While I was doing research for this quarter’s newsletter, an IRS statistic on tax-filing composition caught my eye and prompted me to start over. Indeed, as I went deeper, it became clear to me that the financial industry is ever-changing, because the environment in which it lives never stops evolving. Therefore, financial professionals must learn to navigate the dynamic landscape of our industry – we must adapt in order to best serve our clients. Here are some noteworthy changes in recent years.

Household Composition

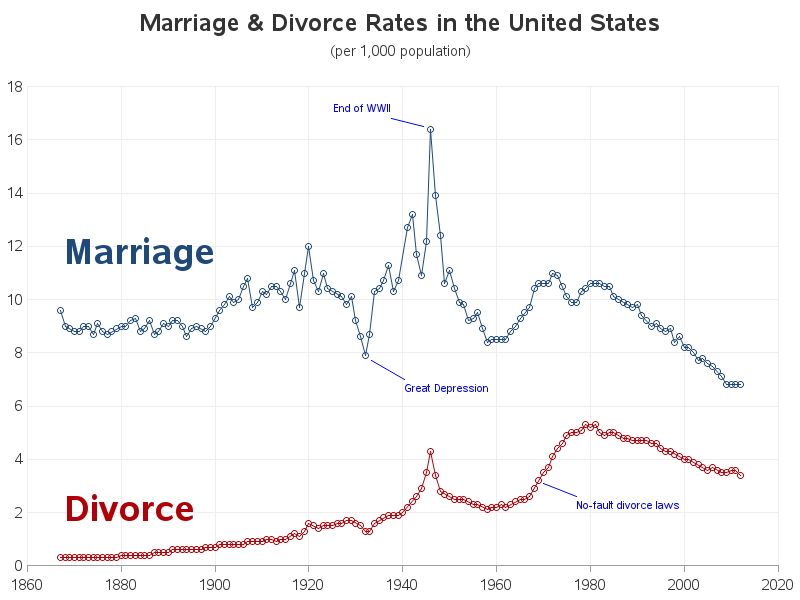

Household composition has shifted over the years. Taxpayers filing as single and head of household began outnumbering married couples in the mid-1970s. That trend coincided with the introduction of “no-fault” divorce laws, first adopted by California in 1969.1 By 1985, almost every state and the District of Columbia had introduced something similar for simplifying the marriage dissolution process. The law allows either spouse to initiate a divorce proceeding by citing “irreconcilable differences.”

The result: Advisors must be able to help problem-solve for clients who are in a separation / divorce situation, particularly on their financial matters.

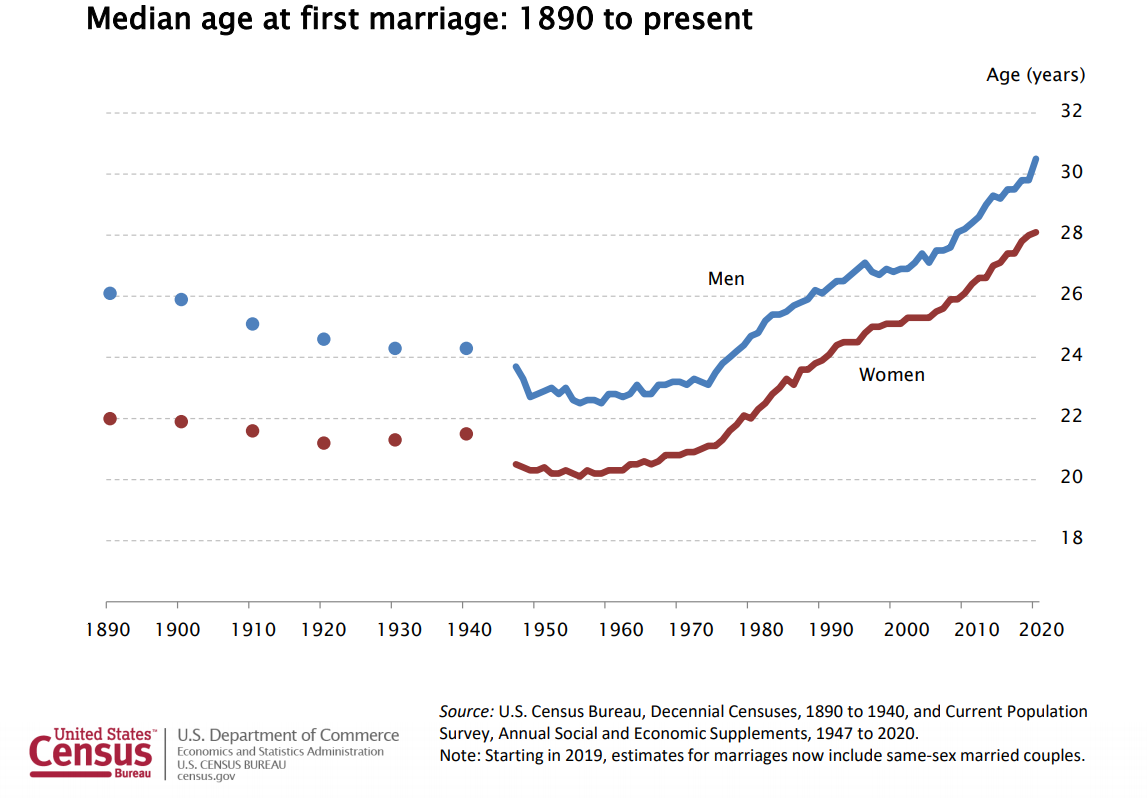

As the chart above depicts, marriage has become less common in recent years. In 2017, the Census Bureau’s data shows that more than a quarter of children under 18 – about 20 million of them – lived with just one parent. Household size, furthermore, has also shrunk to about 2.5 members from 3.7 in 1940.2 The falling number of married couples is not only due to divorce, however. More and more Americans are choosing to delay (see graph below) or forgo marriage altogether. Other forms of domestic arrangements such as cohabitation have emerged. Estate-planning implications for those lacking a valid marriage designation can be significant.  The result: Advisors need to possess basic knowledge of estate planning as it dictates disposition and distribution of financial assets. Simple mistakes can be costly.

The result: Advisors need to possess basic knowledge of estate planning as it dictates disposition and distribution of financial assets. Simple mistakes can be costly.

Gender Equality

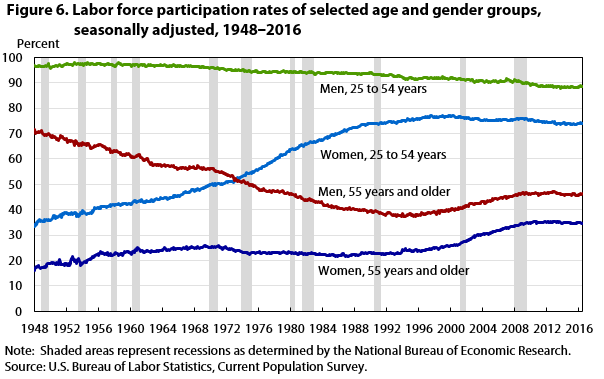

Gender equality has gained momentum. Since the 1950s, more and more women have entered work-force and many have found meaningful careers and better economic status. For both genders, labor force participation is positively correlated to the level of education received. Interestingly, fewer men are now in the workface as a percentage compared to decades ago. Men are no longer the primary financial decision makers – earnings power, education, and social status continue to rise for women.

The result: More and more women are choosing to become financial advisors, and professionals want bona fide advice, not simply investing ideas. Advisors need proper training to better serve male and female clients alike.

Financial Complexity

Personal finance has become drastically more com-plex in the past 50 years. A stockbroker could make a very comfortable living in the 1970s; nowadays, most stock trades are commission free. The consumer awareness and the need for genuine advice that is in their best interest has never been higher. Financial-planning topics run the gamut from A-Z. If it involves money, it can be confusing.

Personal finance has become drastically more com-plex in the past 50 years. A stockbroker could make a very comfortable living in the 1970s; nowadays, most stock trades are commission free. The consumer awareness and the need for genuine advice that is in their best interest has never been higher. Financial-planning topics run the gamut from A-Z. If it involves money, it can be confusing.

For example, traditional pension plans are now few and far between. American workers are tasked to save for retirement on their own. Who and where can they go to for investment and retirement advice?

The result: Consumers need an investment professional they can trust.

New financial products come to the market almost daily – imagine strolling through a supermarket with hundreds of new items added every week. How could a retail investor know what to choose from?

The result: Savvy advisors are expanding their knowledge beyond stocks and bonds to help clients make better investment decision.

As Benjamin Franklin once quipped, “nothing is certain except death and taxes.” While death is not complicated, the same cannot be said about taxes. Between 2001 and 2012, the U.S. tax code changed 4,680 times!3 That number doesn’t even take into account state and local taxes.

As Benjamin Franklin once quipped, “nothing is certain except death and taxes.” While death is not complicated, the same cannot be said about taxes. Between 2001 and 2012, the U.S. tax code changed 4,680 times!3 That number doesn’t even take into account state and local taxes.

The result: Advisors must understand how taxes and their changes affect a client’s situation and allocate funds accordingly, striking a closer collaboration with client CPAs.

Above are just a few key areas shaping how contemporary advisor must transform and expand their “toolbox” in order to provide exceptional value-added services to their clients. Let us know how we can be a better advisor for you and your loved ones!

Footnotes:

1 https://digitalcommons.law.ggu.edu/cgi/viewcontent.cgi?article=1057&context=callaw

2 https://www.census.gov/newsroom/press-releases/2017/living-arrangements.html

3 https://taxfoundation.org/how-many-words-are-tax-code/