GREAT NEWS! Charles Schwab announced that starting on October 7, 2019, transactions to buy and sell stocks and ETFs are FREE! However, Schwab was not the first large broker to make this offer. It is likely that Schwab was reacting to a free commission offering from Interactive Brokers that began the last week of September. Shortly after Schwab’s announcement, other brokers followed their lead by promising the same thing. Starting in November, Fidelity will offer free trades as well.

This seems unbelievable! When I began in the business in 1991, each trade would cost hundreds of dollars. Because of this, there was pressure to make every buy and sell decision a money-maker. This type of goal would lead to holding losers too long and getting rid of winners too quickly because the cost of trading was so high. Timing investment purchases perfectly is impossible for even the most astute investors, and this method of paying for investments can easily put the interests of the broker and the investor at odds with each other. It led to habits of “churning” in client accounts in order to make more commission.

With the advent of computer trading and immediate dissemination of relevant information, costs have fallen dramatically. This move to zero will cost some brokers much more than others, because certain brokers have a sizable percentage of their revenue from commissions. It is not surprising then, that the brokers slashing the rates are those that make a majority of revenue from other sources.

How is the money being made to make up for this cost compression? Who is paying for it? Behind the scenes, the brokers are paid for “order flow” which is the number of trades they submit to the market makers. They often use the small, unsophisticated (i.e. retail) investors for this order flow. Institutional investors with large orders are more interested in the best price and want to squeeze every cent or partial cent out of the cost. Expect to see more discussion of “order flow” and best execution as regulators and firms explore whether paying for order flow is equitable, ethical, or defensible.

Additionally, firms that hold cash deposits make a profit on the difference of the interest rate they pay you versus the interest rate they receive. Many discount brokers earn sizable revenue from cash that is on the sidelines and expensive margin loans.

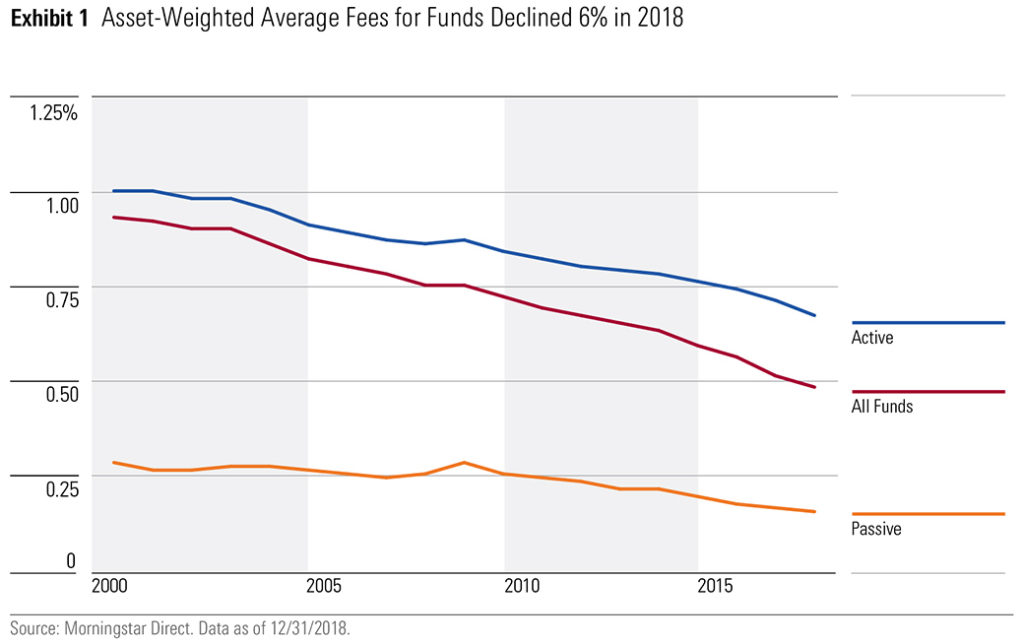

Fee Compression for funds

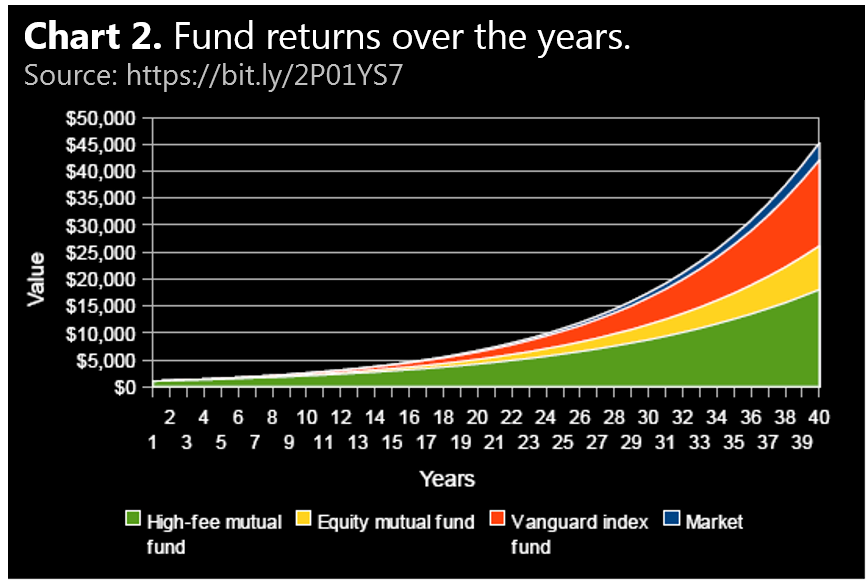

It may be cheap or even free to trade, but it is also true that a reduction of fees on widely held funds has created wealth for investors as well.

The power of compounding really kicks in when fees are lowered.

As an investor, for what should you be willing to pay? In a word: ADVICE. Estate, Tax, and Financial Planning are vital topics that affect your wealth. Consider these advisors as coaches who will help oversee and protect your family’s long-term financial health, keeping you on the path to prosperity. The goal of achieving your financial objectives seems simple and straight-forward until a market disruption occurs. Then it really pays off to have trusted advice and a plan for the future. Making a fear-driven decision at just the wrong time can inflict unnecessary damage to your family’s wealth.

It is indeed good news that fee compression allows compounding to shift wealth from brokers and money managers back to the investors themselves. Investors are the true winners in the Race to Zero!