Click here to download the PDF version of the newsletter.

|

|

In This Issue:

|

|

|

|

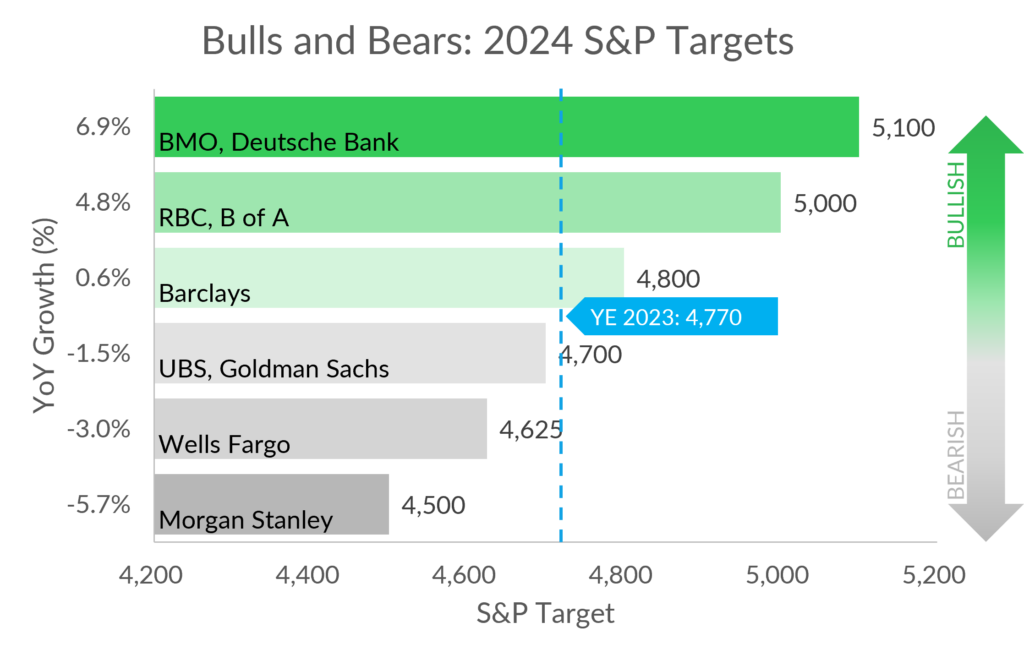

Bulls and Bears

Welcome to the new year! Wall Street has released their 2024 S&P 500 targets, found on the chart below.

In retrospect, 2023 S&P targets ranged from 3,400 (BNP) on the low end to 4,500 (Deutsche Bank) on the high end. Even 2023’s most bullish estimates misjudged the market’s strength; the S&P actually ended the year at 4,770. These estimates are often influenced by the most recent market performance and should be taken with a grain of salt.

Workers Score Wage Increases in 2023

In 2023, American workers scored noteworthy victories in securing wage increases across several industries. What are some long-term impacts from these events?

AUTO

UAW’s unprecedented strikes forced the Detroit Big Three to implement significant pay increases and other benefits. The ripple effect led to Toyota and Hyundai announcing similar pay packages for their US workers, and Tesla boosting factory worker pay in Germany.

Implication: Vehicle prices may face upward pressure for years to come.

HEALTHCARE

HMO behemoth Kaiser Permanente reached an agreement with unions after a historic strike in the healthcare industry. Nurses at various Providence locations across Oregon and Washington have al-so gone on strike, demanding better pay and staffing.

Implication: Healthcare costs will continue to increase at a pace higher than overall inflation.

EDUCATION

2023 also saw many educators walk off their jobs, demanding better working environments. Close to home, the Portland Public Schools strike lasted for more than three weeks in November. Quality education is critical to children and our future.

Implication: Taxpayers are footing the bill. Governments will need to increase tax rates and/or make additional budget cuts to meet un-ion demands.

RETAIL

Minimum wage has surpassed $15 in many metropolitan areas, with California imposing a $20 minimum hourly wage for fast food workers.

Implication: These costs will be passed on to consumers, driving up casual dining costs. However, a more likely trend is the accelerated adoption of robots and technology to help keep labor costs manageable as well as ease labor shortages.

New Roth Provisions This Year

Beginning 2024, several Roth provisions from SECURE 2.0 go into effect.

First, Roth 401(k)s are no longer subject to RMDs. Roth IRAs have always been exempt from RMDs. NOTE: Beneficiaries of Roth 401(k)s ARE still subject to RMDs.

Second, up to $35,000 of funds in a 529 plan are eligible to be rolled into a Roth IRA. Using this newly available feature can be a useful way to re-invest unused 529 assets. However, there are a number of restrictions on this new rollover rule, so be sure you understand them all before taking action!

Finally, SECURE 2.0 mandates that 401(k) catch-up contributions by highly paid employees are Roth contributions. This portion of the law, though set to go into effect this year, has been delayed by the IRS until 2026.

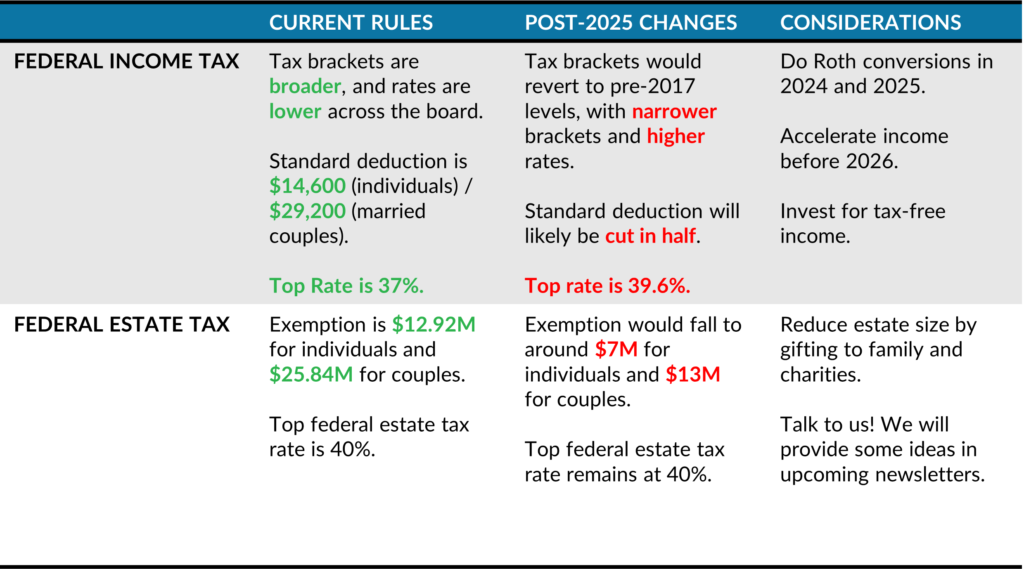

Tax Moves to Consider in 2024 and 2025

The Tax Cuts and Jobs Act signed by President Trump in 2017 is set to expire at the end of 2025. Barring action from Congress, changes will be coming, and taxpayers should plan now to avoid future surprises. Below are two key changes with the biggest impact.

FAQs From Our Clients:

I am 73 and working, and I have contributed to my traditional IRA for 2023. Can I offset my 2023 IRA required minimum distribution by the contribution?

No. Per the IRS, an individual cannot offset his or her RMD for a taxable year by the amount of any retirement contributions for that same taxable year. Contributions and distributions are separate transactions and are reported as such each year by the financial institution or other IRA custodian. It’s best to skip deductible IRA contributions and put the funds in a Roth IRA if eligible.

Send us your questions to have them included in next quarter’s publication!

Did you know… the CEO of one of 2023’s hottest stocks has Oregon roots?

Jensen Huang, co-founder, president, and CEO of Nvidia (NVDA), graduated from Aloha High School and received his bachelor’s degree from Oregon State University.

Following a meteoric rise in 2023, Nvidia is one of just five American companies worth $1 trillion or more.

Important Numbers for 2024

- Qualified Charitable Distribution (QCD): $105,000

- Annual gift tax exclusion: $18,000 (individuals) | $185,000 (to non-US citizen spouse)

- Federal estate exclusion amount: $13,610,000

- State estate exclusion amounts: $1,000,000 (Oregon) and $2,193,000 (Washington)

- State and local tax deduction: $10,000 (all filing statuses)