Could He Have Avoided Breaking Bad?

AMC’s award-winning drama Breaking Bad was a huge success as Bryan Cranston’s Walter White theatrically transitions from an underachieving, ordinary high school chemistry teacher to becoming one of the most sought-after methamphetamine producers in the country: milking, laundering, and ultimately losing tens of millions of dollars for the cause of providing for his family because of his cancer diagnosis.

As I devouringly watch the show on Netflix, I cannot help but have “what-ifs” in my head. What if I were Walter White? What would I do for my family? Or better yet, what if Walter White were a client of mine? How would I, as his financial planner, help him and his family deal with the stressful situation of a looming death and financial difficulties that would be awaiting them in the near future? This makes an ideal case study for planners and advisors because, apart from the drug-making element, Walter White and his situation are as ordinary as can be while posing some of the greatest challenges to many financial planners.

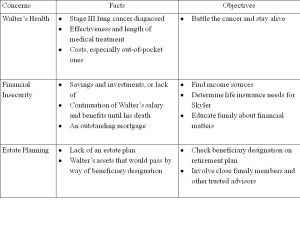

Let’s just assume that Walter White did indeed call me up one day and broke the bad news about his cancer situation. This would quickly lead to a more in-depth conversation, preferably face-to-face and with his immediate family, in which both Walter and his wife, Skyler, would reveal their concerns and fear. I would let them do the talking as much as possible while occasionally helping them stay focused on the core issues and assure them that it is normal to be experiencing a range of emotions. After that, I would summarize and filter the conversation down to key points and, ultimately, their goals and what I could do to help.

Walter’s No. 1 concern was that his loved ones—Skyler, who was also expecting a daughter, and Walter Jr.—would not be financially secure after he died, for he had been and was still the sole breadwinner. His salary as a high school teacher was enough to make ends meet. They had a little bit of savings, which would run out quickly due to his treatments, even though Walter was covered by the school district’s group health plan. The school may also have Walter in their group life insurance policy, in addition to their retirement plan. With the information on hand, my next step would be to make sense of the situation and forecast what their finances would look like post-Walter. For example:

At this point, the White family and I would spend some time on creating a budget for scenarios both with and without Walter. Household income would be less due to missed work and cancer treatment; expenses would be poised to increase, if not skyrocket. A thorough and exhaustive look at their expenses would provide some ideas as to where the “sacrifices” would come from. For instance, cutting the cord (cable or dish), reducing dining-out, and limiting discretionary purchases would be a good start, although it would still not be enough.

Next we would look at ways to cover the stripped-down current household budget. How should we allocate Walter’s paycheck? How to make up the shortfall? What about Walter’s medical expenses? How soon should we start dipping into savings, and how long those may last? What about the possibility of drawing or borrowing from his retirement plan? What factors must be considered? These are all important questions to ask and explore before acting upon them, as each of them could bring up various unintended consequences.

Involving the CPA and an estate planning lawyer for their respective areas of expertise is necessary. Tax and estate planning would need to be set in motion—confirming that Skyler is the beneficiary on Walter’s retirement plan and life insurance policies, making sure no personal property would be subject to probate, and creating a comprehensive estate plan for the surviving family.

Once we discussed their current situation, we would shift focus to Skyler and her life after Walter. Again, budgeting plays a vital role. Income sources pose a challenge here. Skyler’s bookkeeping and accounting background provides a marketable skill that will help her land a job in the future.

Social Security benefits, which should not be overlooked, will give Skyler relief in the post-Walter-era budget. We normally associate Social Security survivor benefits to elderly widows, but in Walter’s case, because a new baby is on its way, Skyler would be entitled to these benefits in order to care for a minor child under the age of 16.[1] Walter, Jr, who is suffering from cerebral palsy, may also be eligible for Social Security based on his disability.[2] Suppose that Skyler was 40 years of age when she gave birth to their newest family member, her Social Security benefits would last until Holly turned 16, and then she could begin her own survivor benefits as soon as becoming 60. As a result, the Whites’ financial picture is not as dire as what Walter had originally envisioned in the drama, which led him to breaking bad!

There are other non-financial factors that are in Walter and Skyler’s favor, with Skyler’s sister, Marie, and her husband, DEA agent Hank Schrader, being their best possible ally. Not only were they very close to the White family, they were also prime candidates to be included in Walter and Skyler’s estate plans. Both of them, for instance, could be named guardian for Walter, Jr. and his sister, Holly. Having a tight-knit, understanding family is probably the best thing that Walter could ever ask for, all things considered.

Now you can see why Breaking Bad is intriguing, even without the dramatization and from the perspective of a boring financial planner. How many times, in our day-to-day life, have we come across with people and families like Walter and Skyler? While the possibility of bad news is difficult to entertain, careful and sensible planning can reduce the stress caused. It is never too late to start planning!

[1] http://www.ssa.gov/survivorplan/onyourown2.htm

[2] http://www.ssa.gov/disability/professionals/bluebook/11.00-Neurological-Adult.htm#Top