America is easily the most philanthropic country in the world, led by the largest charitable foundation —the Bill and Melinda Gates Foundation which has over $42 billion of assets.[1] The aggregate assets of the top 100 grant-making foundations amount to a whopping $290 billion:[2] that is the GDP of Hong Kong![3]

Aside from these enormous private foundations, ordinary American folks have been quietly building their own charitable means through the use of donor-advised funds (DAFs), sponsored and administered through bigger charities and local community foundations. According to a 2014 report by the National Philanthropic Trust (NPT), DAFs have seen healthy and significant growth in recent years (Figure 1), with total assets available for grant-making reaching an all-time high.[4]

What Are Donor-Advised Funds?

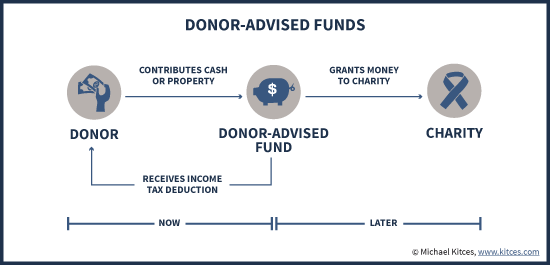

NPT provides an excellent definition: Donor-Advised funds are “a philanthropic giving vehicle administered by a charitable sponsor. A donor-advised fund allows donors to establish and fund the account by making irrevocable, tax-deductible contributions to the charitable sponsor. Donors then recommend grants from those funds to other charitable organizations.”

In our words to clients: A DAF is your own little charity! You put funds or assets (irrevocable contributions) in and, at your desire, make or recommend grants out of it to other charities of your choice. A graphic illustration is below (Figure 2).

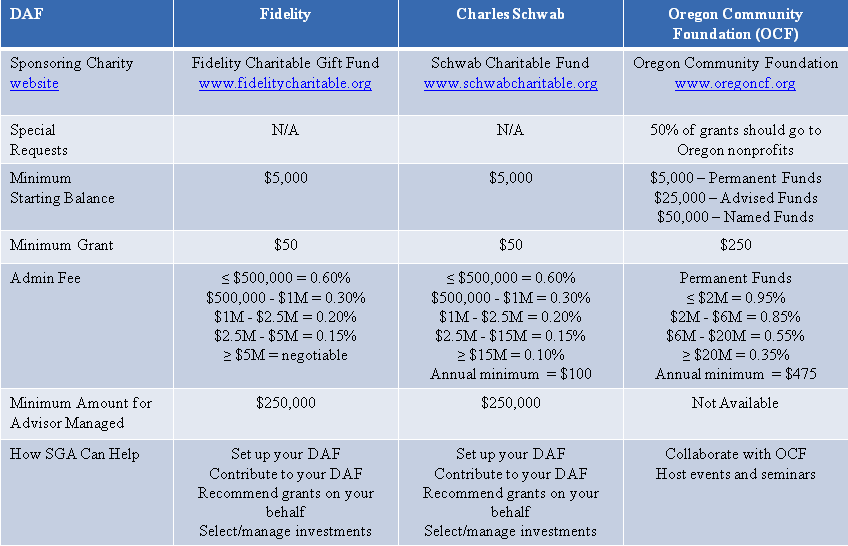

Unlike nationally recognized charities, you do not need to be super wealthy or commit a ginormous amount. Some sponsors allow initial contributions to be as little as $5,000, and grants can start at $50. You may also choose to remain anonymous when recommending a grant.

Why Consider Using Donor-Advised Funds?

Charitable intent. Perhaps the most important factor is that you have charitable desires. But why not simply make a cash donation to your favorite charities?

Timing. While you are always welcome to make cash donations, sometimes you just need some extra time to figure out the details. For example, it is Thanksgiving and you want to make some year-end gifts, but you cannot decide which organizations should be the recipients. By putting those funds into a DAF, it allows you time to do some planning while still getting the charitable tax deduction.

Tax. From Uncle Sam’s standpoint, the bonus of being charitable is that you get a tax write-off. Donations to qualified charities are one of the items if your itemized deduction is bigger than the standard allowance. Utilizing a DAF can be an effective strategy to offset a big income year.[5] In addition, low-basis securities can be contributed into a DAF to avoid the capital gains tax associated with selling the security and giving the cash proceeds.

Simplicity. Operating a donor-advised fund can be as simple as having a personal checking account. The three-step process (Figure 2) is the main reason why DAFs have been gaining popularity among the charitable community. There are no tax-filing requirements (the DAF sponsor handles them); there are no explicit investment decisions to make (you just have to choose from a set of investment options); and if your initial contribution is large enough (usually $250,000), an investment manager can be hired to manage the assets.

Family Values. Donor-advised funds are also a great way to create a family legacy. Many of us are passionate about helping those in need, creating a better community, and making the world a better place to live. By utilizing a DAF and making grants to organizations whose values align with yours, you become part of a much greater cause. Additionally, your children can benefit from being involved in the process. For example, when it comes to recommending grants, let everyone choose a charity of their choice and provide reasons. Then, the family collectively can decide on which one or ones to select. Family members can also rotate between roles in the process so that they get to learn all the ingredients that go into running this “family charity.”

Estate Planning. If you have included charities in your estate plan as beneficiaries, there is a chance that some of them, especially the very nimble ones, may not be in existence to benefit from your bequests, or that their values have changed. Naming a DAF, in this case, would solve those problems as it allows the flexibility that your estate planning documents lack.

How to Use Donor-Advised Funds?

Donor-advised funds are a step-up from simply giving cash to a charity; it, thus, requires careful planning and consideration of different factors. All the good reasons to use DAFs come with a cost, and they vary, so it is best to understand your goals and choose the DAF that matches them. The following chart summarizes the charitable services provided by Fidelity and Charles Schwab, and also the Oregon Community Foundation.

Let us help you explore and evaluate options in order to fulfill your philanthropic wishes.There are IRS guidelines that stipulate how grants can be issued from a DAF. As in the case to any public 501(c)(3) charity, grants cannot be given to individuals, only to other qualified charitable organizations. Grants that result in benefits received by the donor are not allowed either. For example, a donor receiving tickets to sports events in return of his pledge to the alma mater cannot utilize his DAF. Although you have some control over the assets, by no means can you take them back. Once the contributions into the DAF are made, they are irrevocable.

[1] As of March 31, 2015. http://www.gatesfoundation.org/Who-We-Are/General-Information/Foundation-Factsheet

[2] http://foundationcenter.org/findfunders/topfunders/top100assets.html

[3] http://data.worldbank.org/country/hong-kong-sar-china

[4] http://www.nptrust.org/daf-report/recent-growth.html

[5] https://www.kitces.com/blog/rules-strategies-and-tactics-when-using-donor-advised-funds-for-charitable-giving/