Before I had any idea what money was about, I was given a white, ceramic piggy bank. The object itself was absolutely boring, yet I loved the idea of inserting metal objects (coins) into the “tummy” of the pig, hearing the clank, and knowing that they were in a safe place. Yes, cash was pretty much the only form of a financial gift a child would receive back then. These days, the complexity of financial assets is much bigger than a piggy bank can stomach.

As advisers, we are often asked by parents and grandparents what they can do financially in order to set their children up for a better future.

This newsletter, the first in a series of discussions about common savings vehicles for children, will address custodial accounts.

It may come as a surprise to some, but minors are prohibited, by law, from owning assets directly, including cash, because they lack the competency to comprehend and understand financial concepts. Fortunately, a custodial account created under the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA) essentially acts like a “piggy bank,” allowing a minor to receive and hold financial assets. The named custodian, usually a parent or guardian, manages the assets for the minor’s sole benefit until majority of age is reached – 18 at the earliest to no later than 25, depending on the state of residence. The custodian has control over the account and can invest assets in most investments, however, there are several important considerations to remember.

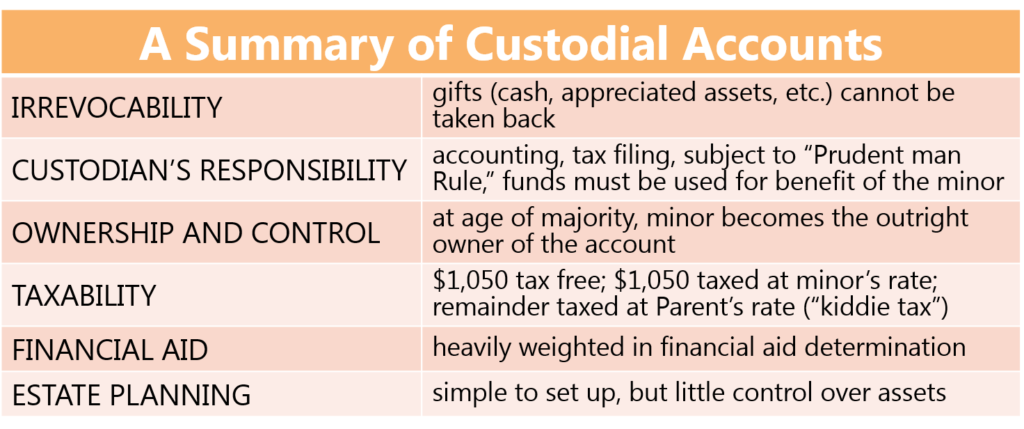

- Irrevocability: Transfers and gifts into a minor’s custodial account are considered complete and, hence, irreversible. Much like a charitable donation, once it is given, you cannot take it back. In addition, cash is not the only form of gift allowed. With a custodial account, parents or grandparent can transfer appreciated stocks, mutual funds and more.

- Custodian’s Responsibility: As a custodian for the minor, you are held accountable for what happens to the assets, such as accounting, tax filing, and investing by the “Prudent Man Rule.”1 It is illegal for a custodian to use the funds on anyone other than the minor. There are legal ramifications if an applicable rule is broken.2

- Ownership and Control: Once the minor reaches the pre-determined age of majority, they will become the outright owner of the account. Financial institutions are very good at enforcing the transfer, sometimes automatically. Although the custodian has certain control over the assets, the minor will gain unrestricted access to the account and can do whatever they wish with the assets once the age of majority is reached. This “windfall” may not always be a blessing if the minor’s view toward money is undeveloped.

- Taxability: Because a custodial account belongs to the minor, there are certain tax advantages. In most cases, the first $1,050 (for 2019) of unearned income is free of tax while the next $1,050 of earnings is taxed at the minor’s tax rate. Unearned income above $2,100 is taxed at the parent’s rate, the so-called “kiddie tax.”3

- Financial Aid: One major disadvantage of a custodial account is that these assets carry the heaviest weight in determining financial aid eligibility and amount. In fact, these assets are assessed at 20% in figuring the expected family contribution (compared to a 5.64% assessment rate on parents’ assets).

- Estate Planning: Custodial accounts pose an interesting dilemma for many parents and grandparents. Their simplicity allows for quick setup, easy gifting, and time for investments to grow. However, the lack of flexibility and control could lead to unintended consequences and defeat the original purpose. For example, the minor may have a false sense of entitlement due to the availability of assets. Because of this, custodial accounts are not ideal for receiving large gifts and many parents choose to keep these accounts a secret for as long as possible. Another potential complication relates to death. If the named custodian passes away while the custodianship is still in effect, the assets are counted as the custodian’s estate. In the event of a minor’s death, however, the custodial assets will be included in the minor’s estate.

As you can see, a simple, thoughtful intention of helping a child actually warrants a deeper conversation, careful planning, and a true long-term perspective. Let us know if this resonates with your situation. We are here to help!

Footnotes:

1 https://www.thebalance.com/what-is-the-prudent-man-rule-or-prudent-investor-rule-357258

2 https://www.thebalance.com/spending-childs-utma-money-illegal-358134