As interest rates and inflation begin to rise, some fret that debt levels will cause a recession once again. However, there are two types of borrowings: fixed and variable. In a rising rate environment, these two loan types behave very differently.

During the 2007 Great Recession, uncreditworthy borrowers, plummeting real estate values, and the proliferation of adjustable rate mortgages (ARMs) created a consumer debt debacle that almost brought down the entire U.S. financial system.

The biggest culprits of the 2007-2009 real estate crisis – unscrupulous loan originators, aggressive ARM/home equity lenders, and marginal borrowers – have been pushed out of the market. Most mortgages are now issued at fixed rates rather than variable rates. As income and interest rates rise, the economic cost of servicing these debts shrinks. The same is true for all fixed rate loans. A positive side of inflation and rising incomes is the function of a shrinking debt burden because you can pay off your debt with cheaper dollars. This is one way to “deleverage” your personal balance sheet.

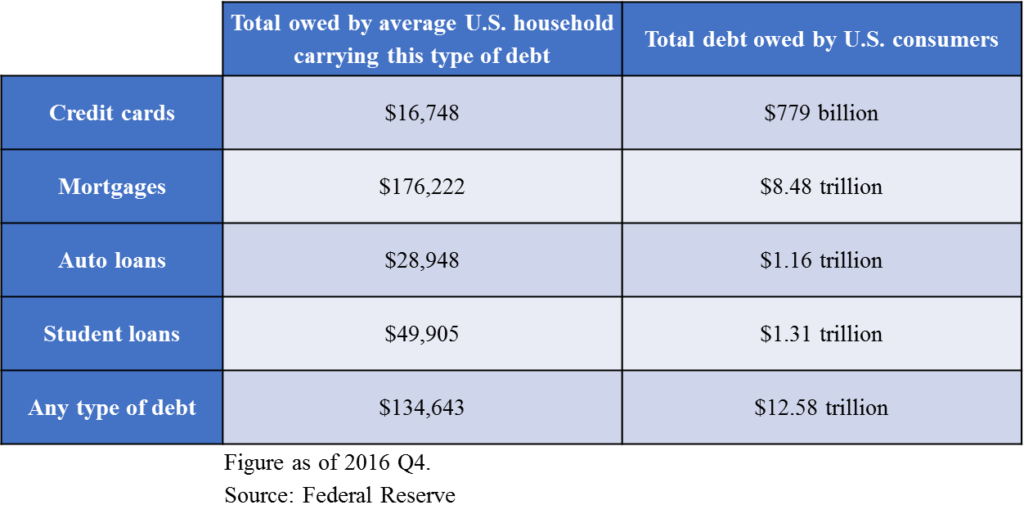

As you can read in the table above, household debt is categorized into four major categories: mortgages, student loans, auto loans, and credit card (revolving) debt. For the average household, fixed rate loans constitute the majority of these debt payments. However, recently, credit card debt has grown faster than income. The rates paid on credit cards are variable and the average household will be paying more in interest each month as rates rise. The same is true for other variable rate debts.

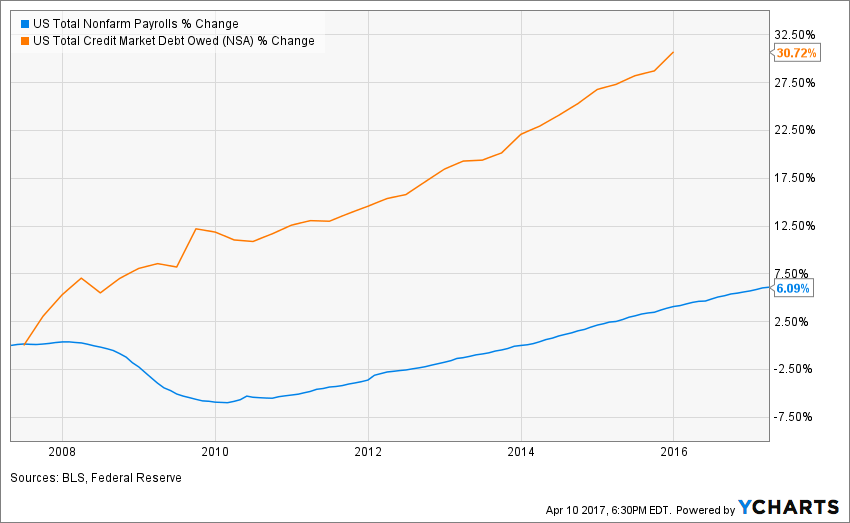

Consumers have been taking on this revolving debt because the cost of living has been growing faster than incomes for quite some time (see graph below).

In summary, the wisest consumers will use the current low rate environment to secure fixed rate loans and reduce reliance on any variable, revolving debt. Do not hesitate to call us if you would like a special review of your financial situation in light of rising rates.

In summary, the wisest consumers will use the current low rate environment to secure fixed rate loans and reduce reliance on any variable, revolving debt. Do not hesitate to call us if you would like a special review of your financial situation in light of rising rates.