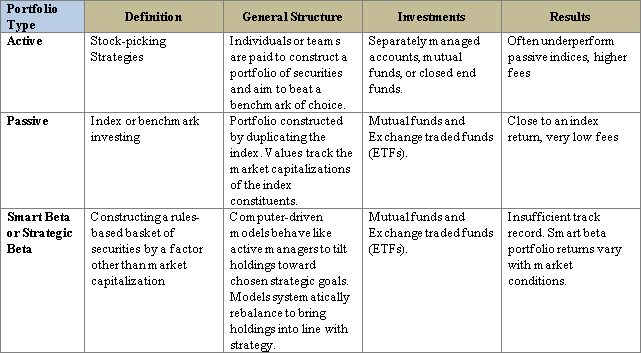

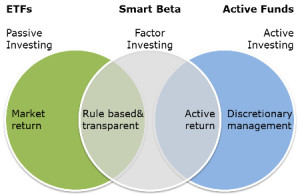

Traditionally, there have been two methods of equity investing – active and passive. More recently, however, a third option has come into play. Claiming that the market is inefficient and that passive indexing can be improved upon, institutional investors set out to create a product that seeks to exploit market inefficiencies by overweighting certain equity characteristics. This new style of investing has come to be known as smart beta or strategic beta.

To take a trip down memory lane, the first money managers utilized stock-picking strategies to design their portfolios. The advent of what is known as active management took hold of the marketplace when mutual funds were formed in the early 1900’s. By the 1960’s, billions of dollars had flowed into these mutual funds. In 1971, Wells Fargo established the first index fund. Also in the 1970’s, no-load funds also became available. The bull markets of the 1980’s and 90’s created mutual fund superstars like Peter Lynch and Michael Price.[1] However, in recent years, passive indices have often outperformed fund superstars, and investors have been content to invest in the overall market utilizing passive strategies. In fact, well-known investors John Bogle (Vanguard), Warren Buffett and Charlie Munger suggest that the average investor would be best served by purchasing an index fund.2

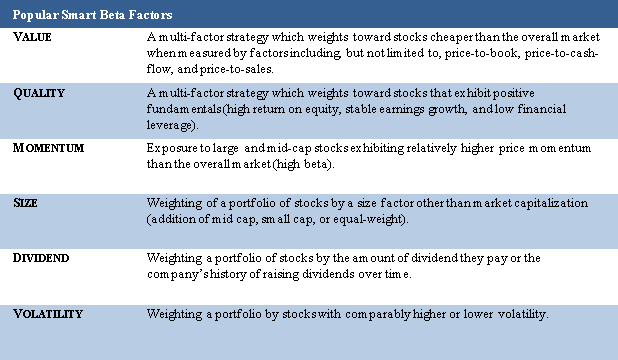

Smart beta portfolios are a natural outcome when big data meets traditional investing. The ability to crunch data and dissect returns has caused the investment world to consider a new option. Since active managers have recently underperformed the passive indices, the concept of being able to take the emotion and personality out of the stock picking (active management) and let the computer generate an unbiased list of stocks that fit a desired set of criteria sounds like a perfect match! Strategies to contemplate might include the following: value, growth, yield, capitalization size, low volatility, dividend growth, high beta, price momentum, equal-capitalization weight (see chart below for explanation).

At this point, computer-driven models do not have a track record that would verify outperformance over the long run. As Ronald Coase, a Nobel Prize winner in economics, stated, “If you torture the data long enough, it will confess to anything.” So, although the idea of overweighting has merit, it is mostly a product of back testing at this point. If outperformance versus a passive index persists over the market cycle, then smart beta will be here to stay.