Click here to download the PDF version of the newsletter.

|

|

In This Issue:

|

|

|

|

Inflation Mitigation (Part 3)

A series on practical ways to protect and fight against inflation. Read our July Newsletter for Part 1: Generate Your Own Power and our October Newsletter for Part 2: Interest Rates and inflation generally rise together.

Part 3: The Fed Campaign and Demand Destruction

After being dormant for several decades, inflation burst to the forefront in 2022. We felt the pain at the pump and in the grocery store, and mortgage rates topped 7%. Despite the hit to our pocketbooks, the recent uptick in interest rates has served useful purposes too.

Investments.

Fixed income investing is no longer a zero-sum game. The correlations between equities and fixed income have normalized and the 60/40 portfolio is once again a compelling option.

Money Market Yield.

Cash is now paying more than it has in years. Short-term Treasury bills and money markets at both Schwab and Fidelity are now yielding over 4%.

Real Estate.

Housing prices are slowing, and inventory is building as higher mortgage rates increase the cost of home ownership and force some first-time buyers out of the market entirely. At some point, the price correction will stop and reach an equilibrium (after overshooting on the downside). That would be ideal for buyers with the resources and ambition of owning a home. Traditionally speaking, real estate value has kept up with, if not outpaced, inflation.

Demand.

Household demand has fallen as government subsidies phased out and inflation persisted. The supply and demand dislocations created by the pandemic continue to work their way through the system. The supply chain is more resilient and inventories more manageable. Demand has shifted from goods to services, as consumers are free to resume normal daily activities. By raising interest rates quickly, the Fed hopes to dampen demand for goods and services so that inflation will dissipate. This is a treacherous move because no one knows where the “sweet spot” is. If the Fed does not do enough, inflation will persist. Should the Fed hike too much, it could induce a recession.

FAQs From Our Clients:

What does the FTX fallout mean for the future of cryptocurrency?

While the crypto market enjoyed a spectacular rally in 2020 and 2021, its collapse has been equally dramatic, particularly with the implosion of FTX at the end of 2022. Although the situation is still developing, it’s likely that this will lead to some form of regulation of digital assets to prevent similar pain to investors in the future.

Send us your questions to have them included in next quarter’s publication!

New Year, New Rules

New contribution limits for retirement plans:

- IRA and Roth IRA – $6,500 (plus $1,000 catch-up for those 50 and older)

- 401(k) and 403(b) – $22,500 (plus $7,500 catch-up for those 50 and older)

Parts of SECURE 2.0 go into effect this year:

- RMD age delayed to age 73

- Additional options for Roth savings

- More exceptions to early distribution penalty

- Missed RMD penalty reduced to 25% (was previously 50%)

Keep an eye out for continued coverage regarding changes brought about by SECURE 2.0.

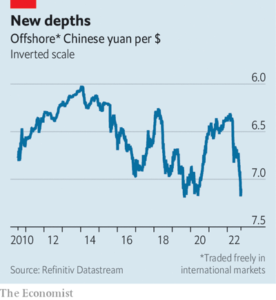

Where does China go from here?

In October, China held and concluded its 19th Communist Party Congress, at which Xi Jinping’s power was solidified to a level not seen since Mao Zedong. In short, Mr. Xi (aka Emperor Xi) can stay in power for as long as he wants. Spooked by this development and the already volatile global markets, investors swiftly shunned Chinese investments, causing a spectacular tumble of the Chinese yuan, Chinese stocks, and the Hong Kong Hang Seng Index.

In October, China held and concluded its 19th Communist Party Congress, at which Xi Jinping’s power was solidified to a level not seen since Mao Zedong. In short, Mr. Xi (aka Emperor Xi) can stay in power for as long as he wants. Spooked by this development and the already volatile global markets, investors swiftly shunned Chinese investments, causing a spectacular tumble of the Chinese yuan, Chinese stocks, and the Hong Kong Hang Seng Index.

Actions speak for themselves. Only time will tell if Xi can rule China the way he intends or if the rising middle class becomes disgruntled and vocal enough to make a policy U-turn. Until then, we stay cautious, watch carefully from the outside, and remain selective of where we place capital.

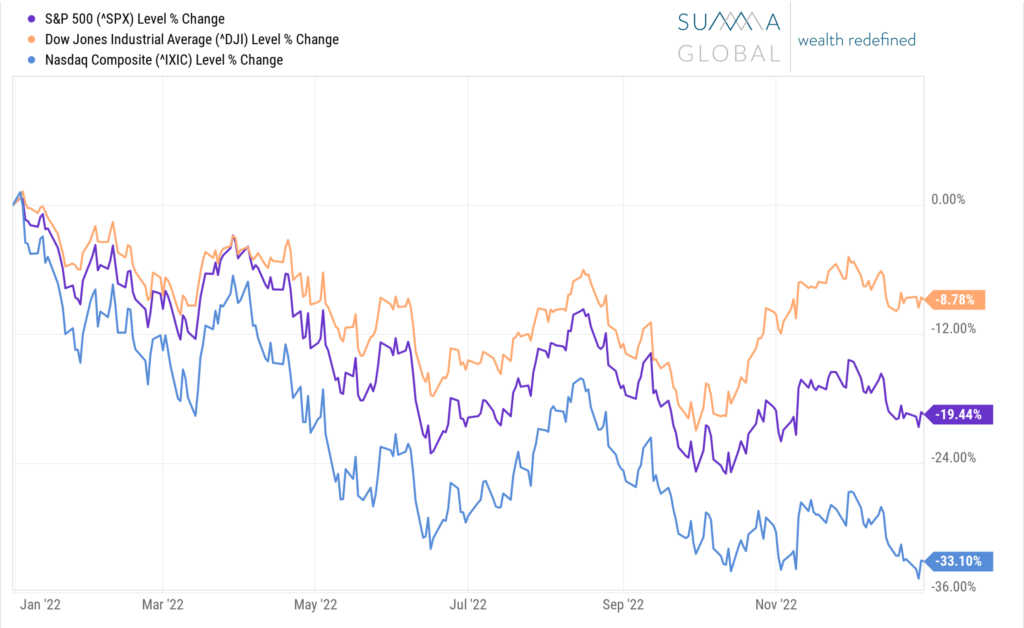

2023 Market Outlook

After a bull market that lasted more than a decade, markets experienced a significant pullback in 2022. All three major indexes registered their largest percentage declines since 2008, with the Dow down nearly 9%, the S&P 500 down over 19%, and the Nasdaq down 33%.

Illiquidity.

Underlying pressure is building as the cost of financing (interest rates) and the amount of assets in non-traded investment vehicles is higher than ever. Because bonds were yielding close to zero, many investors embraced real estate and other illiquid assets to obtain a higher income component for their portfolios. Blackstone Private REIT ($70 billion in assets) and others have had to “close the gates” for those investors wishing to withdraw their investments because real estate is an illiquid asset class.

Lowered Risk-Taking.

Fixed income is now an option. Quality stocks with strong fundamentals, sound business models and healthy cash flows will likely do better than riskier companies. Illiquid assets, meme stocks and dubious digital assets have all fallen out of favor.

Rate Hikes.

Inflation has begun to ease, and investors are asking how long the Fed will continue hiking interest rates in an attempt to curb inflation. Despite the recent decrease in inflation, however, the rate continues to far exceed the Fed’s stated goal of 2%. Fed Chair Jay Powell indicated that more rate hikes are on the way in 2023. Can the Fed achieve a “soft landing” or will the continued increases create too much drag on the economy?

Did you know…

The Social Security Administration does not accept power of attorney?

However, you can designate a representative payee to help manage benefits in the event of incapacity. To get started, create or log into your account at http://www.ssa.gov.