, which is catered towards short-term investing and amplifying negative news for the sake of viewership. If you find yourself more anxious after watching news, you are not alone.[1] Psychologists agree that “negative TV news is a significant mood-changer, and the moods it tends to produce are sadness and anxiety,”[2] according to Graham Davey, emeritus professor of psychology at Sussex University in the UK and editor-in-chief of the Journal of Experimental Psychopathology.

That was what inspired us to commence The Insomnia Cure three years ago, our online blog dedicated to easing anxiety arising from all the noise in today’s near-sighted world. We focus on the fundamentals such as risk and diversification,[3] budgeting,[4] and post-mortem matters.[5] The last thing you want to do is give in to emotions and act reactively.

Fear can come from lack of control and certainty. Evidently, these two factors are much more rampant when market is behaving badly. A two-percent drop on a given day can feel like a bottomless plunge and it is only getting worse (lack of control). A prolonged selloff can seem like an eternity to many – as if the light at the end of the tunnel has all but vanished (lack of certainty).

Planning Perspective: putting matters in capable hands

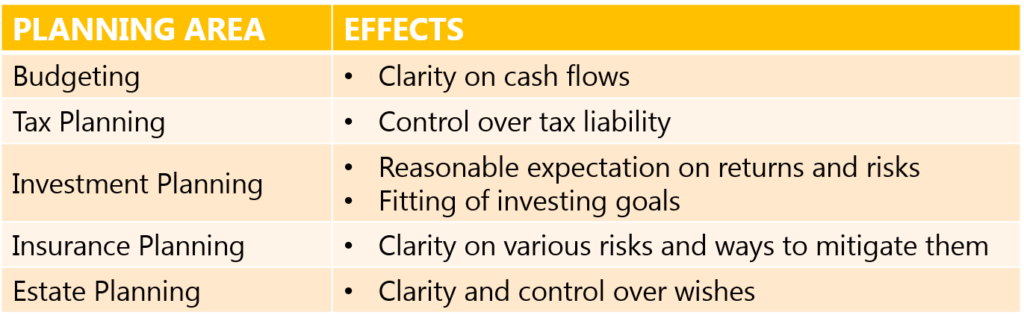

Planning is the single most effective remedy in this case. Beginning at the personal level, creating a household budget provides clarity about cash flows. Tax planning, even on a very basic level, gives certain control over tax liability. Higher-level planning further solidifies these two factors and helps boost confidence about the future.

Tactical Strategies: enhancing future prospects

Some other tactical moves to incorporate during tumultuous conditions include:

- Explore Roth conversions – by converting pre-tax retirement funds, any growth and subsequent withdrawals will be completely free of income tax. It is also not an all-or-nothing move; you have complete discretion over which holdings to convert. One thing to keep in mind is that, since 2018, an IRA owner can no longer undo a conversion if it does not work out.

- Keep or increase recurring contributions – when something you purchase on a regular basis goes on sale, would you not buy more? Classic examples are the monthly Costco coupons or Black Friday sales. If you apply the same logic to investing, buying in a falling market makes sense. Therefore, leaving your monthly 401(k) contributions alone is the least you can do. Or better yet, increase those recurring dollars whenever possible, as each dollar will now buy more shares.

- Put idle cash to work – without touching your cash reserve (a.k.a. emergency or rainy-day fund), market downturn is usually a better time to invest. We do not promote timing the market in the faint hopes of outperformance, but we do like the prospect of investing when everyone else is hesitant.

Money is an emotional subject, which is why many of us struggle with it and all that it has to do with. But combining advice from psychology, insights from professional investors, and a little hand-holding or back-patting from your trusted advisor, can help you sleep much better at night!

Footnotes:

[1] https://www.theguardian.com/media/2013/apr/12/news-is-bad-rolf-dobelli

[2] http://time.com/5125894/is-reading-news-bad-for-you/

[3] https://www.summaglobal.com/blog/risk-and-diversification-understanding-risk-and-why-its-important/

[4] https://www.summaglobal.com/blog/budgeting-why-is-my-take-home-pay-so-much-less-than-my-salary/

[5] https://www.summaglobal.com/blog/insomnia-guide-when-a-loved-one-passes-away/