Click here to download the PDF version of the newsletter.

|

|

|

In This Issue:

|

|

|

|

|

Inflation Mitigation (Part 2)

A series on practical ways to protect and fight against inflation. Read our July Newsletter for Part 1: Generate Your Own Power.

UPDATE to Part 1: Generate Your Own Power – INCREASED TAX INCENTIVES.

The Inflation Reduction Act revitalized tax credits for adding a clean energy system such as solar panels to your home. The tax credit is 30% of the total cost through 2032. Starting 2023, the credit is expanded to cover residential battery storage technology.

Part 2: Interest rates and inflation generally rise together.

INTEREST – Borrowing Costs.

Inflation and interest rates are close cousins, evident in the Fed’s series of rate hikes. Consequently, floating-rate loans, both personal and commercial, adjust according to market conditions. If payoff is not possible, negotiate with the lender for more favorable terms or even change it to a fixed rate. For investors holding margin loans, it’s important to check the current interest rates. Brokers are motivated to negotiate in order to keep your money at their firm. On the other hand, interest rates on most checking and savings accounts are still hovering near zero as banks are not in need of deposits. But there are reasonable alternatives (TARA) these days. Read the “From TINA to TARA” section later.

INFLATION – Series I Bonds.

Series I bonds are backed by the U.S. government and pay both a fixed rate and an inflation-adjusted variable rate which is updated every six months based on the Consumer Price Index. Inflation has made these bonds attractive; investors can buy I bonds at a 9.62% interest rate through October 2022. For more information on I bonds and how to purchase them, check out our recent blog post.

Highlights of the Inflation Reduction Act

Tax break for solar panels is extended to 2034 – 30% of the cost from 2022 to 2032, 26% in 2033, 22% in 2034.

Tax credits for various energy-efficient improvements – be sure to check these out if you intend to make improvements to your home.

Electric vehicles (EVs) tax credits get revitalized – subject to income limits and vehicle costs. Starting in 2024, the credit can be taken at the dealership instead of filing with tax returns. The vehicle must meet certain criteria to qualify.

FAQs From Our Clients:

Are we or will we be in a recession?

Often a recession receives its label far after it has started. As you may remember, we were well into 2008 before the US admitted that a recession had started in December of 2007. There are so many variables and measurements that a defined recession is more fluid than absolute. The current rates being paid to savers (fixed income) are much lower than inflation rates, causing purchasing power to erode over time. This situation needs to correct itself before consumers can gain traction. As the economy slows, the prospect of stagflation could be the looming threat.

Send us your questions to have them included in next quarter’s publication!

Are Equities the Only Game In Town?

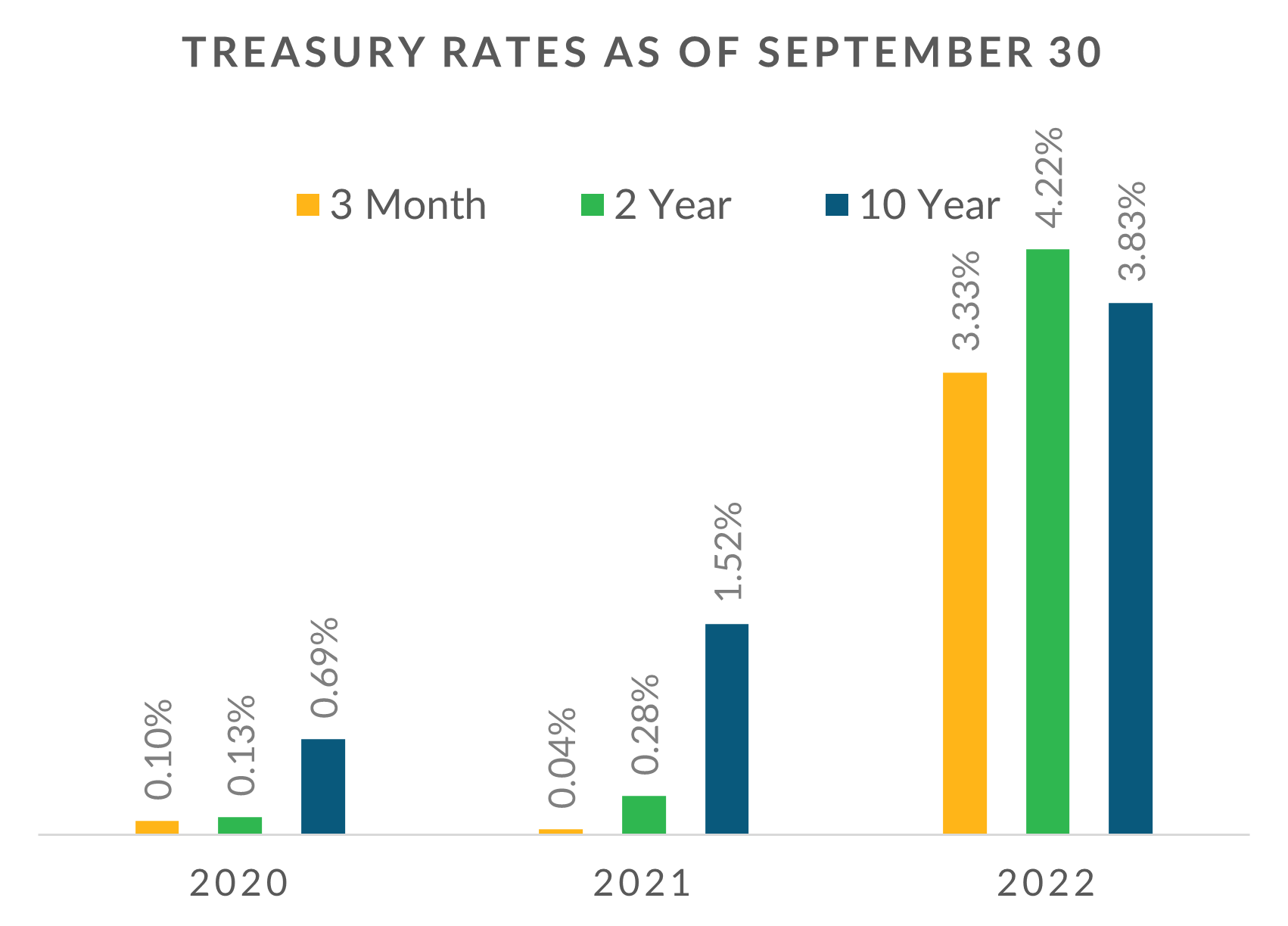

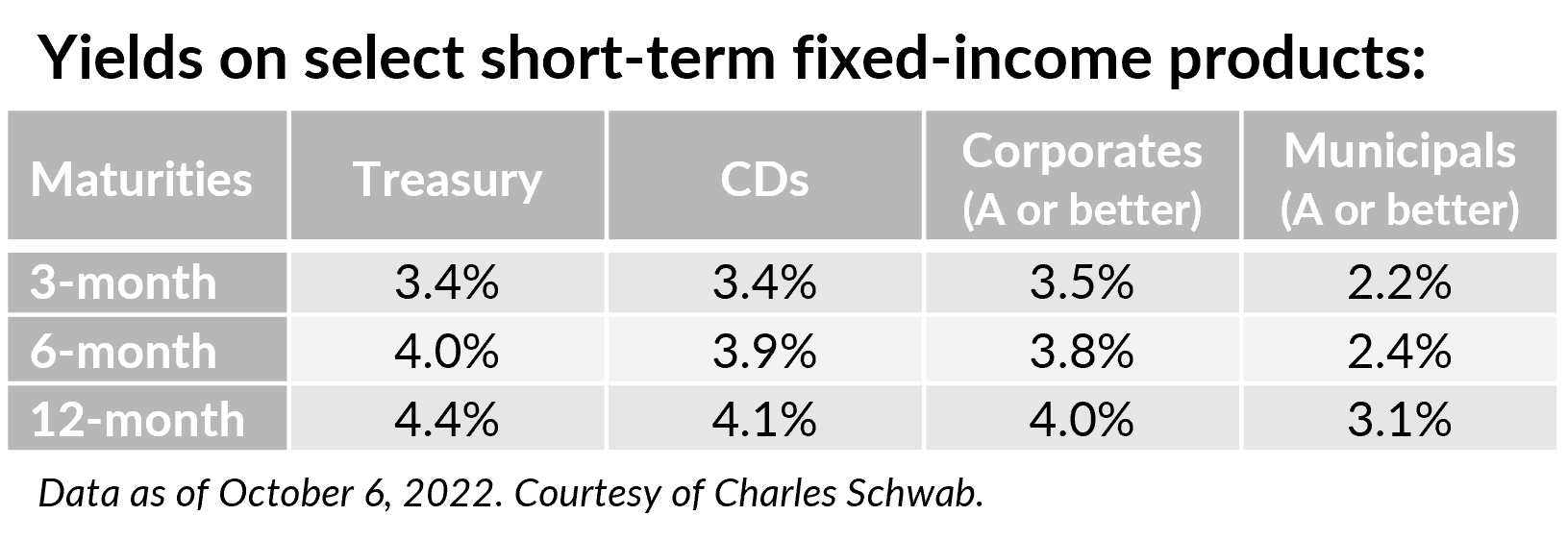

Over the past several years, the acronym TINA – There Is No Alternative (to stocks) – has been the repeated mantra on both Wall Street and Main Street. Record-low interest rates were partly to blame for the exuberance across most risk assets (stocks, real estate, cryptos). In 2022, however, TINA has left the party, replaced by TARA – There Are Reasonable Alternatives. Thanks to a series of interest rate hikes by the Fed, yields on bonds and many cash instruments have risen significantly compared to just ten months ago (see chart).

Money-market funds at the brokerage firms Schwab and Fidelity are currently yielding close to 3%, although they are not FDIC-insured like a bank savings account. That is far superior to what most big banks are currently offering. Ask us for more information!

Six Planning Items with a December 31 Deadline

1 – Maximize contributions to workplace retirement plans

Contributions to workplace retirement plans such as 401(k)s and 403(b)s must be completed by December 31 to count toward 2022.

2 – Execute strategic Roth conversions.

With tax rates historically low and investment values under pressure, it might make sense, even for high earners, to do Roth conversions before 2022 is over.

3 – Complete RMD (if applicable).

If you are over age 72 and have an IRA (or qualified account like a 401(k)), you must make annual required minimum distributions (RMDs) by December 31. If you turn 72 this year, you have until April 1, 2023, to satisfy your 2022 RMD (catch: you will have two 2023 RMDs).

4 – Plan charitable gifts (appreciated assets, QCDs).

If you have appreciated stocks, you can give the stocks to charity and avoid paying any capital gains tax! If you are over age 70½ and have an IRA, you can make charitable gifts, called Qualified Charitable Distributions (QCDs), without counting them as taxable income.

5 – Make Gifts to family.

Family members with little or no taxable income may be able to completely avoid capital gains tax on gifted assets. Tax on long-term capital gains is omitted for married couples with taxable income up to $83,350 (singles $41,675). Gifts under $16,000 do not have to be reported to the IRS and gift recipients do not incur gift tax either. If you wish to transfer assets in lieu of cash, be sure to select assets with gains. Depreciated assets are not ideal as they create a complicated tax situation known as the “double basis rule.”

6 – Harvest tax losses.

Now is a great time to review your investments and tax situation. Capital gains can be offset by capital losses, potentially reducing taxes. Taxpayers can deduct up to $3,000 of income from net realized losses and unused losses can be used in later years.

Please contact us if you have any questions or wonder if these solutions might make sense for you!

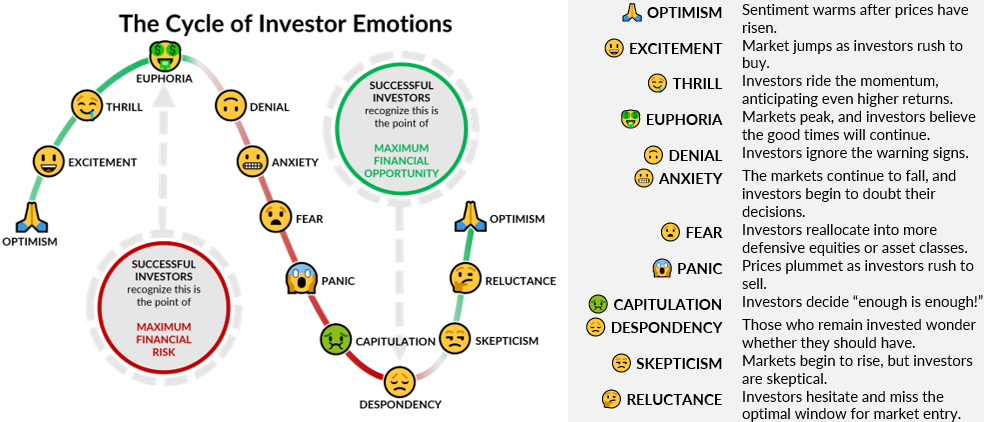

Investor Sentiment Barometer

When the party is on, people seldom see the need to prepare for bad times. US stocks and other risk assets had been on a tear since 2009, creating excitement, thrill, and wealth for investors and speculators alike. In 2021, as the stock market continued its ascent, the word “euphoria” was often cited on Wall Street. This year, however, the party has ended abruptly, leaving investors feeling lost and anxious. Which emotion best describes how you currently feel about the market? Tell us by completing the survey below!

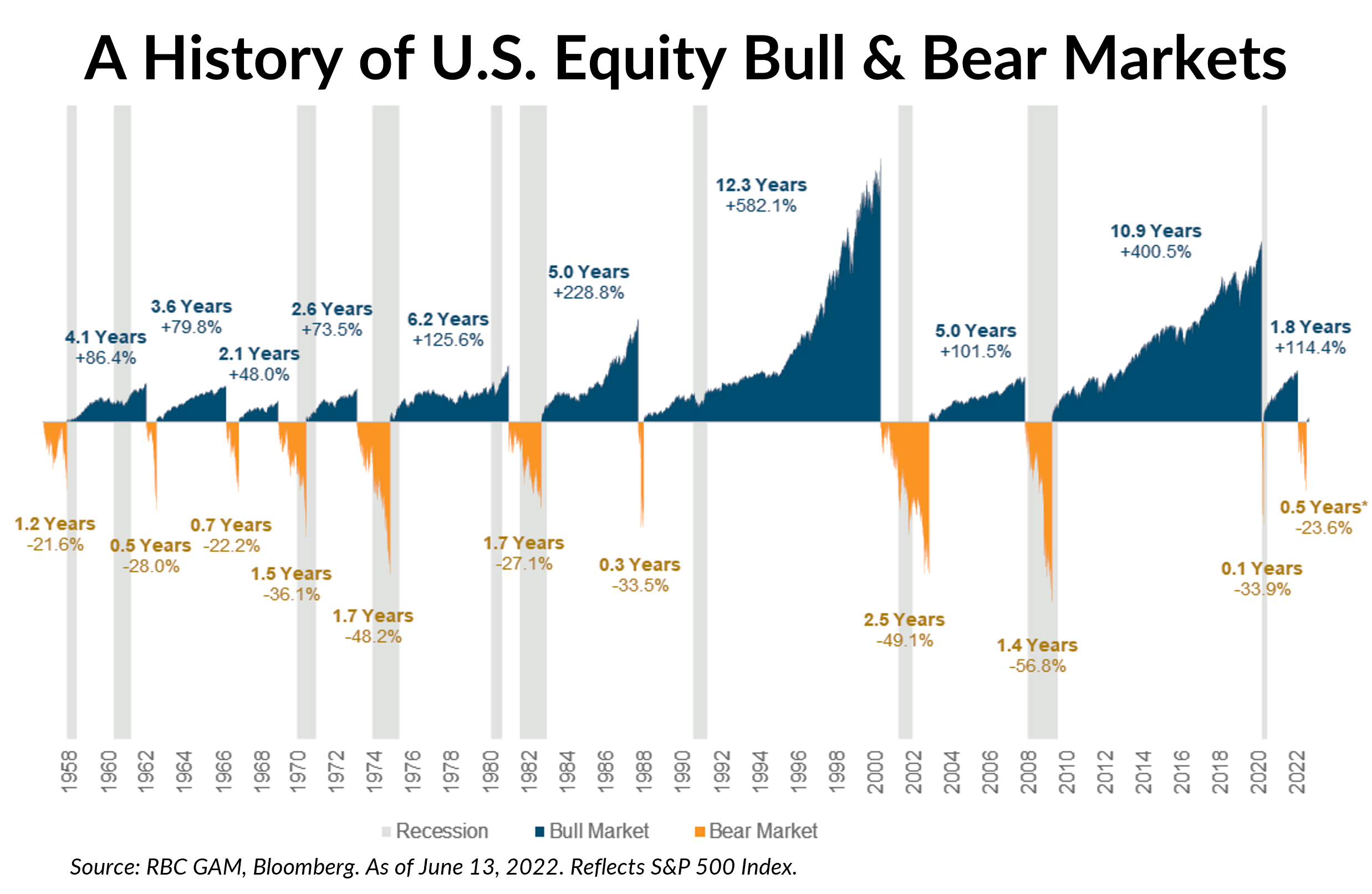

We’ve been here before.

Though psychologically, market downturns are exponentially more painful, history shows that the recovery that follows generally far outpaces the pullback. Since 1950, each time the market has dropped substantially, it also experienced a significant bounce back in the following years.

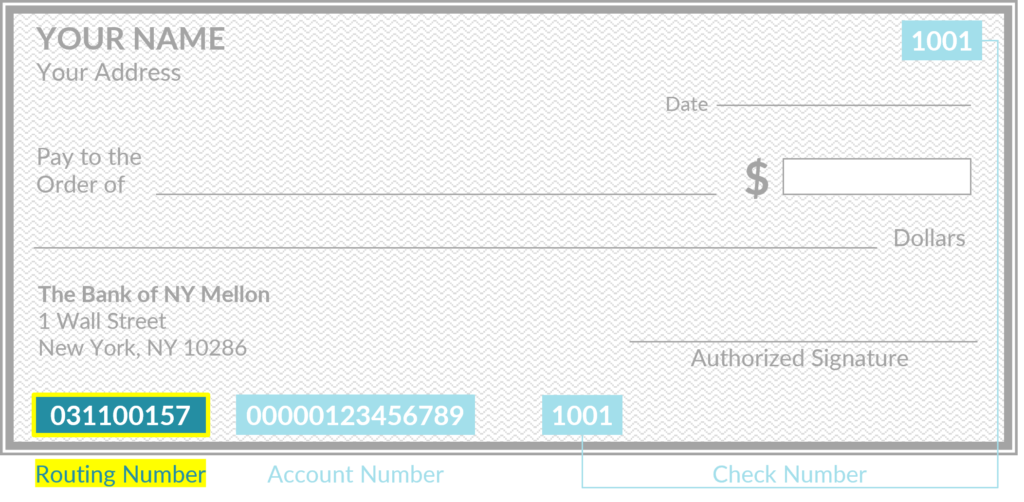

PLEASE CONFIRM YOUR SCHWAB CHECKS AND DIRECT DEPOSIT INSTRUCTIONS ARE CORRECT. You should have received an email from Schwab if you need to make these changes.

The ABA routing number for Schwab One® accounts has changed from 031000053 (PNC Bank) to 031100157 (Bank of NY Mellon). After December 31, 2022, Schwab WILL NOT HONOR checks or electronic funds transfer (EFT) instructions that reference the former routing number.

Please check your Schwab Checks and any direct deposit instructions to confirm that the routing number is correct. The correct number is 031100157.

If, upon review, you find the wrong routing number associated with checks or direct deposit instructions on your account, be sure to do the following:

- Order new checks

- Go to schwab.com/checks and log in.

- Select your Schwab One account from the dropdown menu.

- Click the “Debit Cards and Checks” link.

- Update direct deposit info (payroll, Social Security, utility bill, tax refund, etc.)

PLEASE NOTE: The Schwab One® routing number is not the same as the Schwab Bank routing number (for those who have High Yield Investor Checking accounts).

Year-End Review

If you want to schedule a meeting (in-person or virtual), please utilize our online scheduler or call us at 503-636-2022.