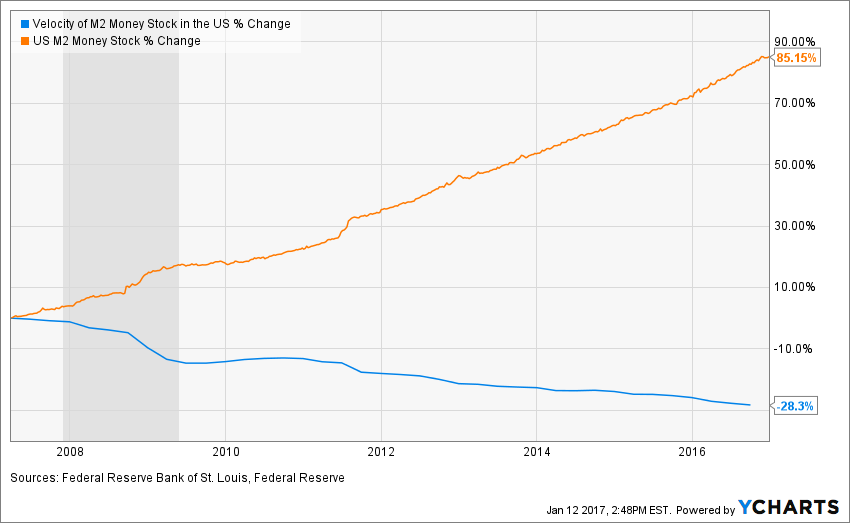

For years now, market prognosticators have been warning us to expect inflation and the resulting increase in interest rates. As fiscal theories postulate, how can we have so much monetary stimulus without triggering inflation at some point? As we all know, the Federal Reserve proactively flooded the economy with money to create stability in the financial system. Although the money supply has doubled, the velocity of that money dropped, so that the Quantitative Easing has not had the anticipated effect….yet (see graph below).

That may be changing.

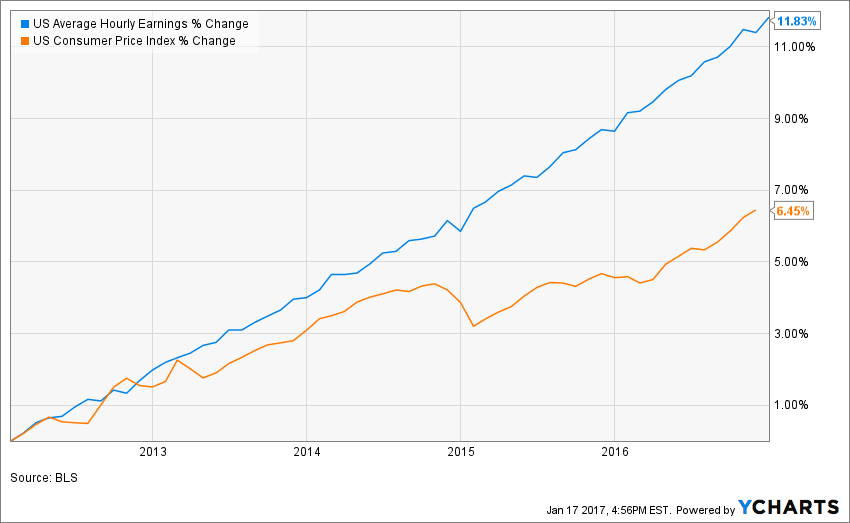

In the past, one of the primary indicators of inflationary pressures building has been wage increases. This past year, the US economy began to show signs of strengthening and part of that has been wage growth. There may be several reasons for the uptick in wages we have witnessed recently.

First of all, minimum wage has increased in many localities. When the cost of labor goes up, the employer must decide to either accept lower profits or raise their prices or, perhaps, both. For now, hourly wages are pacing ahead of the Consumer Price Index, which bodes well for employees (see graph below). As the minimum wage increases, it is quite likely that there will be a compression of wages on the higher end of the spectrum. The dark side of this increase in prices is that it can result in a corresponding decrease in demand if the market cannot bear the higher prices.

Secondly, the unemployment rate has come down significantly, creating a tight job market. Skilled workers are hard to find. Many jobs now require significant technological training. Finding the right fit for each job is a difficult task. As time goes on, the baby boomers continue to retire, creating job openings for the younger generation. However, this generation is more amenable to job changes and may go to a different job if the benefits offered are superior. As recently as 2014, workers would receive bigger salary increases are a result of job transfers rather than internal company wage hikes. Now that trend is reversing itself, as companies begin to reward those employees who stay with the firm. That makes sense when considering the employment rate and the shortage of qualified applicants.

In order for the economy to experience growth, individual citizens of that country must also experience growth. Although inflation has very few admirers, it is another way to deleverage the economy, paying back debt with cheaper dollars. Thus, a rise in wages can be beneficial as long as it doesn’t happen too quickly and spur unmanageable inflation. Keep an eye out for the all-important wage indicator as we start 2017 with the wind at our back!