In spite of the drastic economic shocks caused by the Coronavirus during 2020, the market managed to regain its footing in a few short months. Some dominant market trends are worth a discussion here.

Optimistic Expectations Drive Valuations

Euphoria for Bitcoin, Wall-Street “unicorns” like Snowflake, Zoom Video, and a host of other companies is reminiscent of the 1999-2000 tech bubble. Even well-known names, such as Tesla, are trading at prices that seem exorbitant when put into context and fundamentals are considered. As of the writing of this article, Tesla’s market capitalization (its price multiplied by the number of outstanding shares) stood at an astounding $781 Billion. By contrast, Ford ($39B), Fiat/Chrysler ($31B), GM, ($72B), Daimler ($72B) and Toyota ($207B) had a combined market cap of $421B. Tesla faces a high hurdle of future growth, profitability and market share gains in order to attain the expectations built into this stock price.

To Make a Pile, Be in Style

To avoid the valuation pitfall described above, it is prudent to understand the current makeup of the market. Often market leadership changes after a bear market downturn. Two specific scenarios have been playing out across the market.

First of all, the performance and weighting of large-cap U.S. indices is dominated by a handful of stocks. This phenomenon is similar to what was observed in 1999-2000 when the most popular stocks were widely held. As you can see, only one of the stocks repeated in the top five after twenty years.

Secondly, growth stocks have been superb during this last market cycle, while value stocks have languished. What is meant by growth versus value? To simplify, growth stocks are measured by high Price to Earnings (P/E) ratios while value stocks generally have lower P/E ratios. The earnings of growth stocks are expected to grow at an above-average, while value stocks tend to be cyclical growers and stable names. This creates an ebb and flow to value earnings. These two styles of investing often run in cycles. The most recent cycle has been tilted toward growth for both large and small cap companies. On a valuation basis as well as a mean reversion basis, the value style is overdue for a bounce-back. Thankfully for investors, dividend-paying stocks, when purchased at a reasonable valuation, have been a consistent haven, differing markedly from high growth stocks.

Value stocks have already started to demonstrate increased leadership, as share prices for energy and financials rebound (click the chart below to enlarge it).

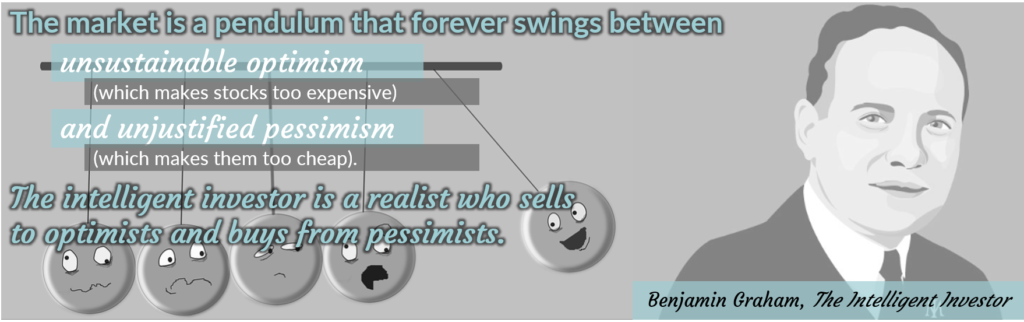

This shift is bullish for further stock market gains. In order to take advantage of value investing, it is necessary to drown out the noise of the most popular investment stories and focus on valuation and reasonable expectations.

Even index construction has a bias toward growth, as shown in the most recent additions and subtractions from the Dow Jones Industrial Average index.

As 2021 begins, we will not let FOMO (Fear Of Missing Out) cause us to stray from solid investment decisions, but will continue to maintain a well-diversified, balanced portfolio approach as the key to building wealth.