Click here to download the PDF version of the newsletter.

|

|

In This Issue:

|

|

|

|

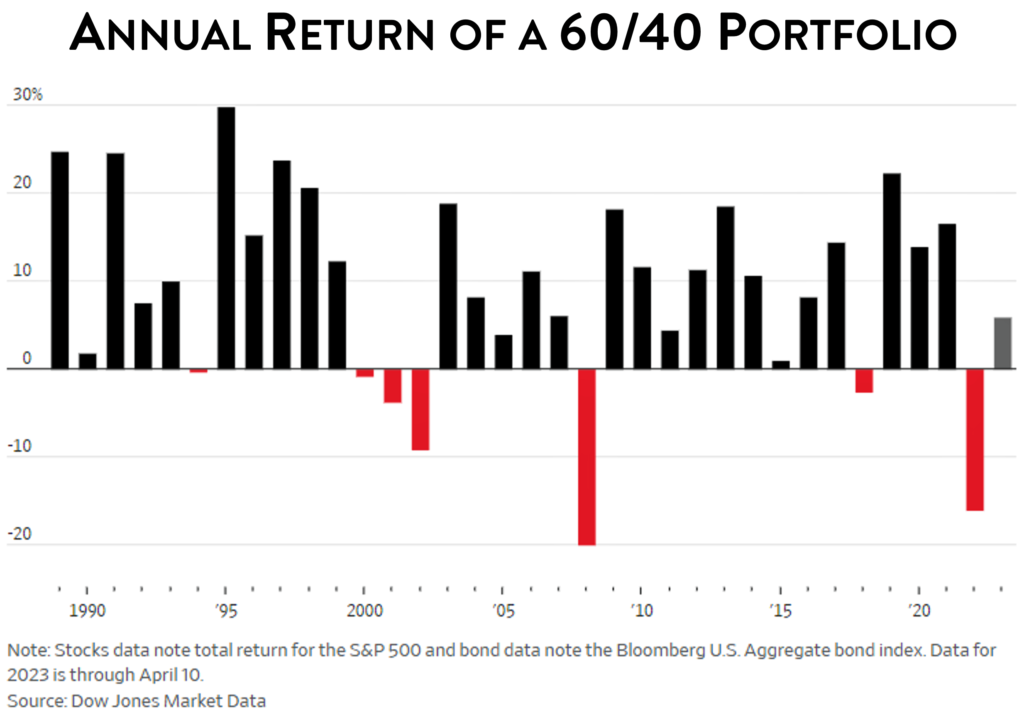

Back In Balance

Recent rate adjustments have breathed new life into the bond market. Although 2022 was a down year for both stocks and bonds, 2023 presents an opportunity for the traditional 60/40 asset allocation to bring added value to your portfolio once again. US Treasury bills returning a steady 4% and equities responding well to weakening inflation expectations provide an investing framework that resembles the days before zero-interest cash became the norm. Because bonds are making a comeback, it is no longer necessary to increase a portfolio’s risk factor by using alternatives, high-dividend stocks, and other illiquid assets to generate income.

In 2023, the strength of the equity market will be determined by earnings growth and profit margins. Inflationary pressures, persisting pandemic imbalances, and supply chain bottlenecks cloud the macroeconomic picture, but there is no doubt that investing in companies with pricing power will continue to serve shareholders well.

of the equity market will be determined by earnings growth and profit margins. Inflationary pressures, persisting pandemic imbalances, and supply chain bottlenecks cloud the macroeconomic picture, but there is no doubt that investing in companies with pricing power will continue to serve shareholders well.

FAQs From Our Clients:

Is it better to give stocks to charities?

Yes of course – because you can avoid capital gains! However, you should first make sure these two things are in place: 1) Your stock is highly appreciated (it’s worth more now than you paid for it), and 2) the receiving charity has a brokerage account to accept the stock.

Send us your questions to have them included in next quarter’s publication!

What’s going on with Banks?

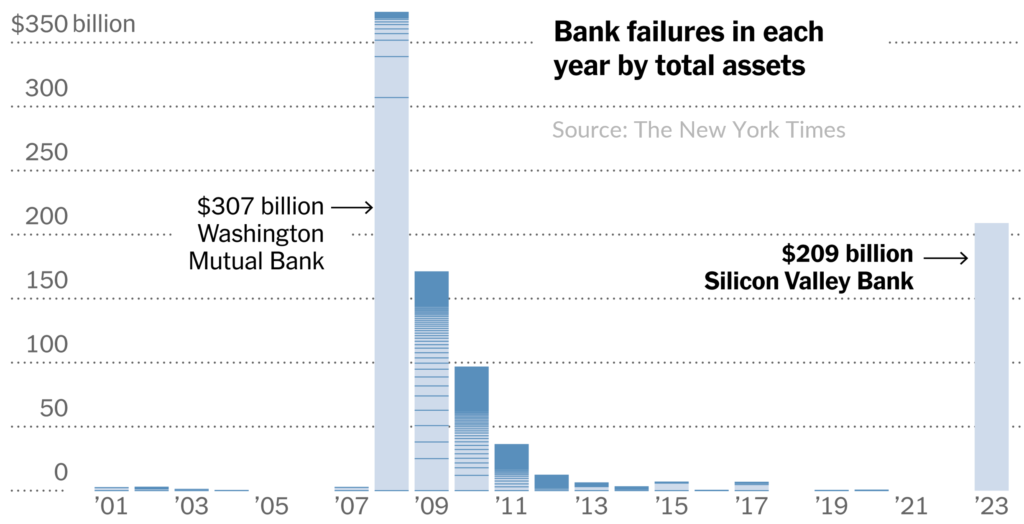

In early March, SVB, a big regional bank in California serving tech startups and venture capitalists, failed in spectacular fashion. Its downfall was a classic example of a bank run, yet with a modern twist that dramatically accelerated its collapse. Once customers got wind that the bank was selling assets to meet withdrawal demands, the floodgates were opened; the ability to transact with a simple tap or mouse-click brought SVB to its demise in just 48 hours. Read What Happened to SVB in Simple Terms by Newsweek.

Since the Global Financial Crisis, top national banks have significantly shored up their capital structure and reduced risks, in addition to meeting ongoing regulatory “stress tests.”

Since the Global Financial Crisis, top national banks have significantly shored up their capital structure and reduced risks, in addition to meeting ongoing regulatory “stress tests.”

Many of these requirements, however, do not apply to smaller banks such as SVB and Signature. The COVID cash infusion and ultra-low interest rate environment compelled banks like SVB to purchase conservative fixed-income investments such as long-dated Treasury bonds and mortgage-backed securities. These investments lost value when interest rates rose quickly (the Fed Funds rate went from 0.25% to 4.75% in less than a year), creating a liquidity problem.

The White House is proposing stronger regulations for banks of all sizes, but will their solution work or simply create new problems? Only time will tell.

Did you know…

Banks fail more often than we realize, although most are small banks.

FDIC keeps track and publishes these failures online at https://www.fdic.gov/bank/historical/bank.

The Case for Roth IRAs

The case for Roth IRAs mainly centers on one thing: tax-free withdrawals. This feature makes Roth IRAs beneficial not only to the account holder but also to their surviving spouse and heirs.

- Tax free distribution – qualified distributions are completely tax-free.

- No RMD – Roth IRAs are not subject to required minimum distributions (RMDs).

- Beneficiary tax planning – non-eligible designated beneficiaries such as children inherit the assets tax-free and may wait for 10 years before making a full withdrawal.

- Historically low tax rates – low tax rates make contributing or converting to Roth IRAs appealing. Take advantage of the current historically low rates and avoid higher tax rates in the future!

- No tax “hikes” for surviving spouse – surviving spouses can be blindsided by higher tax rates once they are unable to file jointly. Tax free distributions from Roth IRAs provide a way to avoid this problem.

For more information, check out our blog post: Why You Should Seriously Consider Roth Conversions.

Cash Is King

What options do I have for protecting my cash? Store it in your mattress or couch. Just kidding! Keeping a large amount of cash at home is not safe at all! Your bank deposits under individual ownership up to $250,000 are covered by FDIC insurance (joint accounts get $500,000 of insurance). You can learn more at the FDIC website. Of note is the fact that the FDIC recently agreed to insure ALL deposits at Signature and Silicon Valley.

If you have cash above the insurance limit, spreading assets across accounts at multiple banks is one way to ensure adequate insurance coverage. However, it can be cumbersome to keep track of numerous accounts. Additionally, many bank accounts offer only ultra-low yields on cash deposits.

Instead, a popular and more compelling alternative is to use excess cash to purchase US government securities. These government securities offer the following upside:

- US Treasury bonds are backed by the full faith and credit of the US government and considered the safest possible investments (“risk-free” investments).

- Returns on short-term US Treasury bonds are over 4% (average yield for savings accounts is 0.24%, according to Bankrate’s April 5 weekly survey).

- Treasury bonds are very liquid and can be bought and sold almost as easily as stocks.

As part of our ongoing portfolio management, we have been actively keeping excess cash in Treasurys (individual bonds and funds) to maximize cash yields and minimize risk.

Did you know…

We can help review your life insurance to determine whether changes are necessary.

How have your permanent life insurance policies (whole and universal) performed, especially after 2022’s market turmoil? You can request an “in-force” ledger and send it to us to initiate the review process. Contact us if you are interested.