Ever since the Social Security Act was signed into law in August of 1935, the federal insurance program has grown leaps and bounds in terms of the number of beneficiaries and coverage. According to data from the Social Security Administration, a little over 53,000 people received a total of $1.3 million dollars of benefits in 1937.  By 2008, the number of recipients was almost 51 million while aggregate benefits paid totaled over $615 billion. Several amendments throughout the decades have added significant changes, such as disability (1954), medical coverage for seniors through the Medicare bill (1965), and automatic cost-of-living-adjustments or COLAs (1972).[1]

By 2008, the number of recipients was almost 51 million while aggregate benefits paid totaled over $615 billion. Several amendments throughout the decades have added significant changes, such as disability (1954), medical coverage for seniors through the Medicare bill (1965), and automatic cost-of-living-adjustments or COLAs (1972).[1]

In this quarterly letter, we will be looking at the factors determining Social Security (SS) benefits and how to incorporate them into a retirement plan.

Social Security Credits

In order to be eligible for SS benefits, a U.S. worker aged at least 18 has to accumulate credits. For 2015, it takes $1,220 of covered earnings to earn one credit. Up to four credits can be earned throughout each calendar year and no more than 40 credits can be accumulated (10 years of earnings record). To properly receive the credits, make sure SS (FICA or OASDI) taxes are being deducted from payroll.

Earnings Record and Retirement Benefits

So how are SS benefits determined? Two factors: earnings (dollar) and work history (years). SS looks at a worker’s highest 35 years of earnings and computes what is known as the “primary insurance amount,” or PIA, which is the benefit a person would receive at full retirement age (FRA). When clients are contemplating retirement, one of the questions we ask them is how many years of SS earnings do you have in the system? Sometimes it makes sense to stay in the workforce for a few more years.

Retirement Age and Benefits

Retirement Age and Benefits

In addition to earnings history, deciding when to retire has perhaps an even bigger impact on benefits. FRA for baby boomers (born in 1943 to 1954) is 66, and that increases to 70 for those born in 1960 and later.

Workers can opt to claim SS retirement benefits as soon as they turn 62, with a reduction up to 25%. There is a handy calculator online that compares benefit decrease (and increase) at different retirement date.[2]

While claiming SS benefits early results in benefits reduction, delaying them, on the other hand, comes with a bonus. For every year of not claiming SS benefits once FRA is reached, a worker will receive a bump of 8% in benefit, up to age 70 (Figure 1).

Source: Kiplinger, Social Security

Work, Taxation and Social Security

There are some special rules regarding working and claiming SS benefits before FRA. In a nutshell, SS benefits are reduced if a worker/recipient makes over $15,480 in 2015.

Source: Social Security

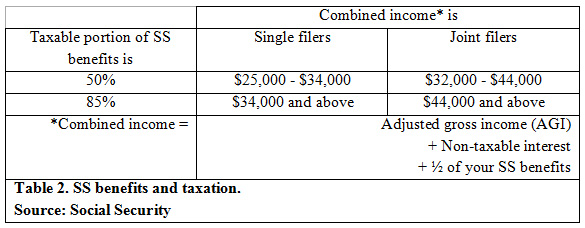

The above rules do not apply anymore once a worker reaches FRA; however, SS benefits become taxable once household income goes over certain threshold.

Source: Social Security

This creates a dilemma to retirees and advisers alike. SS counts non-taxable interest income when figuring out how much of the benefits are subject to income tax. Retirees who count on municipal bond interests as one of the funding sources often have a hard time understanding this “taxable” concept. Having a sizable municipal bond portfolio during retirement, therefore, may not be as “tax-friendly” as one believes.

Smart and Thoughtful Planning

How do we incorporate SS into a retirement planning scenario? Or better yet, how do we know which SS withdrawal strategy is the most beneficial? We can solve that puzzle! By looking at all the factors that go into creating a retirement plan, our plan can quantify 1) the maximum SS benefits throughout retirement and 2) the strategy with the best probability of success.

For instance, in the above plan for Jack and Jill, the difference of benefits between the circled choices is over $400,000. Delaying SS may not always yield top dollar. Also, after considering other factors such as investments, retirement lifestyle, goals, etc., we arrive at a strategy that would achieve two things—maximizing SS and maximizing plan probability (yellow highlights).

If you think it is time to talk about retirement, or have any questions regarding the materials in this article, do let us know.

[1] http://www.ssa.gov/history/briefhistory3.html

[2] http://www.socialsecurity.gov/OACT/quickcalc/early_late.html