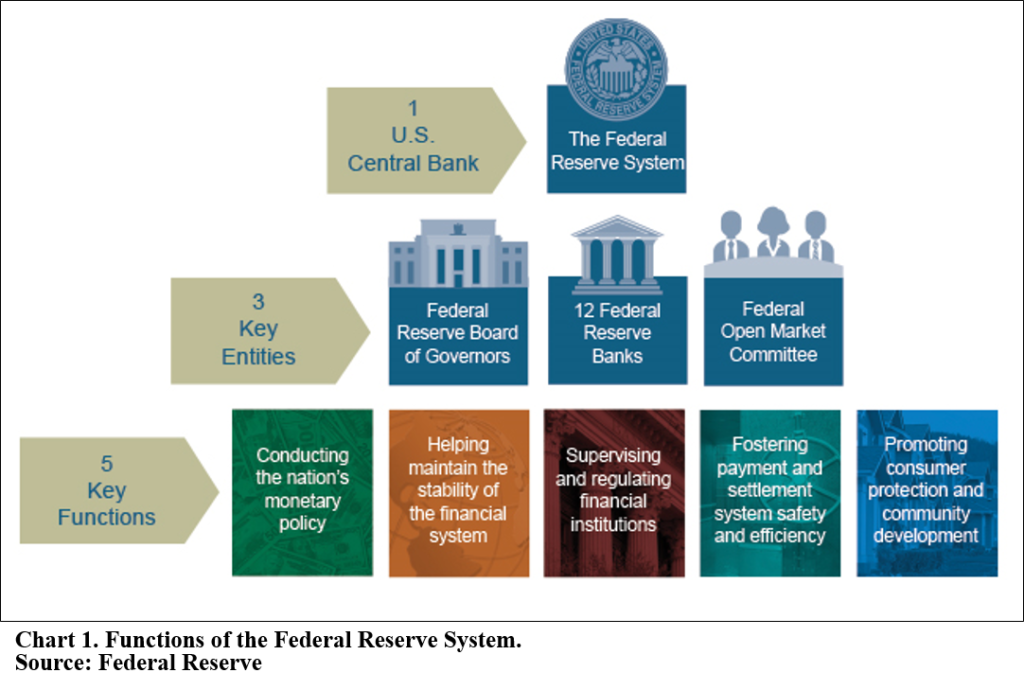

Since the financial crisis, which began a decade ago, the U.S. central bank (the Federal Reserve) has been flooding the markets with excess liquidity. In the last few years, terms such as Quantitative Easing, or QE, have become household terms as descriptors of the Fed’s activity. According to Investopedia, quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. With all of the stress on the banks and resulting illiquid assets, the Federal Reserve was quick to fulfill its functions as stated in Chart 1 below.

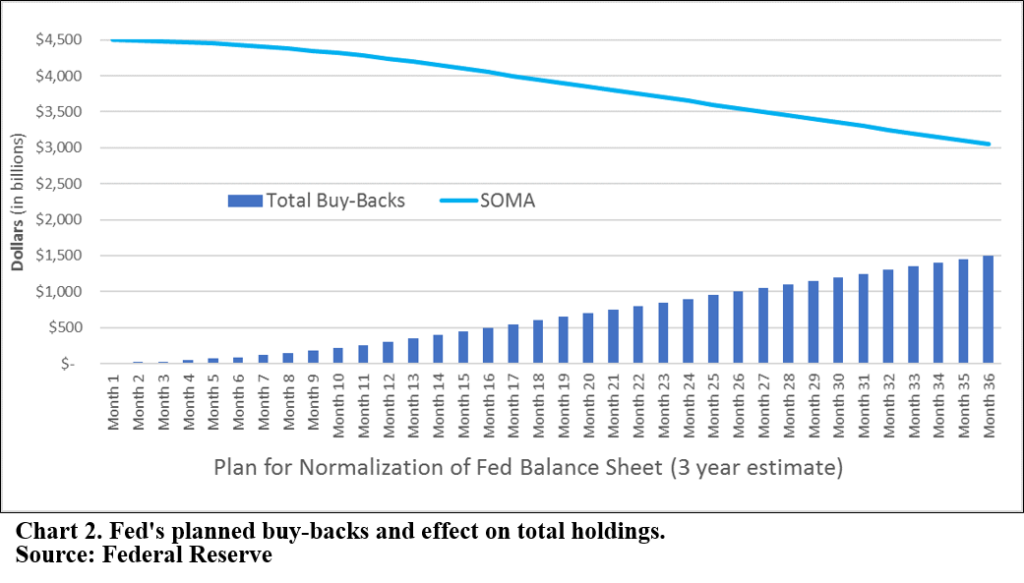

QE has not been without side effects, however. As the Fed purchased Treasury securities and mortgage-backed securities as the “lender of last resort” to keep banks solvent, they concurrently created an enormous System Open Market Account, or SOMA. The balance in the SOMA account went from $1.1 trillion in 2009 to $4.5 trillion today.1 In recent years, the SOMA account has continued to reinvest the principal and interest of the securities held, maintaining the status quo. Now, with the economy getting back on its feet and the rates beginning to normalize, the Federal Reserve wants to carefully wean the financial system off easy money. According to Janet Yellen, balance sheet adjustments are reserved for providing liquidity only where the policy rate is still extremely low, and for withdrawing liquidity where the fed funds rate is quite elevated such that further hikes are not immediately desirable, and the economy is assessed to be able to cope with supplementary tightening aimed solely at avoiding an overheating of the U.S. economy.2

Now that the economy is humming along again, albeit at a slower pace than recent recoveries, the Fed will begin reducing their SOMA holdings (see Chart 2).

They recently outlined how they are planning to tackle this imbalance. Basically, as securities come due, they will not reinvest it. Of course, this plan is not set in stone, but many economists expect it to start in late 2017.

Just like the QE, this balance sheet reduction and simultaneous rate hikes put the U.S. economy and monetary policy into unchartered territory. Much credit should be given to the central bank for their role in helping to avert a full-blown financial crisis and possible depression. Investors should watch carefully as the Fed attempts to gracefully retreat from being a major player in the financial markets. Let’s hope they can exit the fray as gracefully as they entered.

References: