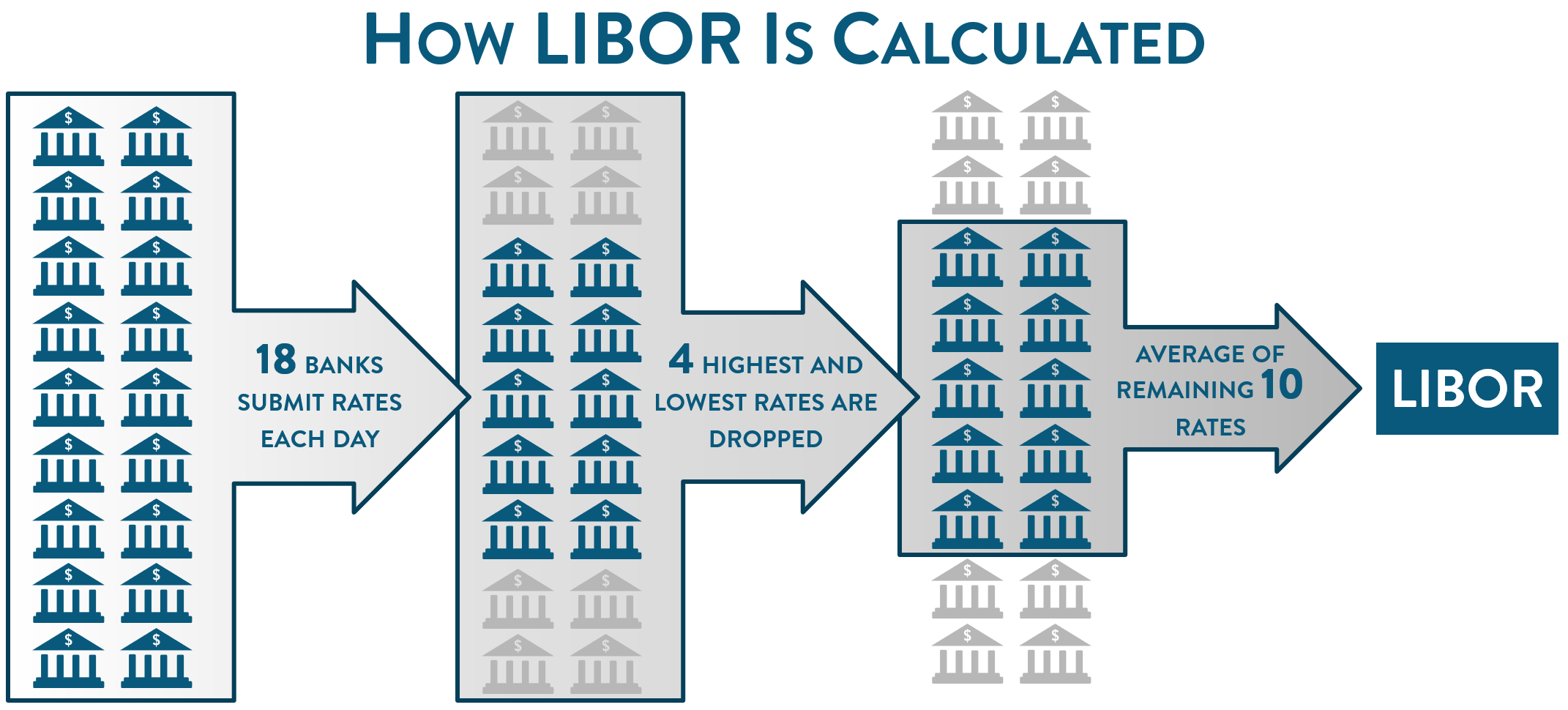

Since 1986, the London Interbank Offered Rate (LIBOR) has functioned as the global benchmark for adjustable-rate loans. Lenders set or reset rates on loans periodically according to the LIBOR rates. The rates are based on what banks forecast they would charge another bank to lend funds. Eighteen international banks submit rates each day and after the four highest and lowest rates are dropped, the daily rate is set as an average of the remaining rates. LIBOR is calculated daily in five currencies: UK Pound Sterling (GBP), Swiss Franc (CHF), Euro (EUR), Japanese Yen (JPY), and the US Dollar (USD).

Recently, the UK Financial Conduct Authority reiterated that LIBOR will be discontinued at the end of 2021. Excepting the US Dollar, all currencies for which LIBOR provides rates will be discontinued. The US Dollar LIBOR transition must be fully completed by June of 2023. This transition was first announced in 2017 but has proved to be more difficult than anticipated. A change in adjustable-rate systems worldwide affects pricing, risk management, and performance measurement across countless assets.

Recently, the UK Financial Conduct Authority reiterated that LIBOR will be discontinued at the end of 2021. Excepting the US Dollar, all currencies for which LIBOR provides rates will be discontinued. The US Dollar LIBOR transition must be fully completed by June of 2023. This transition was first announced in 2017 but has proved to be more difficult than anticipated. A change in adjustable-rate systems worldwide affects pricing, risk management, and performance measurement across countless assets.

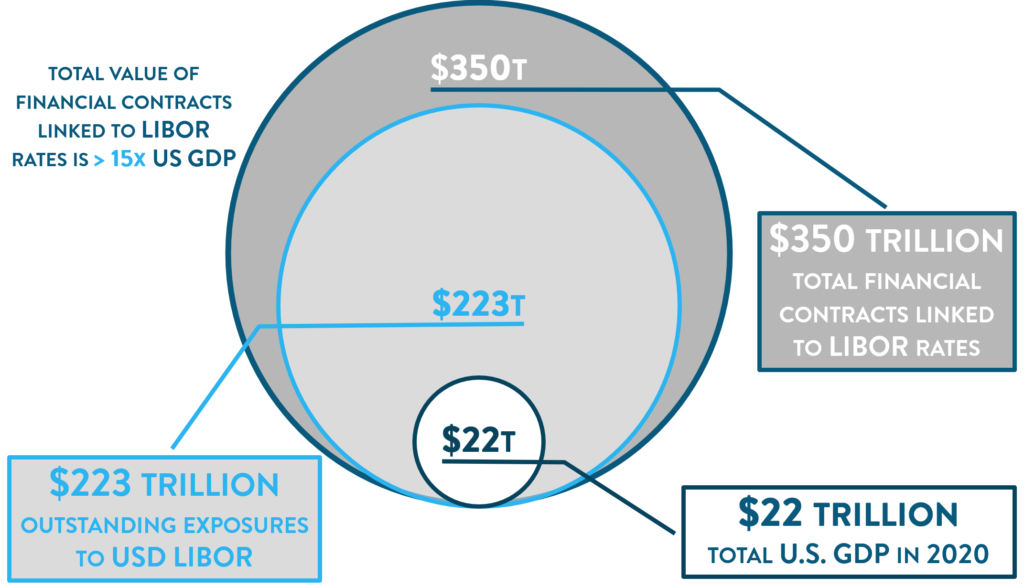

The size and scope of this undertaking cannot be overstated. LIBOR rates are used for floating rate notes, business loans, consumer loans, securitizations, and derivatives. In fact, an estimated $350 trillion of financial contracts are linked to LIBOR rates, including approximately $1.2 trillion of residential mortgage loans and $1.3 trillion of consumer loans.1, 2, 3

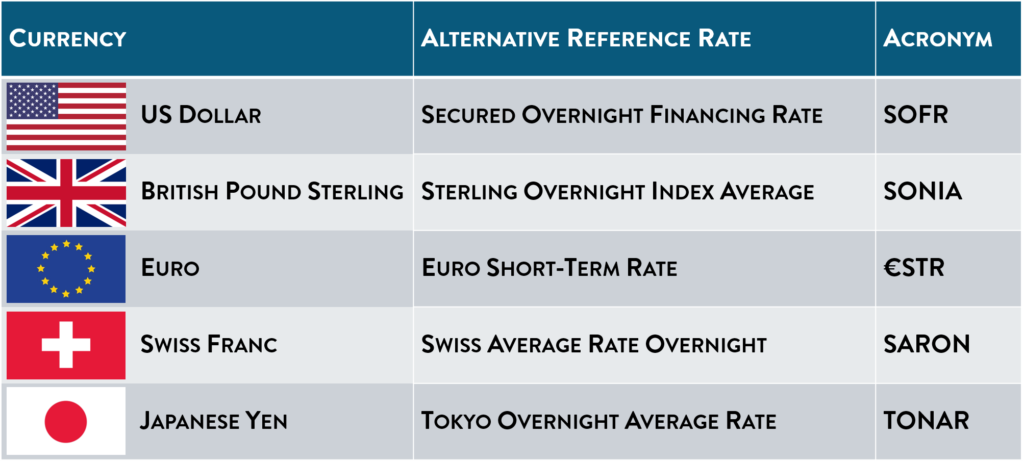

All of these contracts will need to be rewritten to include fallback provisions and specify new reference rates. While no single alternative has been identified that can provide the global reach of the LIBOR, the following alternative reference rates are slated for use across major currencies:4

What can U.S. borrowers expect in the future? The Alternative Reference Rate Committee (ARRC) has determined that the new reference rate will be SOFR and new financial products will be referenced to that benchmark as LIBOR is retired. Borrowers can also expect to see other countries utilizing different rates as outlined in the table above. Floating rates are a necessary piece of the financial system, as it allows borrowers and lenders to hedge against interest rate exposure.

One thing is certain – a smooth transition from LIBOR to SOFR is critical for global financial stability.

Footnotes:

1 https://www.forbes.com/advisor/investing/what-is-libor/

2 https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2021/USD-LIBOR-transition-progress-report-mar-21.pdf

3 https://www.bea.gov/news/2021/gross-domestic-product-third-estimate-gdp-industry-and-corporate-profits-4th-quarter-and

4 https://resourcehub.refinitiv.com/443811globallibor/443811-LIBOR-BlogMovingForward?utm_source=Eloqua&utm_medium=email&utm_campaign=443811_2021GlobalLiborEDM&utm_content=443811_2021GlobalLiborEDM+Email4LIBORPaperManagingTransitionRisksA