Click here to download the PDF version of the newsletter.

|

|

In This Issue:

|

|

|

|

The Fed’s Balancing Act

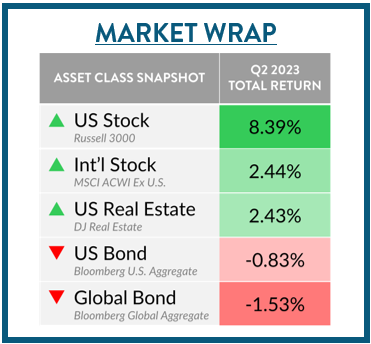

The Federal Reserve is grappling with conflicting economic signals as its next announcement approaches. Most experts anticipate that the Fed will raise rates on July 26, but the economic data tells a more complicated story. While certain indicators point toward a robust recovery, others suggest potential headwinds and uncertainty. The central bank’s response to this challenging landscape is pivotal in maintaining economic stability and charting a course towards sustainable growth.

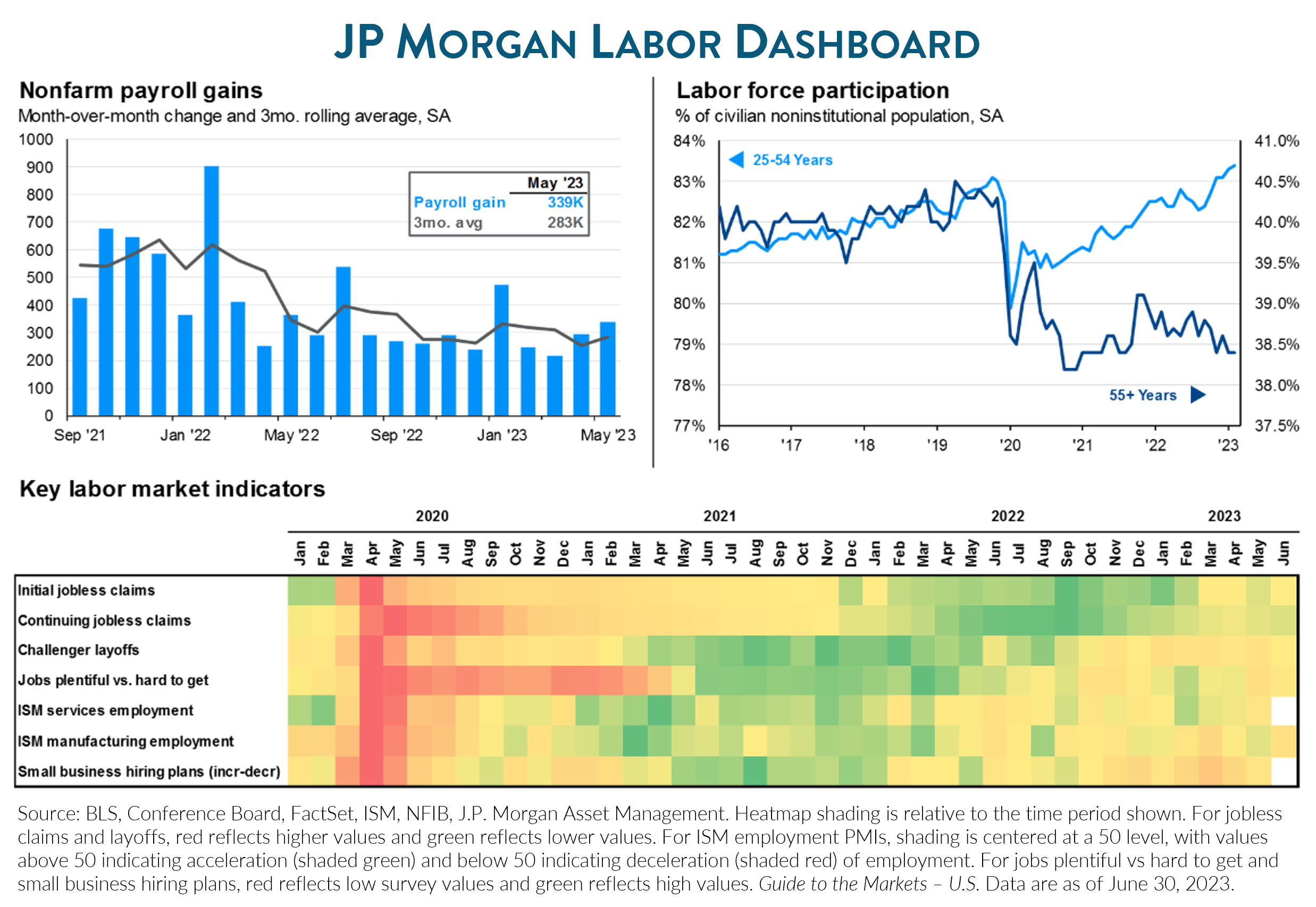

Labor Market. One factor that the Fed will consider is the evolving labor market. On one hand, job creation has been strong in recent months and improved labor force participation has supported job growth. However, the participation rate for adults aged 55+ has remained depressed, indicating that many baby-boomers have permanently left the workforce.  Inflation. Inflation is slowly becoming more manageable, though it remains above the Fed’s target rate of 2%. Overall inflation (CPI) hit 3% in June, its lowest mark since early 2021, but the gap between overall inflation and core inflation has widened, with June’s core inflation coming in at 4.8%.

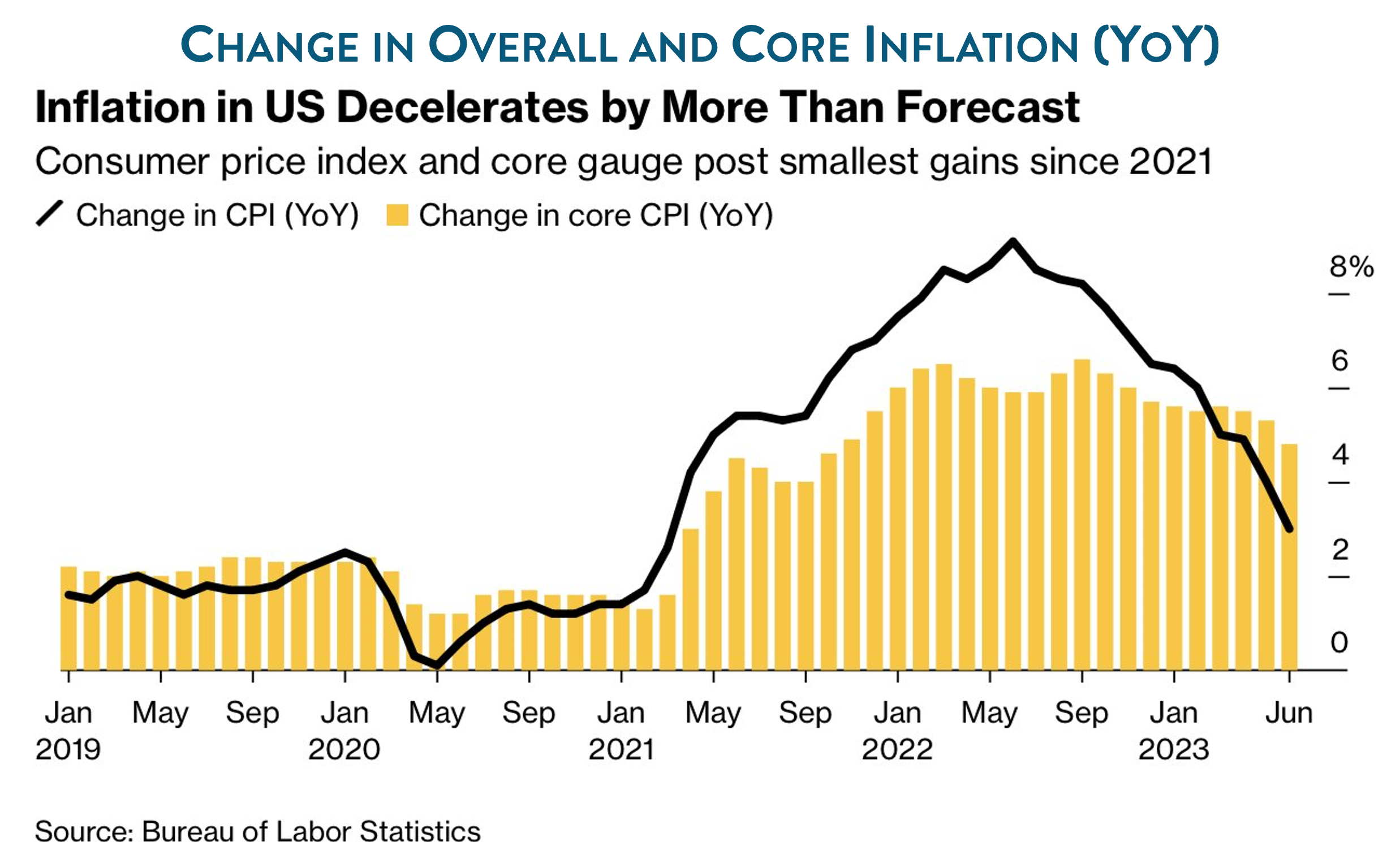

Inflation. Inflation is slowly becoming more manageable, though it remains above the Fed’s target rate of 2%. Overall inflation (CPI) hit 3% in June, its lowest mark since early 2021, but the gap between overall inflation and core inflation has widened, with June’s core inflation coming in at 4.8%. The Fed is tasked with determining how long to continue to raise rates to return to its 2% target, while not overdoing it and pushing the economy toward a recession.

The Fed is tasked with determining how long to continue to raise rates to return to its 2% target, while not overdoing it and pushing the economy toward a recession.

The Federal Reserve faces a difficult task as it weighs these factors. Striking the right balance between supporting economic growth and guarding against inflationary pressures will be a delicate balancing act.

Digital Estate Planning

With our ever-increasing online presence, failing to plan for our digital life can be painful for our loved ones. Here is a brief overview of digital estate planning available for some of the most popular digital accounts and services.

- Apple – a named legacy contact can access photos, messages, and files without knowing a user’s Apple ID password. They will need to present a death certificate along with a unique access key.

- Google – users can designate an “inactive account manager” who will be notified when the Google account has not been accessed for a predetermined amount of time.

- Facebook/Instagram – legacy contacts can look after a main profile if it is memorialized. Instagram profiles can also be memorialized, but currently Instagram does not allow a user to add legacy contacts.

- LinkedIn/Twitter – neither allows users to name legacy contacts but survivors can request the removal of a deceased person’s account.

Social Security Claiming Mistakes Couples Make

Here are seven Social Security claiming mistakes that couples make.1 If any of the following concern you, we would love to talk with you about it!

- Confusing spousal benefits with survivor benefits.

- Assuming a non-working spouse is ineligible for spousal benefits.

- Misunderstanding how claiming decisions affect spousal benefits.

- Failing to optimize survivor benefits.

- Failing to consider income replacement rates.

- Not making claiming decisions as a couple.

- Thinking Social Security will disappear.

FAQs From Our Clients:

How can I take advantage of the high interest rates?

There are several safe options to invest extra cash – short-term Treasuries, money-market funds, CDs, and even savings accounts. Here is a table of saving vehicles and their rates (as of July 12, 2023):

On the other hand, avoid credit card debt and other consumer loans as interest rates on these products are well over 20%! Read our Time Value of Money blogpost to learn more.

Send us your questions to have them included in next quarter’s publication!

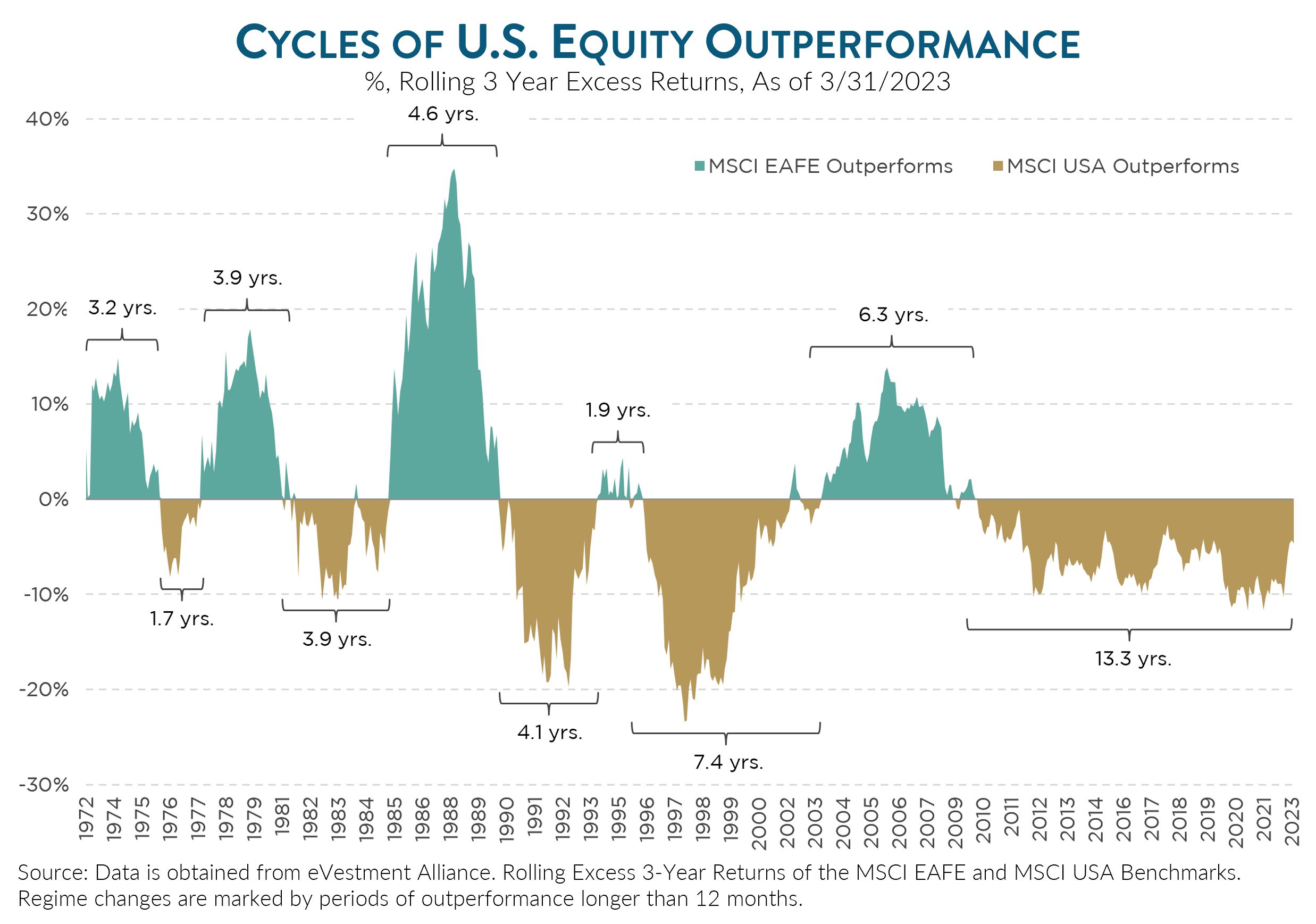

Don’t Overlook International Equities

International stocks have lagged US markets for more than a decade. If history repeats itself, we could be looking at new market leadership in the coming years. While it’s easy for US investors to be biased toward familiar domestic names, investors too heavily concentrated in domestic companies risk missing out on the international rebound.

Emerging-market equities should do well at some point in the cycle. Developing countries have young populations and expanding economies. In April of 2023, India overtook China as the world’s most populous nation. As these economies develop and further democratize, growth will help well-managed companies to thrive and create wealth for investors.

Footnotes:

1 Source: ThinkAdvisor, Feb. 23, 2023