Financial exploitation comes in all shapes and forms, from the less convincing IRS scams and fake fundraisers, to sophisticated hoaxes such as the Madoff Ponzi scheme, to ultimately heart-breaking deceptions known as the “sweetheart” and “grandparent” scams.1 Even if we have not been met with one ourselves, it is safe to say that all of us at least know someone who has been approached by a con artist. The elderly population (age 65+) is especially vulnerable because of the following factors:

- they are the fastest growing demographic group in the US;

- they often live independently or alone (widowed);

- they have accumulated assets and/or receive regular income to support retirement;

- they lack “fluid” financial intelligence—the ability to “manipulate and transform financial data;”2 and

- to further compound the problem, cognitive decline (i.e. dementia) makes it much harder to make complex decisions.3

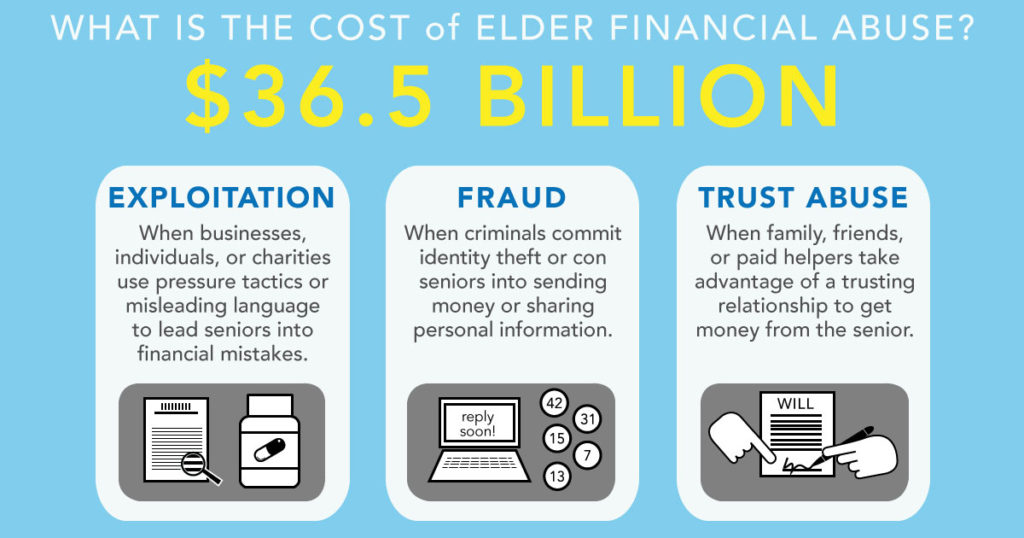

Of course, scammers do not only target elderly women, but several factors make them more vulnerable than other demographics. Traditionally, many older women had little to no involvement in finance while their husbands were alive. Therefore, when the responsibility of making financial decisions falls on them, often all of a sudden, they may be unprepared to make informed decisions. Furthermore, a majority of the exploitations (90%) are carried out by family members or other trusted companions, while the number of cases reported to the authorities is extremely low,4 shattering an otherwise trustworthy relationship. See Figure 1 for a summary.

Legislative shield

Since 2006, lawmakers nationwide have slowly but surely assembled rules in hopes of combating elderly financial exploitation. The Securities and Exchange Commission (SEC), Federal Deposit Insurance Corporation (FDIC) and Treasury Department’s Financial Crimes Enforcement Network (FinCEN) are leading the charge of protecting us from financial fraud and abuse.

Many states have also enacted rules that require legal, healthcare, and financial services professionals to report suspected financial abuse of senior clients. Oregon and Washington are two states with such requirements in place.5 6 In addition, many financial institutions are requesting that customers designate a Trusted Contact – someone who would be able to assist with a questionable transaction in the event that the account owner cannot be reached.

Summa’s dynamic approach

Here at Summa, we began implementing a similar Trusted Contact initiative in 2017 in an effort to make communication easier and to protect our clients. Though many of our relationships involve multiple families in the same household, we are prohibited from disclosing privileged information even to close family members (such as adult children) without consent from the client. By designating a Trusted Contact, clients allow us to communicate and verify critical information when necessary. Assigning a Trusted Contact does not give that individual permission to request transactions or withdraw assets, but merely facilitates the flow of information.

Because cognitive functioning declines as we age, simplifying financial matters is also helpful in safeguarding from fraud. A suggestion we put forth to many of our clients is to consolidate assets into three accounts or categories: taxable, tax-deferred (IRAs) and tax-free (Roth IRAs). Mom would certainly appreciate having two or three accounts as opposed to having eight or nine! Brokerage accounts, in most cases, can also serve as a traditional “checking” account, with helpful cash-management features such as direct deposit, bill pay, debit cards, and more. Best of all, these things are free of charge.

Why is it helpful to also use your brokerage account as your checking account? As your advisor, we monitor cash transactions on a daily basis. Atypical withdrawals catch our attention and we will follow up. When it comes to required minimum distributions (RMD), making sure that requirement is met and handled in a tax-smart manner is our area of expertise.

Reducing complexity also means minimizing holdings. With the use of exchange-traded funds (ETFs), it is possible to achieve diversification and create tax-efficient portfolios without having a massive number of holdings. Insurance policies such as life, long-term care, and annuities require special attention and coordination with the particular agents. What mom is not aware of could make a good policy useless or costly to fix. We also strive to work closely with family members (especially those holding power of attorney), trustees, CPAs and family lawyers to ensure duties are defined (who does what under different scenarios), protective mechanisms are in place (asset protection), and communication is open and inviting.

It may be hard to believe, but we speak mom’s language, which is:

- avoiding confusing financial jargons and terms

- using plain English, graphs, and charts

- discussing what matters the most to her (family, philanthropic wishes, etc.)

- acting as the liaison and her advocate

There are many stories we can share about best practices and lessons learned from years of experience helping moms attain a peaceful and meaningful retirement. Think of that as a tightly woven blanket—all of us can be seen as the needles and fabric used to create that safety net mom can rely on and find comfort in. Together, let’s take care of mom (and dad) like she took care of us!

Footnotes:

1 https://www.lifeandmoney.citi.com/money/protecting-yourself-from-financial-scams

2 Dane, Stephen. Elder Financial Exploitation. Why it is a concern, what regulators are doing about it, and looking ahead. June 2018. US Securities and Exchange Commission.

3 https://www.summaglobal.com/newsletters/2011_Q2_BabyBoomers.pdf

4 A wake-up call for financial advisors: Creating Value for Elder Clients. 2015. FirstClearing.

5 http://bit.ly/2XafHXr

6 http://bit.ly/2IzAhMC