For the past few decades, the Federal Reserve has succeeded in keeping inflation low—perhaps too low. It had an assist: Shifts in the global economy, including globalization, demographics and the rise of e-commerce, helped keep prices in check.

~ WSJ · Gwynn Guilford · July 12, 2021

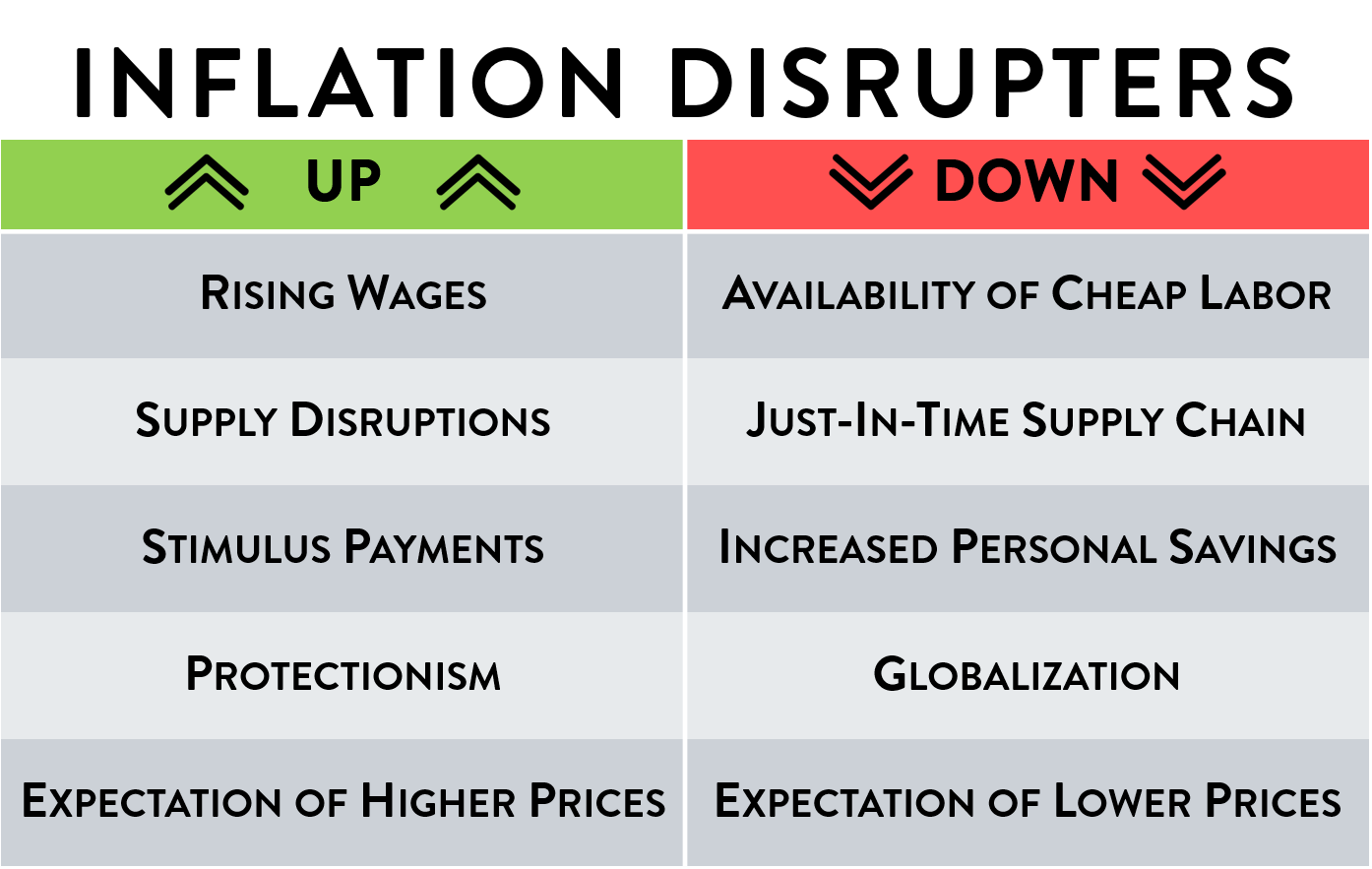

Price levels are increasing – home prices, car prices, fuel prices, and food prices, to name a few. Supply/demand conditions, wage appreciation, and worker shortages are creating inflationary pressures across the United States.

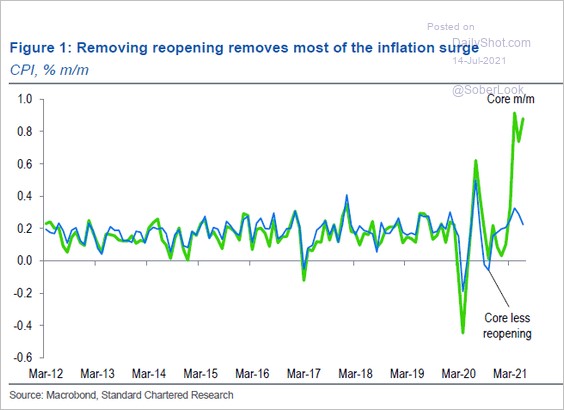

Supply disruption is occurring in much of the economy. The pandemic as well as existing tariffs have riled the global markets, causing price spikes on items from lumber to semiconductor chips. Rolling business closures continue to affect the ability to assemble products built from components made around the world. Transportation bottlenecks, increased fuel prices and inventory drawdowns have also contributed to the tight supply and rising prices.

Demand has been uneven across consumer sectors, creating even more strain on businesses. Hotels, airlines, and restaurants have borne the brunt of the consumer demand shock. Cars, new and used, have been “flying off the lot.” Pre-pandemic business practices of just-in-time inventory and efficient supply chains have been dismantled and caused supply/demand mismatches worldwide. Global sourcing, formerly a source of great wealth creation, became an albatross for companies around the world.

Demand has been uneven across consumer sectors, creating even more strain on businesses. Hotels, airlines, and restaurants have borne the brunt of the consumer demand shock. Cars, new and used, have been “flying off the lot.” Pre-pandemic business practices of just-in-time inventory and efficient supply chains have been dismantled and caused supply/demand mismatches worldwide. Global sourcing, formerly a source of great wealth creation, became an albatross for companies around the world.

Even before the pandemic, employers large and small were experiencing difficulty getting quality hires. This was especially true for low-wage, labor-intensive work. These jobs were first to go and slow to rebound after the onset of COVID-19. Restaurant staff, hospitality workers and retail employees have been reluctant to begin work again. Large corporations have swooped in and moved the hourly wages up, creating a very difficult environment for smaller businesses to compete.

Rounds of stimulus payments and expanded unemployment benefits have further strained the supply of workers and have effectively placed a floor on wages. Unemployment assistance discourages prospective workers from seeking gainful employment opportunities.

Family habits have changed as workers stayed home to care for school-aged children and did not face the grind of commuting and related costs. Now, when presented with the choice of returning to the workforce, they may choose other options.

Last, but not least, inflation expectations can drive prices up (and down). If consumers expect prices to rise, they will purchase more today. If they expect a lower price in the future, they will delay spending. After many years of low prices, consumers have become accustomed to waiting for sales or even lower price points. If inflation continues to climb, consumer behavior will adjust to either buying now or foregoing the expenditures altogether.

The increase in wages and costs of inputs for consumer goods and services will trickle down to the prices paid. This effect, combined with stimulus payments (i.e., increasing government debt), could cause prices to continue their climb. Only time will tell if these changes are transitory, as the Fed claims, or if they are sticky. Investors will need to stay nimble in order to adjust to either outcome.