Click here to download the PDF version of the newsletter.

|

|

In This Issue:

|

|

|

|

Job Market Report: Partly Cloudy, Partly Sunny

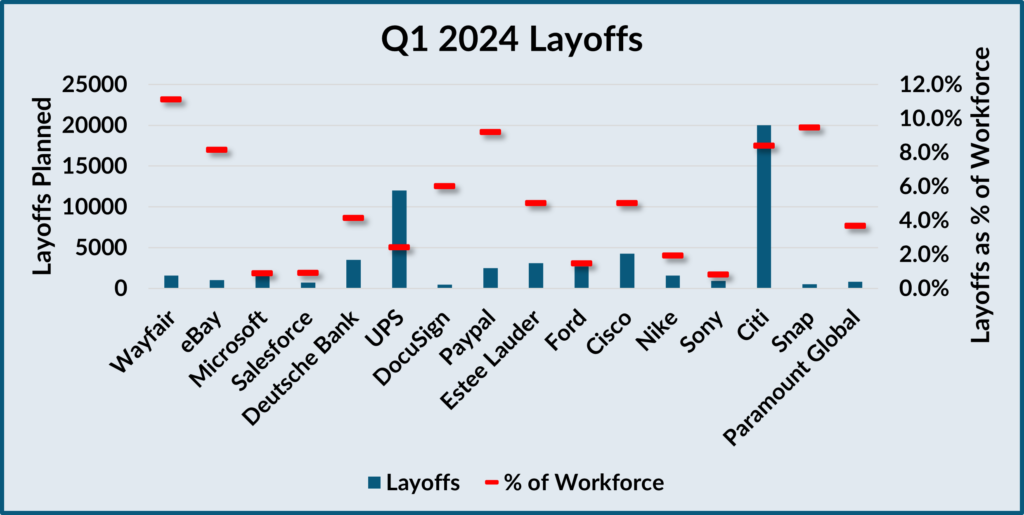

Several companies announced significant layoffs in the opening months of 2024. UPS and Citi received considerable attention as they announced job cuts of 12,000 and 20,000, respectively. Other companies, such as Snap, Wayfair, and PayPal, laid of fewer employees but a larger percentage of their total workforce.

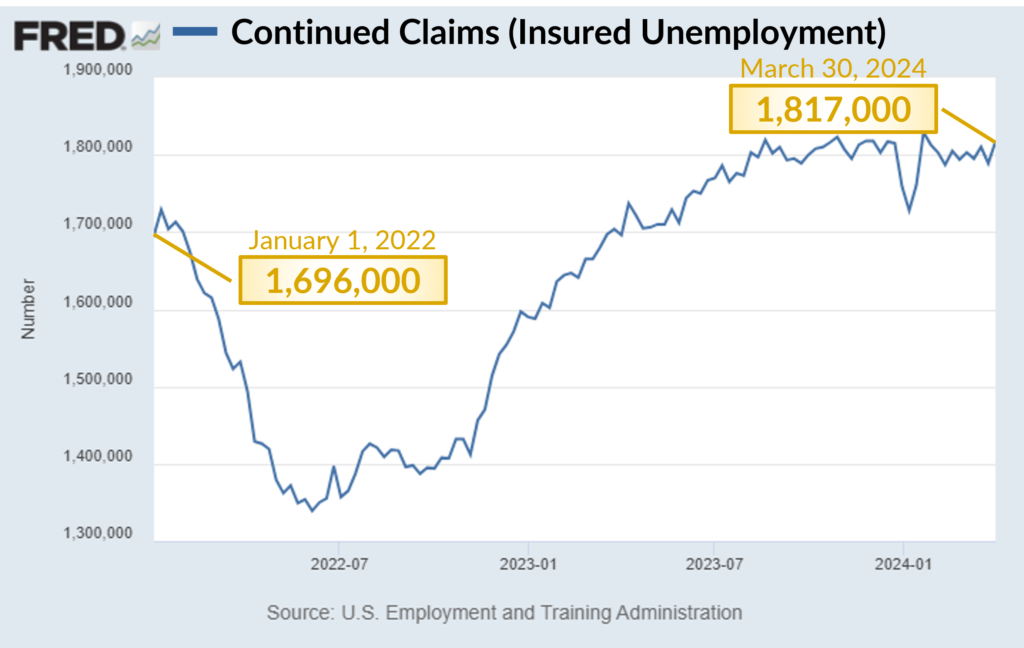

Continuous claims are near a 2-year high, putting some pressure on the job market.

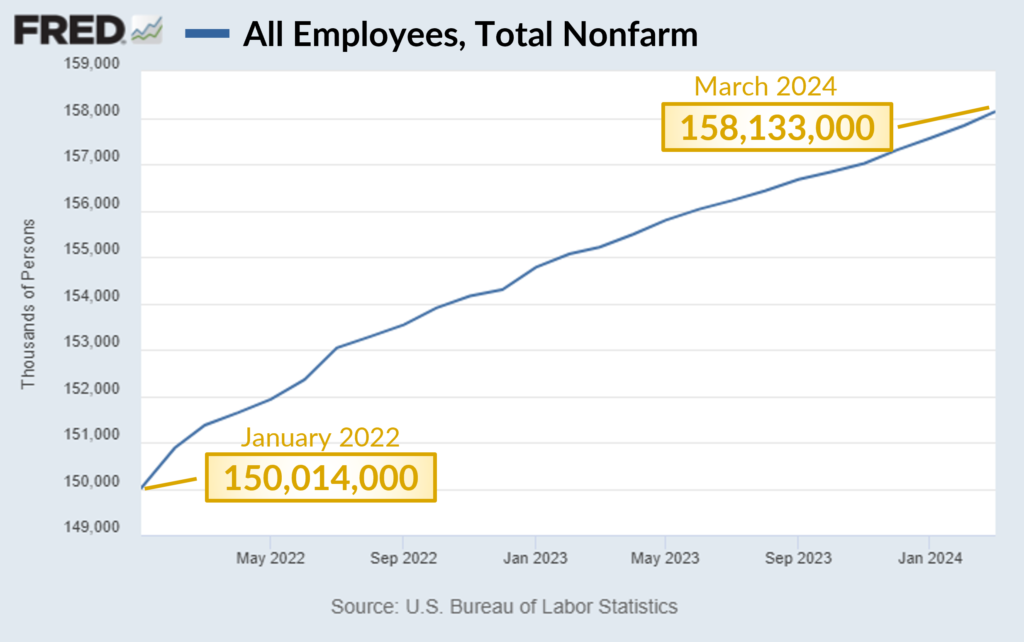

The picture is not all gloomy, however. Job reports in the first three months of the year have surged past even the most optimistic forecasts. Wage growth has been reasonable and continued jobless claims are below the long-term trendline, indicating sustained momentum in the job market. As long as the job market stays healthy, so too can the U.S. economy.

Tuning Out the Noise

Modern investors are inundated with market signals. Though many are just noise, certain indicators are worth a closer look. What is the current market telling us and how should we prepare ourselves?

Stock Market

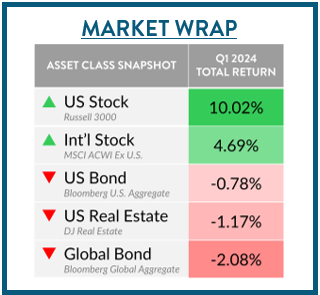

First quarter market returns notched the best start to a year since 2019. Ten of the eleven S&P sectors were up in the first quarter, and more than half of the stocks in the S&P reached new 52-week highs, showing the breadth of the rally.

Notably, the stocks colloquially known as the “Magnificent Seven” – Nvidia, Alphabet (Google), Apple, Microsoft, Tesla, Meta (Facebook), and Amazon – underperformed the S&P 500 in March, rising 2.5% in the past month while the index was up 4.4%. In 2023, the Magnificent Seven gained 107%, versus 24% for the S&P 500. So far in 2024, market leadership has not been concentrated in a handful of names but is expanding – a positive sign.

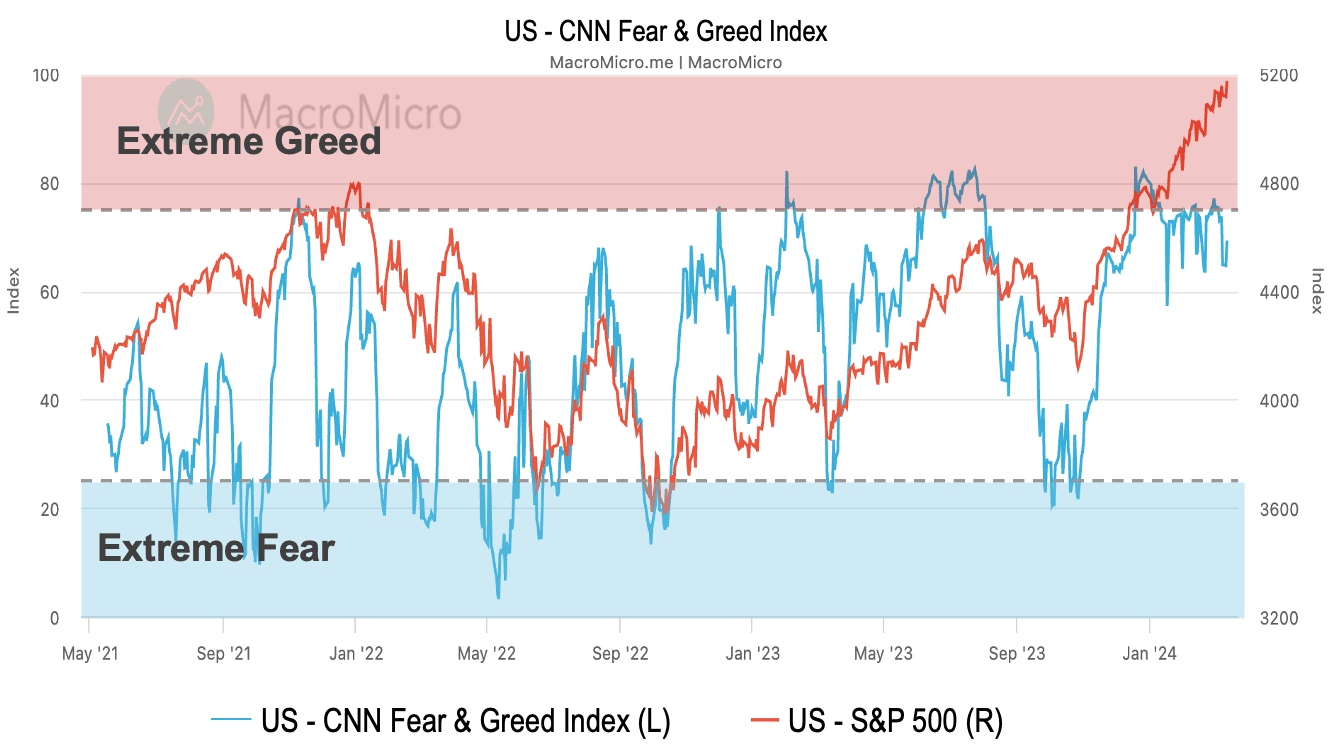

Greed and Volatility

A research report we follow wrote on March 8, 2024:

Greed has dominated equity markets since the October lows, underscored by derivatives traders continuing to sell VIX futures calendar spreads to get exposure to “short volatility.” The longer the greed-dominated “short-vol” trade persists, the bigger the risk of a violent correction in stocks.

The market has been sprinting for almost six months and needs a breather. Whether it will be a short break or an extended period will depend on investor sentiment and economic indicators.

Bond Market

Strong economic data and concerns about persistent inflation have caused some weakness in the U.S. bond market. After rising 6.8% in the final quarter of 2023, the U.S. Bloomberg Aggregate Bond Index, or “the Agg,” fell 0.8% in the first quarter this year. The “yield curve” is still inverted, which has been a leading indicator of a domestic recession since World War II. It is likely that we could see a brief and shallow slowdown. Many investors may not see or feel the impact unless the market overreacts.

FAQs From Our Clients:

With interest rate cuts imminent, does it make sense to have long-term bonds now?

It depends. If locking in a 4%-ish annualized return on 10- or 20-year Treasury bonds provides income reliability and investment certainty, then it is advisable. On the other hand, is 4% a reasonable compromise when your investment time horizon can be 20 years or longer? Keep in mind that annual return on U.S. large-cap stocks has averaged about 8% since 2004.

Send us your questions to have them included in next quarter’s publication!

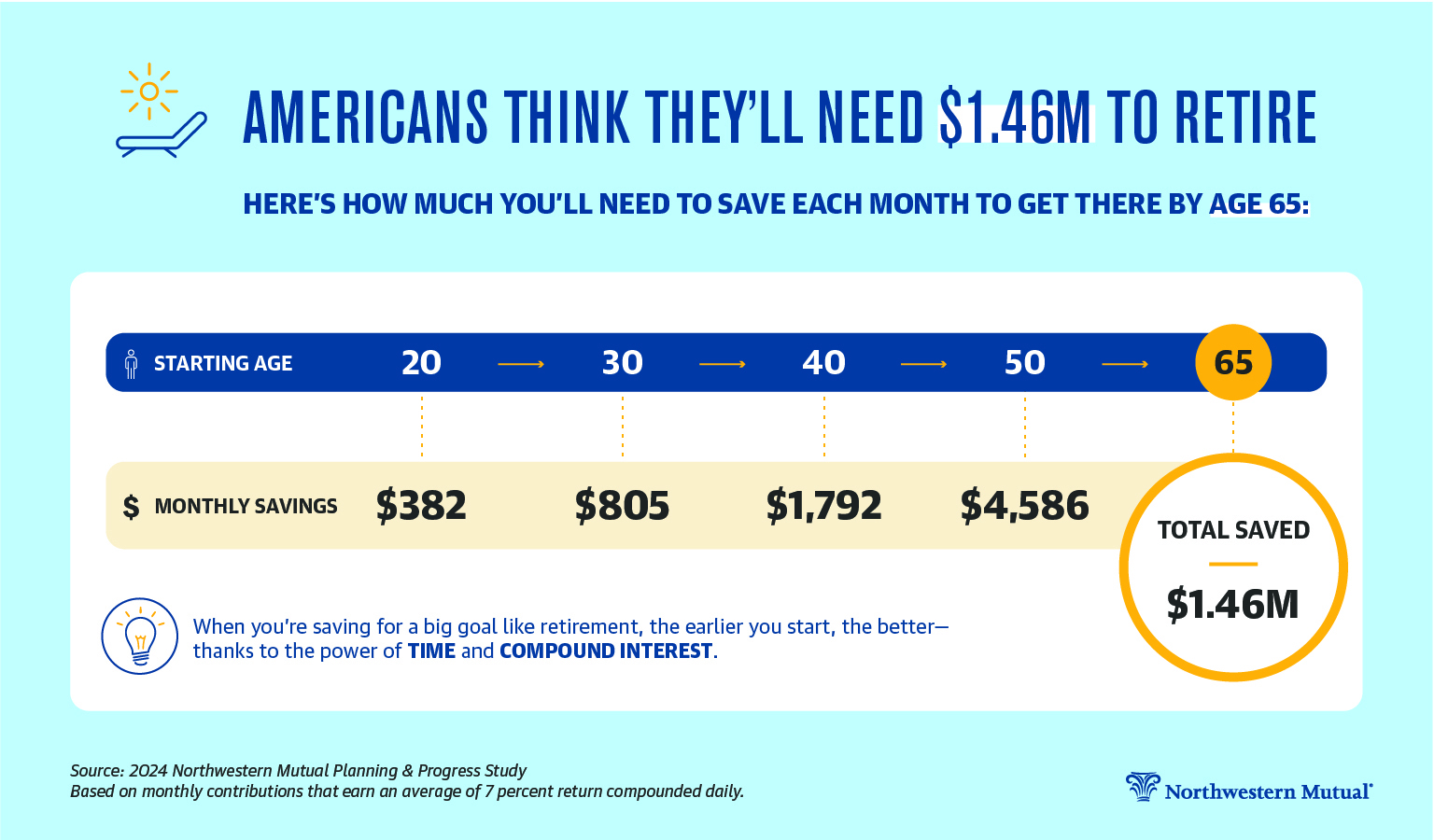

How Much Do I Need to Retire?

The 2024 Northwestern Mutual Planning & Progress Study has garnered attention since its release, thanks to the all-time high amount that Americans think they will need to retire – $1.46 million. Retirement savings is a marathon, and the earlier you start, the greater your advantage. Talk to us about ways to get started or an in-course checkup. View the full study here.

Financial Spring Cleaning

- Watch your withholding – check your W-4 form and make sure that you’re withholding the right amount from your paycheck. Your tax returns can tell you a lot.

- Revisit retirement contributions – are you maxing out your workplace retirement plan if you can? Are you contributing to an IRA or Roth IRA?

- Confirm beneficiary designations – double-check that your retirement plans and life insurance

policies have the correct named beneficiaries. - Dust off your estate plan – it’s a good idea to review your estate plan every year – especially in years with a major life event. If you have yet to put an estate plan in place, don’t put it off any longer!

- Get a better savings rate – savings rates are higher than they’ve been in a long time. Although many high-yield savings accounts have interest rates upwards of 5%, the national average for savings accounts is just 0.57% APY. Ensure your cash is working for you! Talk to us about getting 5% interest on your cash.

- Maximize credit card rewards – make sure that you’re making the most of your credit card perks. Also, beware of record-high credit card APRs.

- Check credit report – each of the three major credit bureaus – Equifax, Experian, and TransUnion – allow you to access a free credit report once per week. Be sure to check for any errors that could be affecting your credit score.

- Update your budget – evaluate spending and eliminate unwanted subscriptions. Confirm that your budget aligns with your goals.

- Review insurance policies – verify that you’re getting the best rate. Bundling your home and auto insurance can help.

- Consolidate accounts – if you find it difficult to keep track of your financial accounts, consider combining and/or closing out accounts that you no longer need.

Did you know… April is Financial Literacy Month

Take this Financial Literacy Assessment by State Street to see how much you know (or don’t know).