Click here to download the PDF version of the newsletter.

|

|

In This Issue:

|

|

|

|

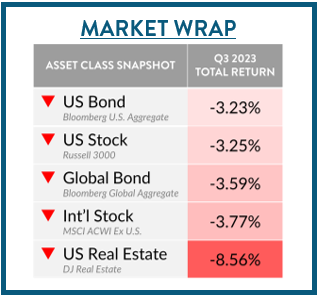

Macroeconomic Overview

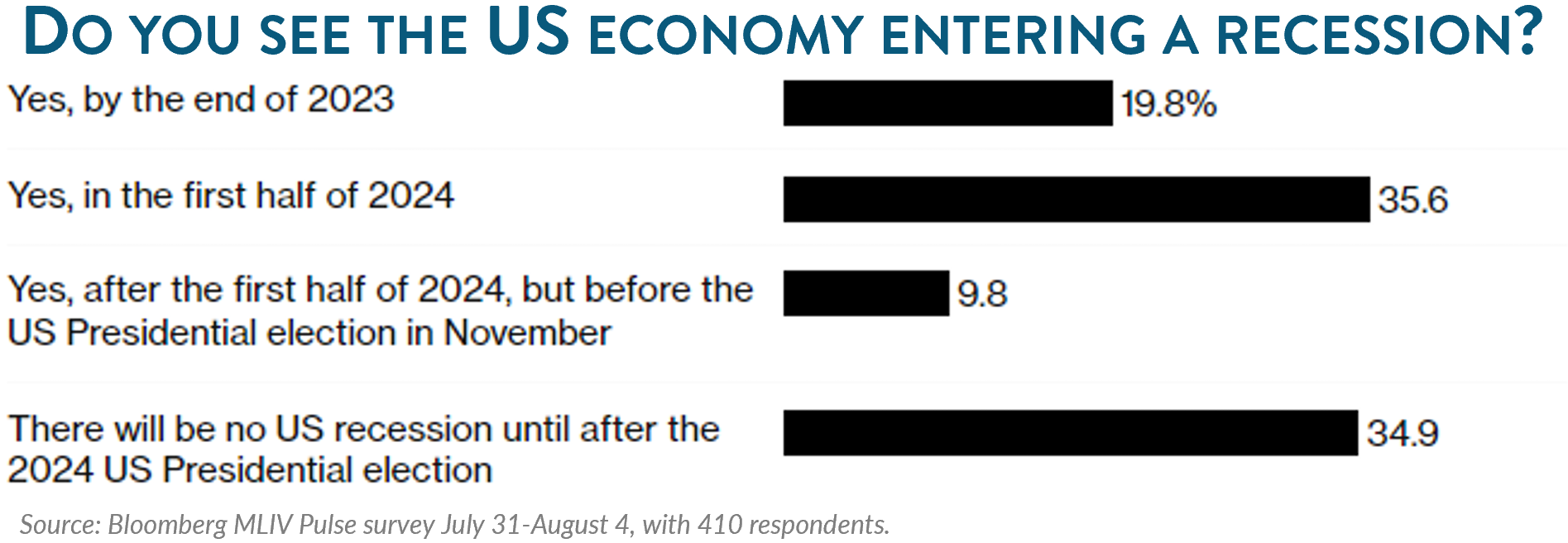

A recent Bloomberg survey revealed that about two-thirds of investors expect a recession before the 2024 Presidential election.

The possibility of a recession looms large over investors. The market and economy are giving mixed signals, clouding analysts’ ability to predict future events. So, what are those signals? And what are they telling us? Let’s take a look.

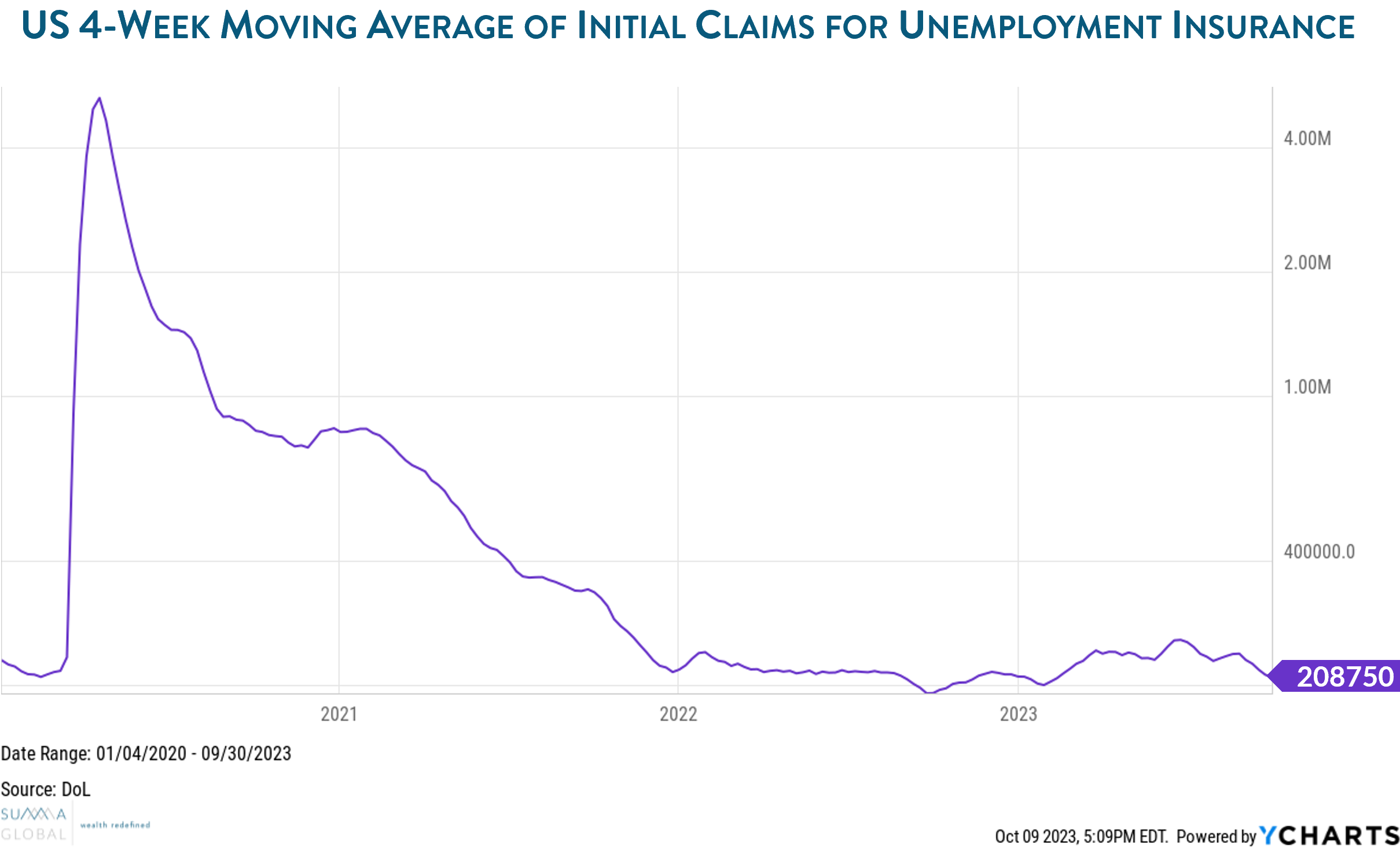

POSITIVE SIGNAL: Weekly Jobless Claims

Weekly initial claims for unemployment insurance have hovered around 200,000 to 250,000 for the past two years, indicating healthy labor demand. By contrast, weekly jobless claims skyrocketed to nearly 7 million at the onset of the pandemic.

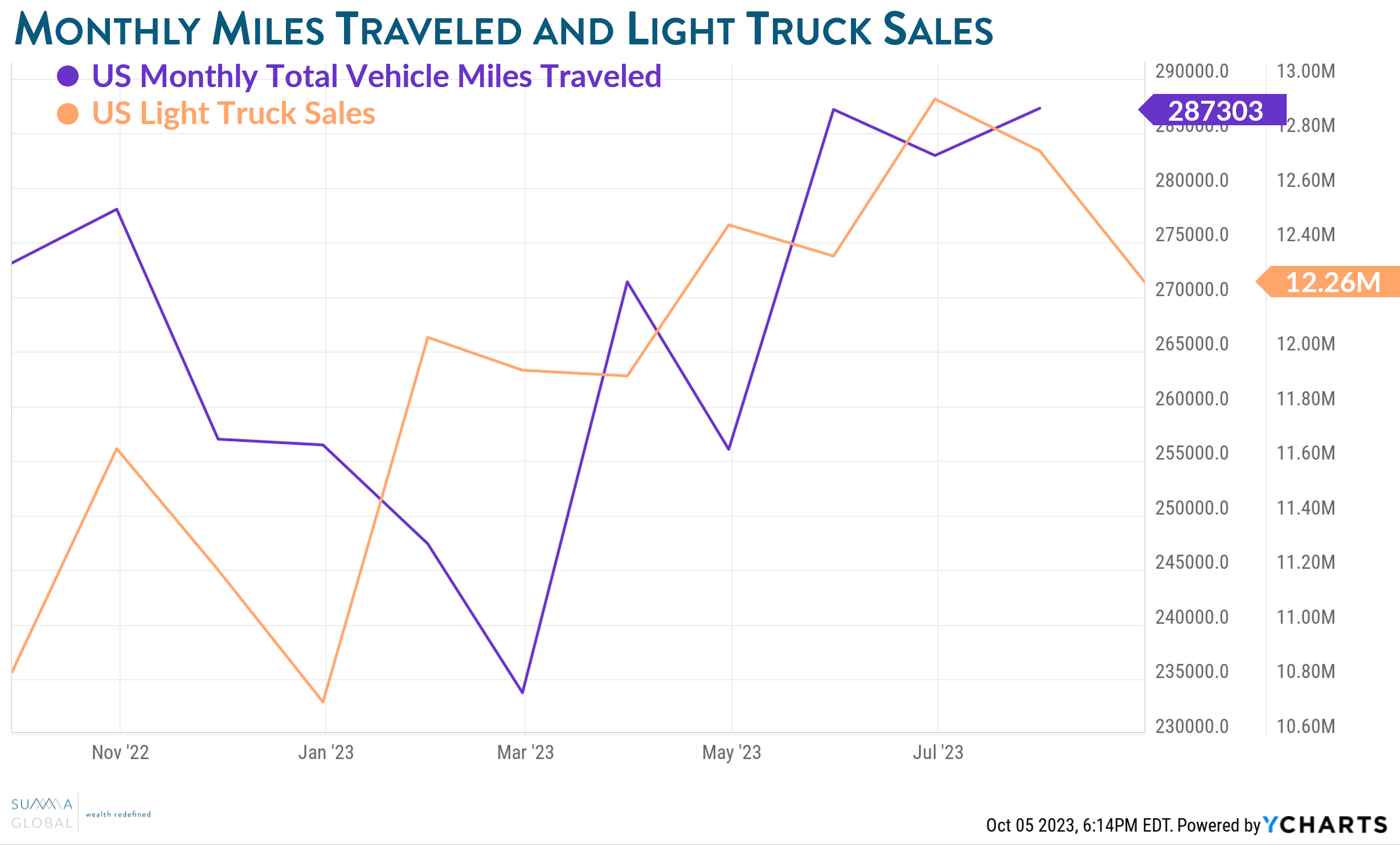

POSITIVE SIGNAL: Vehicle Miles Driven

Total miles driven have not shown signs of slowing down, another indicator signaling continued economic strength.

POSITIVE SIGNAL: Light Truck Sales

Sales of light trucks, essential for many workers, have held steady, indicating ample economic activity.

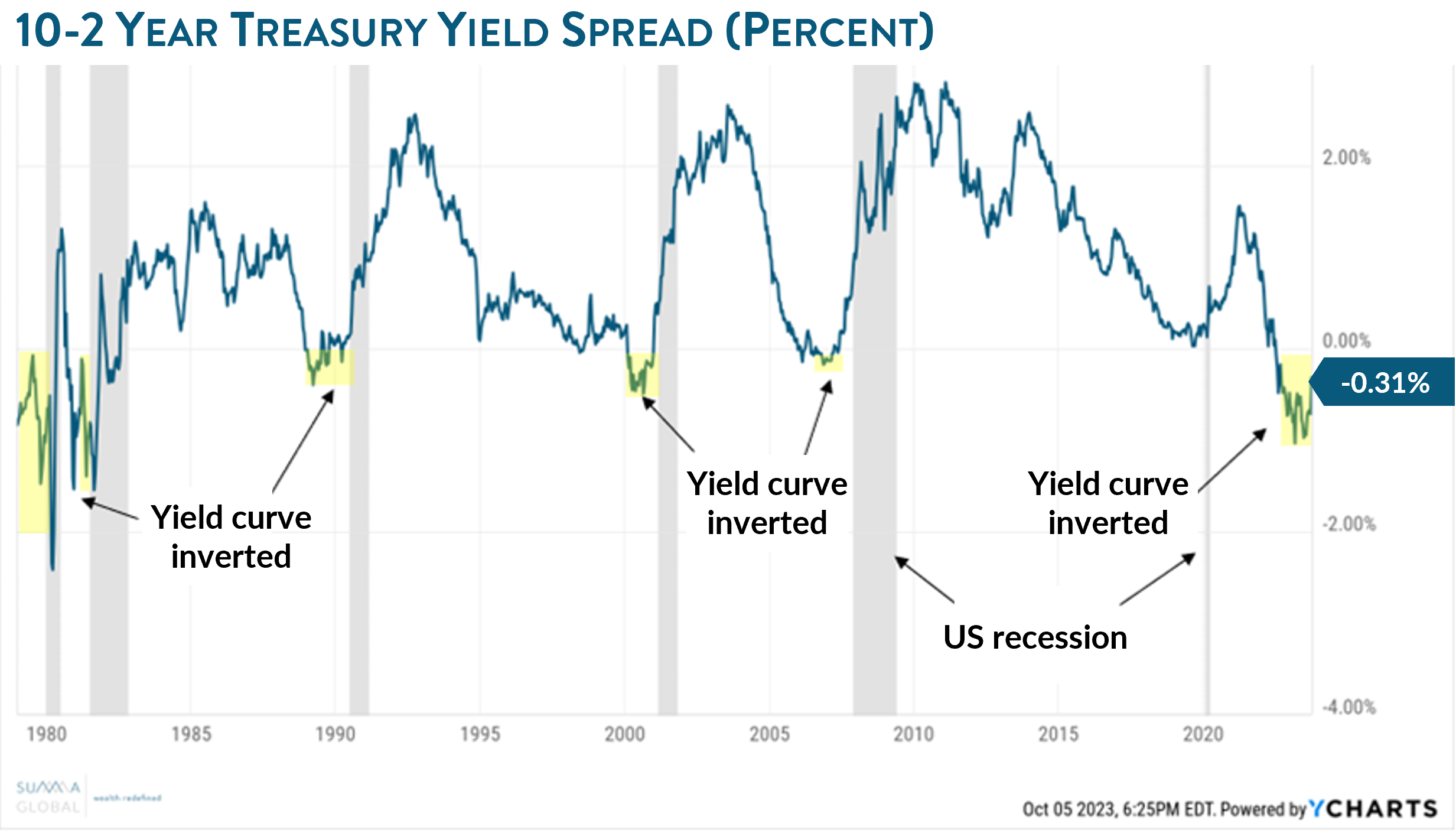

NEGATIVE SIGNAL: Yield Curve

A normal yield curve should have an upward slope. Since World War II, domestic recessions have always been preceded by an inverted yield curve – when the 2-year Treasury yield is higher than the 10-year Treasury yield. The current inversion began in late 2021.

As you can see, the economic outlook is not clear, but we will continue monitoring all relevant indicators.

When Does a Professional Trustee Make Sense?

Estate planning often involves the use of a trust instrument, which requires a trustee – someone responsible for carrying out the trust provisions for the benefit of its beneficiaries. In most cases, a family member or trusted friend is chosen for this crucial role. Trusts are one of the most complex estate planning tools and trustee selection should not be taken lightly. In cases where it is difficult to enlist the help of a close family member or friend, hiring a professional trustee can be a solution.

The following factors can help determine when appointing a professional trustee is appropriate.

- Neutrality. When a trustee is a relative and, perhaps, even a beneficiary, conflicts of interest can occur. This becomes especially complicated when multiple beneficiaries from different families or groups are involved. A professional trustee is a neutral third party.

- Expertise. Because trusts are funded with as-sets (stocks, family business, etc.), a certain level of knowledge is required. Professional trustees generally have knowledge, experience, and access to other professionals to effectively manage trust assets.

- Dedication. Most individual trustees serve on a part-time and voluntary basis and may not have time to manage the trust when it is needed the most. Professional trustees exist exclusively to carry out the terms of the trust.

- Checks and balances. Professional trustees are audited, regulated, bonded, and insured. These requirements are absent for individual trustees.

- Costs and value. A professional trustee’s added value often outweighs their monetary costs, especially when a trust requires special attention and/or presents unique challenges.

Adapted from American Heart Association’s Essential Decisions: Choosing the Right Trustee

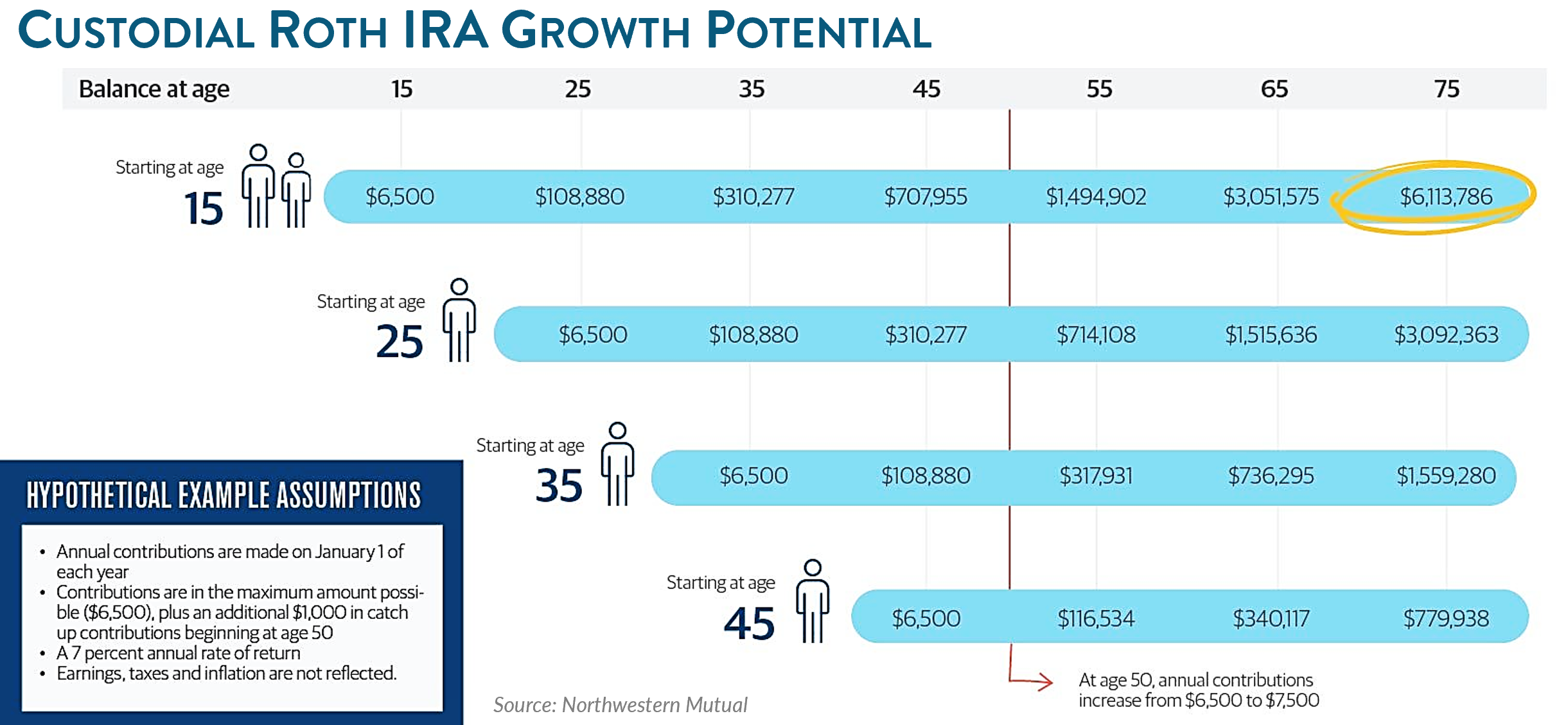

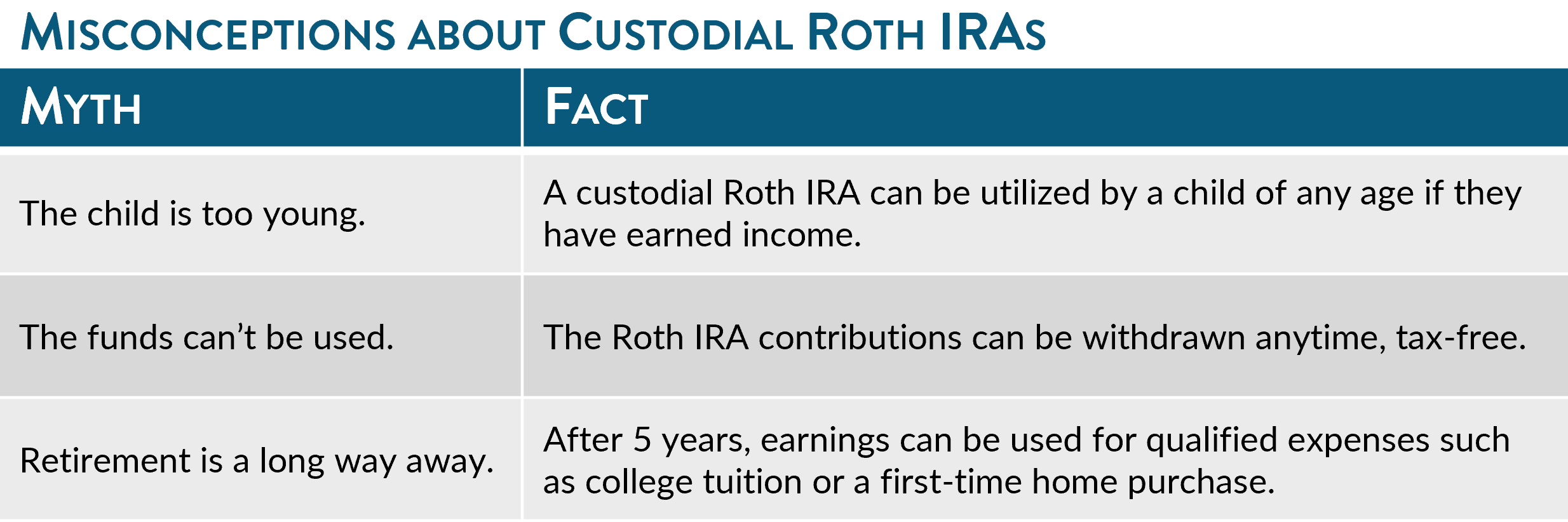

Roth IRAs for Kids

Has your child or grandchild been working hard all summer? Although retirement is probably the last thing on the mind of teens working summer jobs, a custodial Roth IRA provides parents and grandpar-ents an opportunity to jumpstart the future of those they love and emphasize the importance of financial literacy too.

What is a Custodial Roth IRA?

A custodial Roth IRA has all the benefits of a Roth IRA, except an adult is initially named as the custodian of the account, because US law prohibits minors from owning assets directly. When the minor reaches the age of majority, they become the owner.

Why use a Custodial Roth IRA?

The tax advantages of a Roth IRA are excellent for kids, who likely owe little or no taxes. Compound interest works wonders, and more time means more growth – so the sooner they start investing, the better! Although the idea is to save for the long-term, funds contributed to a Roth IRA can be used for more than just retirement.

How to contribute:

- The minor must have earned income during the year.

- The maximum that may be contributed is the lesser of total earned income or $6,500.

- An adult can gift or match up to the limit. Any amount is a good start!

Example 1:

Your 16-year-old granddaughter has been working at a coffee shop throughout the year and has earned $7,000. You can contribute up to $6,500 to a custodial Roth IRA on her behalf.

Example 2:

Your 13-year-old son earned $2,000 doing yardwork for neighbors this summer. You agree to match any contributions he makes toward his retirement. He contributes $1,000 to his Roth IRA, and you match it with another $1,000 contribution, maxing out the contribution limit for this year.

A custodial Roth IRA is a great way to help your children or grandchildren jumpstart their future savings! Contact us if you think a custodial Roth IRA may be beneficial for someone you love.

The Obamacare Tax is Ten Years Old

The 3.8% surtax on net investment income (aka Obamacare tax) was enacted in 2013. This tax applies to passive income such as dividends, taxable interest, capital gains, and rental income on modified AGI above $200,000 for single taxpayers and $250,000 for married couples. These thresholds do not adjust for inflation. As such, the number of taxpayers incurring this surtax has grown by 4 million in the past ten years, and the tax amount has increased by $38 billion, according to Kiplinger Tax Letter. Having tax-free income like municipal bonds is a fantastic way to mitigate the impact. We manage your portfolio with these tax implications in mind.

FAQs From Our Clients:

Will I be penalized for selling my Treasury bonds before they mature?

You may sell your Treasury bonds at any time without penalty. However, you will forfeit any future interest and the bonds may be trading at a discount at the time you wish to sell.

Send us your questions to have them included in next quarter’s publication!

Did you know?

Check fraud has consistently increased over the past three years, with criminals particularly targeting the U.S. mail system in the wake of the COVID-19 pandemic. It’s important to be alert and take precautions where possible. Click here to read the alert issued by the Financial Crimes Enforcement Network (FinCEN) earlier this year.

Important Year-End Deadlines to Keep In Mind:

- Medicare Open Enrollment – October 15-December 7, 2023

- Set up and fund a Donor-Advised Fund – December 1, 2023

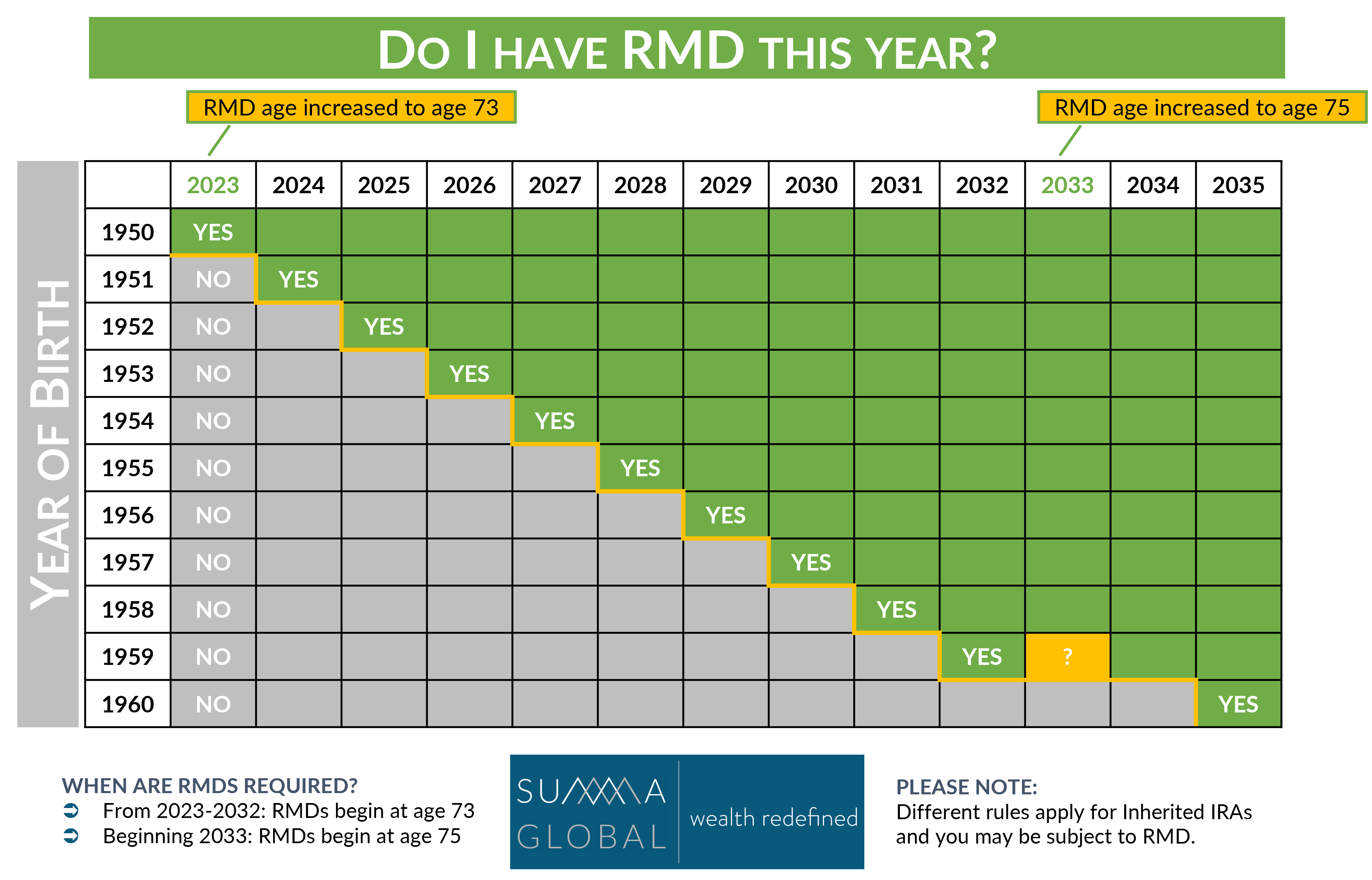

- Required Minimum Distributions (RMDs) – December 29, 2023

(check out the chart below to see when you’re required to take RMDs)- Qualified Charitable Distributions (QCDs) – December 29, 2023

- Roth Conversions – December 29, 2023

Be on the lookout for our year-end planning blog post for a more extensive list.