Click here to download the PDF version of the newsletter.

|

|

|

In This Issue:

|

|

|

|

|

Inflation Impact

Americans are alarmed by inflation. The inflation that was first deemed “transitory” is here to stay, and consumers are feeling its effect on their pocketbook.

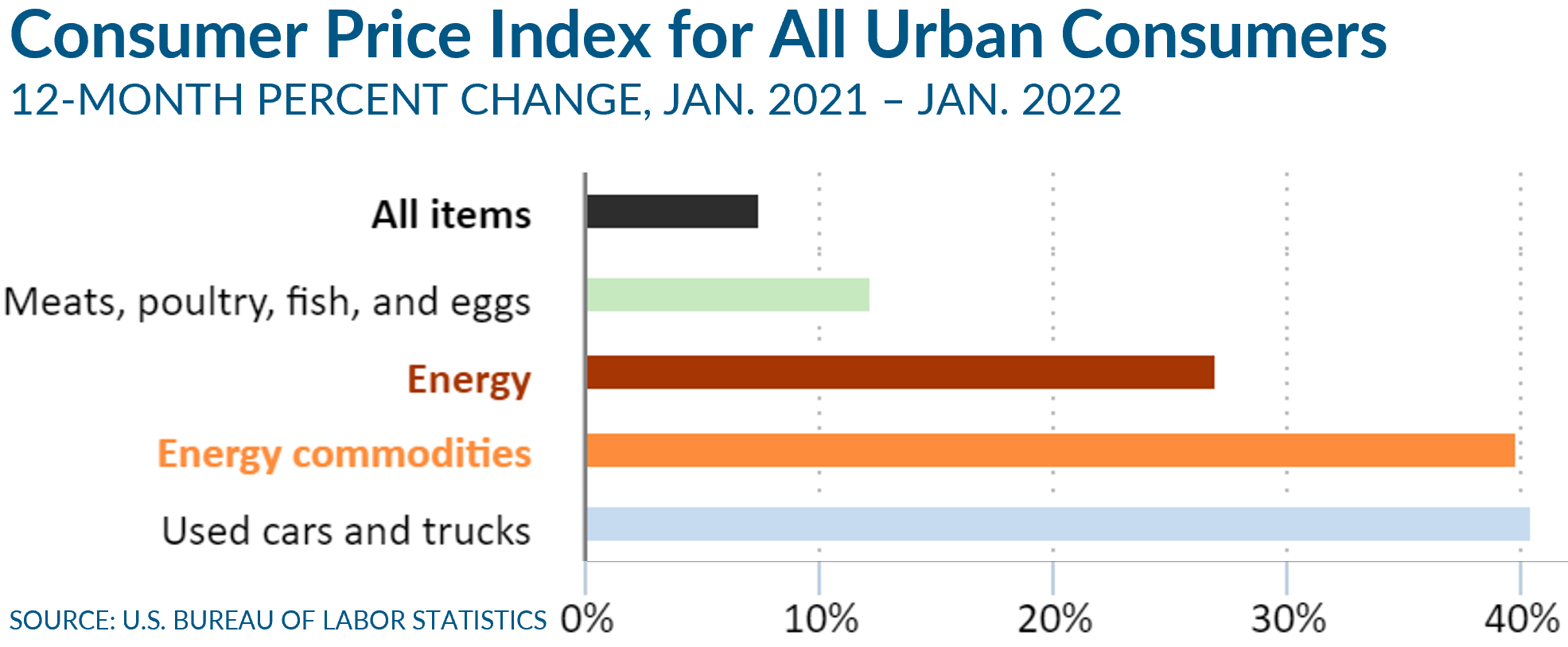

Inflation is stubbornly high for goods and services. Some sectors have been disproportionately impacted. Used car and energy prices, for instance, increased approximately 40% in the past year.

What’s causing it?

Since the onset of the COVID-19 pandemic and the subsequent lockdowns implemented by governments around the world, supply-chain disruption has been a major contributor to inflation. Freight costs, despite being cut in half from last summer’s peak, remain five times higher than March 2020 levels.1 Commodity prices have also been on the rise, exacerbating the already painful transportation costs. Additionally, rising wages driven by an increasingly tight labor market are fueling inflation.

Federal Reserve policies and several rounds of stimulus passed by Congress allowed cash to flow freely. Meanwhile, government lockdowns and increased subsidies created excessive demand for specific types of goods and further drove up prices.

Inflation often shows itself in the following forms:

Price inflation – increase in sticker price such as per gallon gas at the pump.

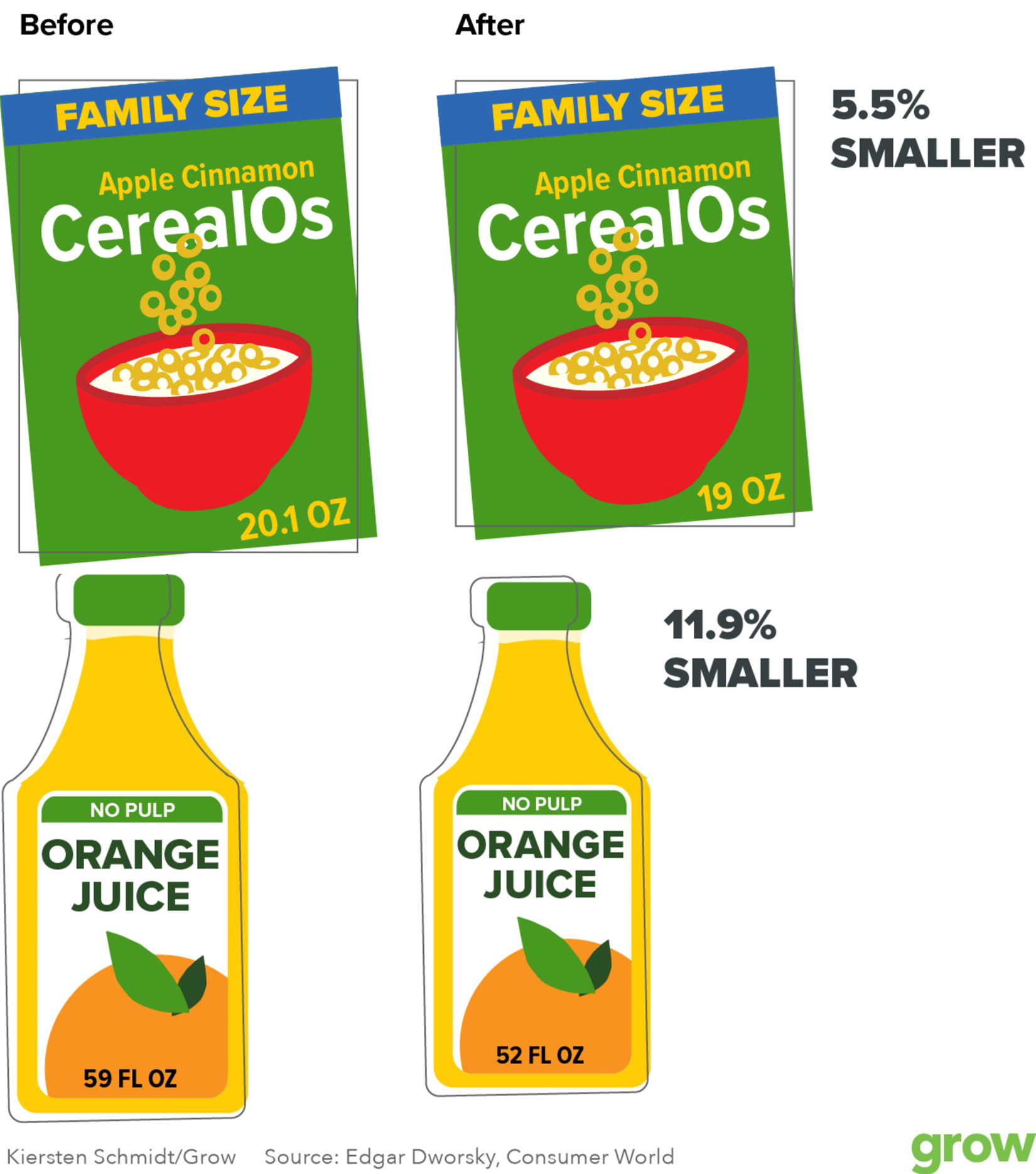

Shrinkflation – smaller quantities without a change of price.

Why does inflation matter?

When inflation runs high, it changes consumer behavior. Since more money must be spent on everyday necessities, consumers have a smaller budget for discretionary spending (leisure, capital goods, etc.), reducing demand. This reduction in demand pressures the companies providing the goods and services to cut costs wherever they can, including terminating employees. The cycle repeats.

Inflation hurts savers in the form of diminished purchasing power. Interest rates on savings accounts also lag far behind inflation. Consumers, in anticipation of higher future prices, may opt to make non-discretionary purchases now instead of waiting.

When economic growth slows down during an inflationary period, the result is stagflation. This could lead to a recession.

If you own fixed-rate annuities as part of your retirement income plan, you could be disappointed in an inflationary environment. Many annuities do not come with a cost-of-living adjustment (COLA) like social security benefits do. Without a COLA rider (added cost), annuity payment amounts do not adjust for inflation.

Stay tuned for our July newsletter, where we’ll discuss ways to protect against inflation.

Inflation and Estate Planning

The Lifetime Estate and Gift Tax Exclusion, at $12.06 million per individual in 2022, adjusts for inflation every year. A high inflation number will make the exclusion bigger. Even if the exclusion reverts to 2016 level ($5 million) after 2025, the amount will still receive the annual adjustments.

Family loans and certain estate-planning techniques involve the use of interest rates, known as the Applicable Federal Rates, or AFRs. These rates generally fluctuate with inflation. Depending on the specific goals of a plan, the applicable AFR may work for or against your intentions.

Market Minute

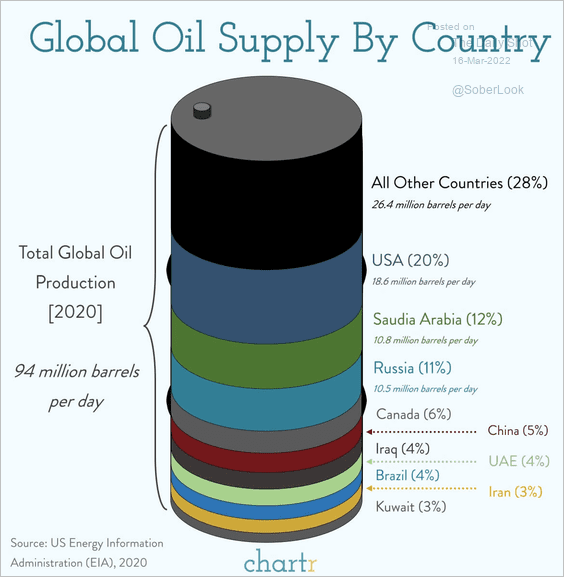

The Ukraine-Russia War. On February 24, 2022, Russian President Vladimir Putin launched a large-scale invasion of Ukraine. In the wake of his violent actions, NATO and the West responded by enacting sanctions. These measures, however, have not been without repercussions. Economic uncertainty in the aftermath of the invasion combined with supply chain shortages caused by Western sanctions have weighed on commodity prices. European countries have been hit especially hard due to their dependence on Russian oil and gas.

Agriculture is another casualty of the war in Ukraine. According to the Center for Strategic and International Studies2, twenty-six countries source at least half of their wheat imports from Russian and Ukraine.

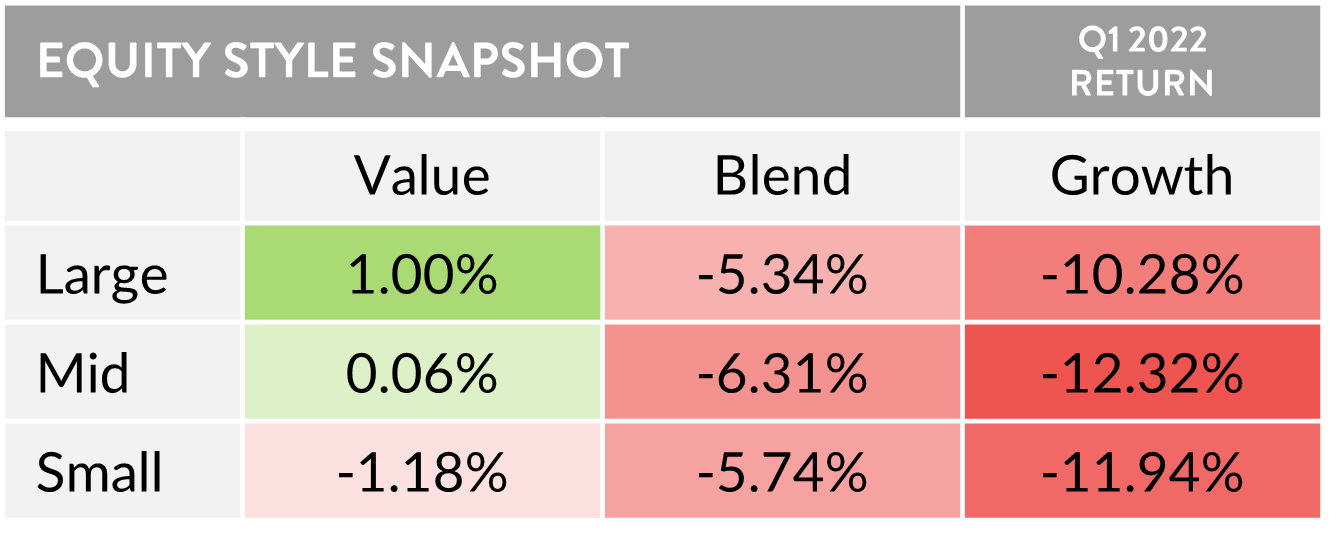

Growth Stock Valuations. As anticipated, expensive growth stocks suffered the most during the market downturn this quarter. Will value stocks’ outperformance continue?

FAQs From Our Clients:

Can I gift more than $16,000 a year to a person? If I do, will I have to pay tax?

The annual gift tax exclusion for 2022 is $16,000 per recipient. Married couples can give $32,000 without reporting to the IRS. If you wish to give an amount above the annual exclusion, you will need to file a gift tax return (Form 709) – but do not have to pay taxes on that money in most cases. The amount can be applied to your lifetime exclusion ($12.06 million in 2022). For example, if you wish to give your daughter $50,000 to help her buy a house, you will have to file a gift tax return, but need not pay a gift tax. The excess ($34,000) will be applied to your lifetime exclusion, leaving you with a remaining $12.026 million exemption.

How will the war in Ukraine affect the U.S.?

The most immediate effects are further increases in commodity and food prices. Additionally, the market could remain volatile for some time, as investors weigh economic uncertainty and inflation among other factors. The U.S. may also be forced to increase defense spending in its role as a global peacekeeper.

Send us your questions to have them included in next quarter’s publication!

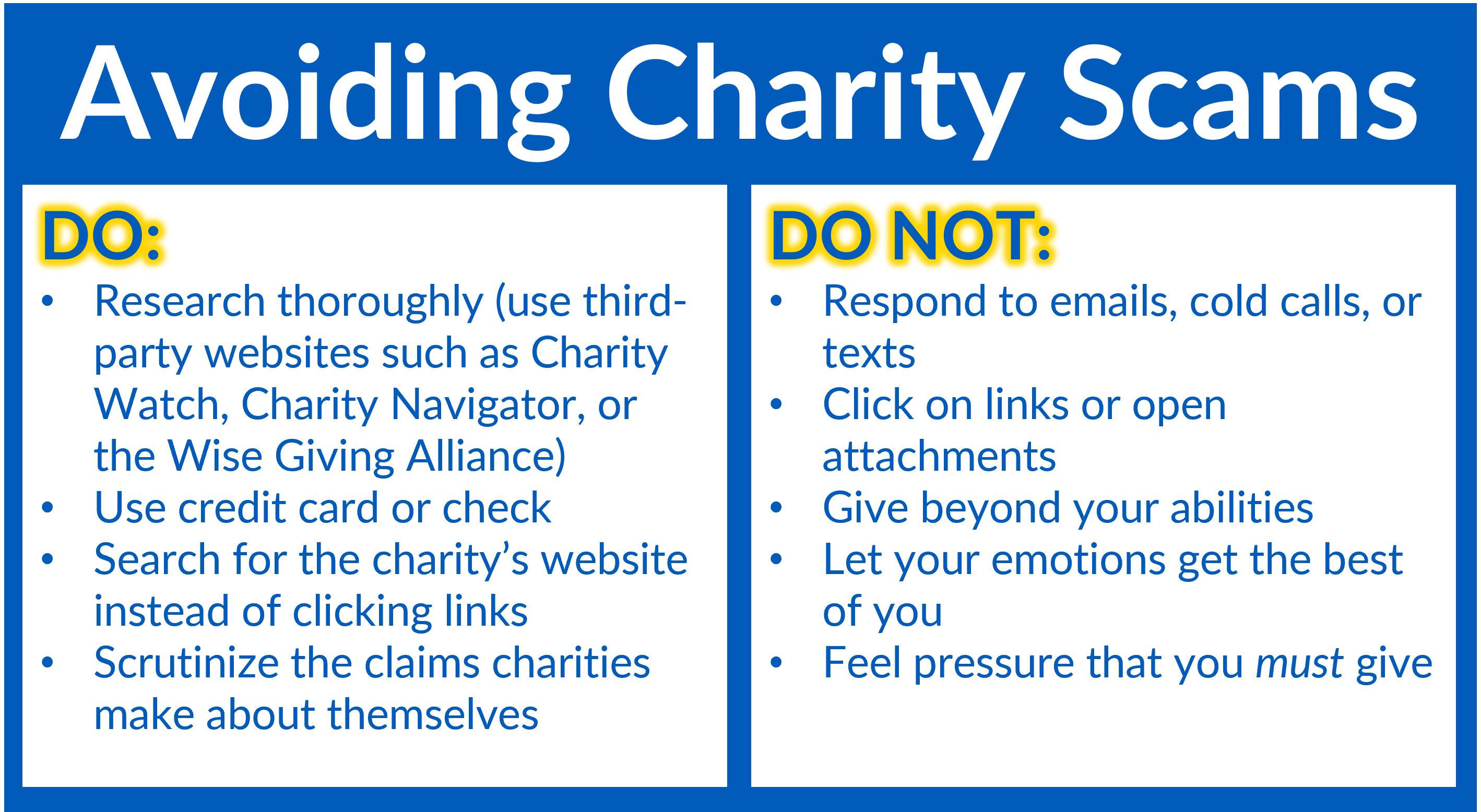

Avoiding Scams

Since the war started, people from around the world have desired to help Ukraine through charitable donations.

In what has been dubbed the “pay, don’t stay” movement, people worldwide booked Ukrainian Airbnb trips with no intention of staying there as a way to get cash into the hands of locals.

As the movement gained popularity (especially on social media), scammers saw opportunity to take advantage of these well-wishers. Hosts created listings for apartments that did not actually exist in an attempt to pocket “donations” from the “pay, don’t stay” movement. Airbnb has since disallowed new hosts to create listings in Ukraine.

Unfortunately, these Airbnb scammers are just one example of ways that criminals prey on the emotions of generous people who are looking to help. Below are some tips to avoid being scammed.

1https://blogs.imf.org/2022/03/28/how-soaring-shipping-costs-raise-prices-around-the-world/#post/0

2https://www.csis.org/analysis/agriculture-and-food-security-casualties-war-ukraine