By the time you are reading this, we are about two weeks away from what is expected to be the most contentious (and even potentially controversial) presidential election in recent history. Polls are pointing to a victory for Joe Biden, along with a “blue wave,” but as we have learned over the last few years and especially year 2020, any-thing is possible!

If President Trump gets another term, expect the status quo with policies prioritizing domestic economic growth and the possibility of making permanent the temporary provisions in the Tax Cuts and Jobs Act (TCJA).

The Democratic nominee, former Vice President Joe Biden, has a contrasting plan, which focuses mainly on increasing taxes on the wealthy and high-income earners. This letter will examine key ingredients in the Biden tax plan.

In order to better wrap your head around this topic, it will be helpful to have a basic understanding of the U.S. tax system. Refer to this Infograph for a visual concept before reading on.

A Three-Trillion-Dollar Plan

The Biden tax plan, at its core, would generate $3 trillion of revenue for the federal government over a ten-year period, over two-thirds of which would come from the following personal income taxes:1

- $1 trillion by raising top marginal rates on income over $400,000 and taxing qualified dividends and long-term capital gains above $1 million of income as ordinary income.

- $820 billion from additional payroll tax on earned income over $400,000.

Two Magic Numbers

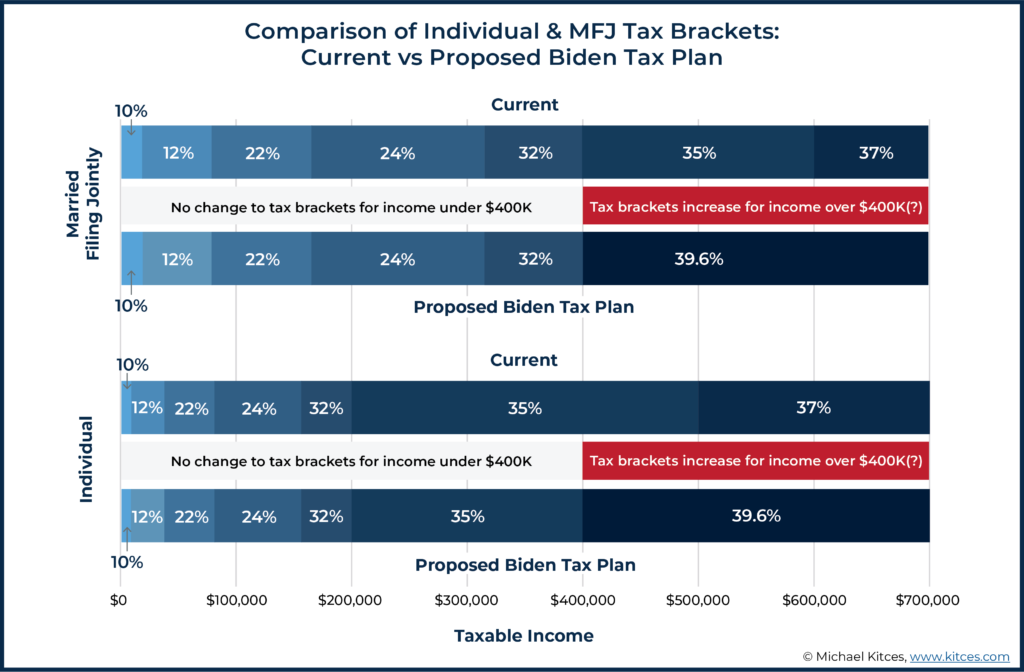

As you can see, if you earn at least $400,000 on a consistent basis, under the Biden tax plan, you can expect to pay more because your top marginal ordinary-income tax rate would increase to 39.6%. The current rate tops out at 37% and is applied to income above $518,400 and $622,050 for single and married taxpayers, respectively. Mr. Biden’s plan, therefore, would result in the higher rate kicking in at a lower amount.

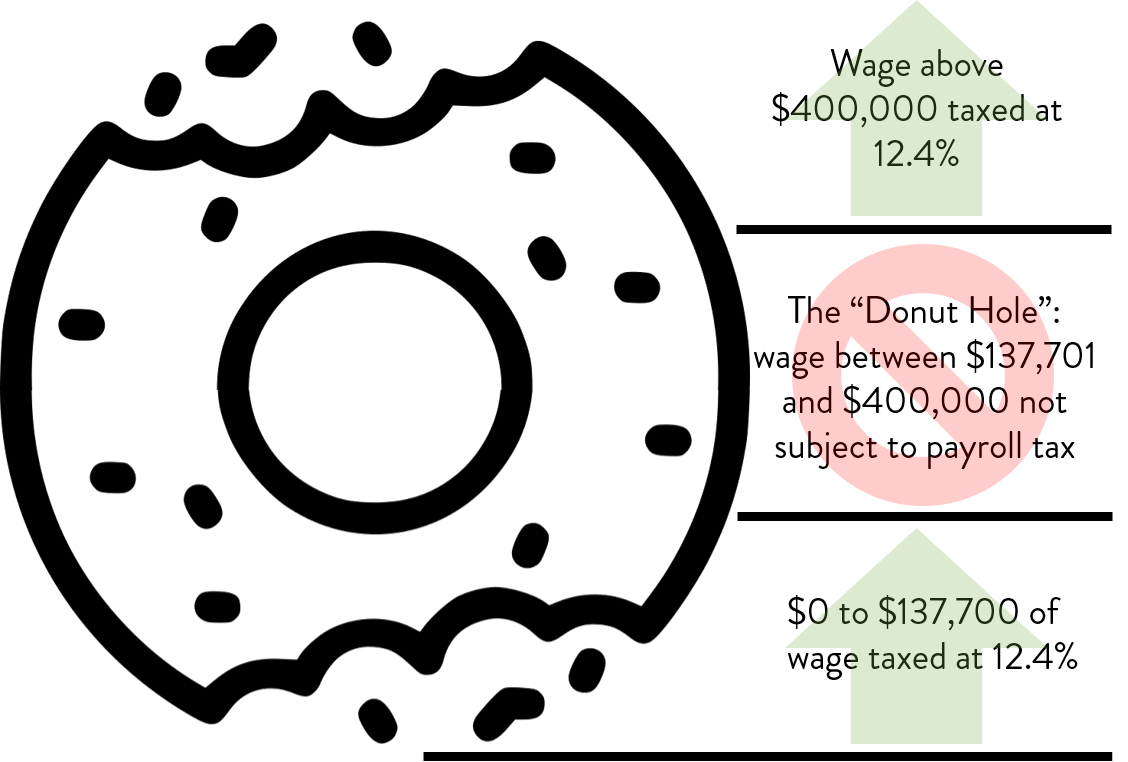

All workers in the U.S. incur FICA taxes, comprised of Social Security (payroll) and Medicare taxes. These are mandatory taxes and taxpayers do not get a refund. Payroll tax applies on the first $137,700 (2020) of earned income, at 12.4%, split between the employer and employee while self-employed individuals are responsible for the full amount. Medicare tax (2.9%) does not have a cap on salary. The Biden tax plan would re-introduce the payroll tax at income earned above $400,000, creating a “donut hole” at which a chunk of wage would not be subject to payroll tax (see graph below).

Another proposed change for those hitting the magic number is the elimination of Qualified Business Income (QBI), or Section 199A, tax deduction, also a temporary tax break from the TCJA. Currently, owners and members of many partnerships, LLCs, S corps and sole proprietors enjoy a 20% deduction on these pass-through incomes with few limitations and restrictions. The Biden tax proposal would all but put an end to that. Additionally, taxpayers who itemize would see the tax benefits capped at 28%.

For those who own real estate and are familiar with a 1031 Exchange, Mr. Biden would like to curtail this tax-deferral strategy as well, but only for taxpayers who make over $400,000. Particulars on this item are not available yet but expect fierce opposition from the real estate industry.

The “Other” Magic Number

The Biden tax proposal purposely targets the ultra-high-income earners (the so-called 1%). For those lucky few, making over $1 million means higher taxes compared to the current environment. More specifically, long-term capital gains and qualified dividends above $1 million of income would be treated and taxed as ordinary income, at 39.6%, plus the 3.8% Medicare surtax. For example, if John Doe’s 2021 income is $1.2 million, $200,000 of which is qualified dividends, the tax on the latter would be $86,800 ($200,000 x 43.4%) under Mr. Biden’s plan, instead of $47,600 ($200,000 x 23.8%) under the current structure.

The One Seismic Surprise on Wealth Transfer

The 2017 Tax Cuts and Jobs Act (TCJA) significantly increased the estate and gift tax exemption amount until 2025. For 2020, the exemption is $11.58 million for each person, meaning “an individual can leave $11.58 million to heirs and pay no federal estate or gift tax, while a married couple will be able to shield $23.16 million.”2

The Biden tax plan would make the following changes to estate taxation:

- Reversal of the exemption amount back to pre-TCJA levels – $5 million per individual and tax rate on excess increased to 55%

- Elimination of the “basis step-up” rule on death. There are two possibilities instead:

- Heirs would either inherit assets with the original—in most cases unknown—basis, or

- The death would trigger a realization of gains and subsequent taxes due.

The elimination of basis step-up would cause a seismic wave in estate planning and create headaches for many if it became law. From a practical standpoint, tracking of cost basis is sporadic at best and is often lost with the decedent. This issue gets exponentially more complicated with illiquid assets such as closely-held family businesses, real estate, antiques, artwork, and jewelry. It would substantially increase the time and cost of calculating cost basis by requiring acceptable appraisals and adding to legal and accounting fees. In many situations, the estate or heirs would likely be forced to sell some (if not all) of the assets in order to pay 1) the added costs, 2) estate tax, and 3) capital gains tax. A small relief, however, is that Congress has twice enacted something almost identical in the past (first in the late ‘70s and later in 2011), but with very little success.3

Take Some and Give Some

The Biden tax plan would rake in historic revenue amounts, and we can safely assume equivalent expansion on government spending and various tax breaks aimed at lower income earners. Some of the more important ones are:

- Expanding the Child and Dependent Tax Credit to $8,000 per dependent (or $16,000 for two or more).

- Increasing the Child Tax Credit to a maximum of $3,000 for children under 18.

- Replacing tax-deductible retirement contributions with a refundable tax credit to encourage low-earners to save.

- Reintroducing the First-Time-Homebuyers’ Tax Credit of up to $15,000.

Whether the Biden tax plan would become reality depends on how this election plays out and whether these changes could become law. We are not advising clients to make changes until there is clarity. As you know, things on Capitol Hill never move at light speed, giving us ample time to analyze potential outcomes and create counter-measures. Rest assured, when confronted with new tax policies or other legislative changes, our task is to provide current and actionable advice that will help you continue to achieve your financial goals.