In recent months, news that early PayPal investor Peter Thiel’s Roth IRA was worth $5 billion caught the attention of people everywhere, particularly those on Capitol Hill. Many have reacted with outrage, because the original Roth account of $2,000 grew to $5 billion and that account will never be taxed. To my knowledge, Mr. Thiel’s massive Roth IRA balance was built through perfectly legal means (and probably at the advice of his financial adviser). Consequently, this is not a case of bad actors or behaviors, but rather highlights the fact that, under the “perfect” conditions, Roth IRAs can be a tremendous tool for building and protecting wealth.

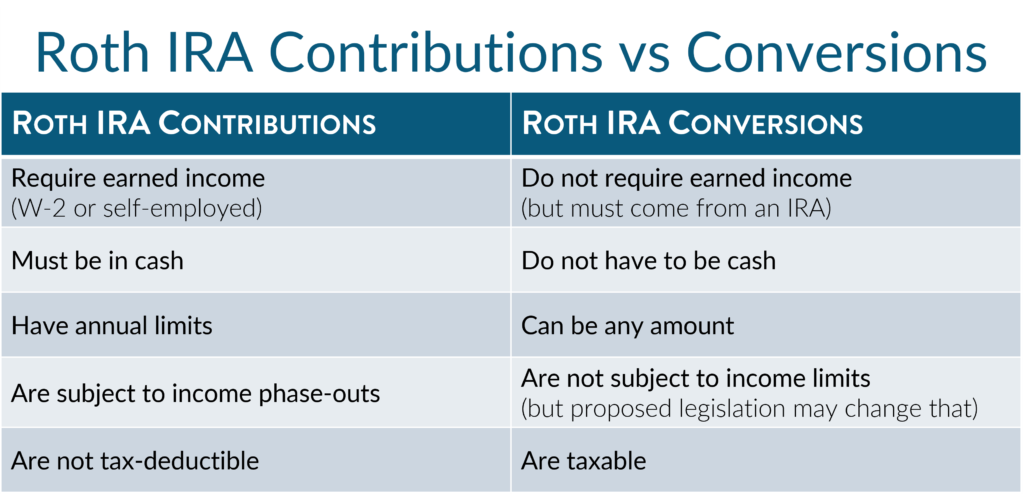

For most of us, of course, the odds of investing in a start-up that turns into the next PayPal are hardly better than winning the Powerball jackpot. However, investing with tax-free certainty should not be overlooked! While contributing to an IRA has certain restrictions, Roth conversions are much more flexible. What are the differences?

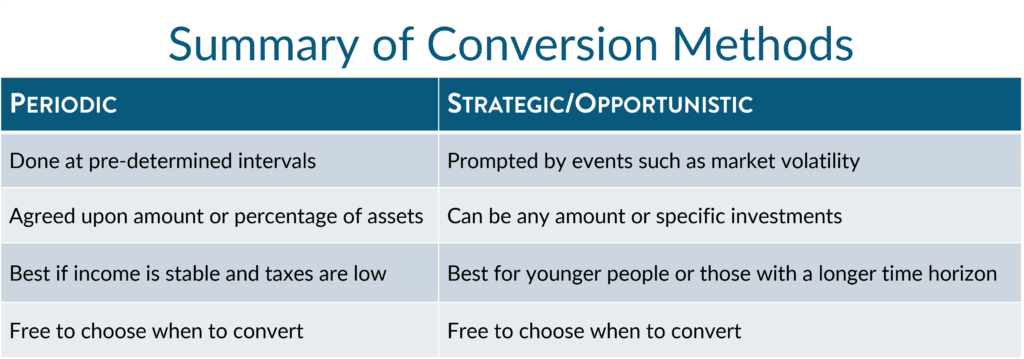

There are two main ways to go about Roth conversions: periodic and strategic. Both rely on a key assumption that future taxes or tax rates will be higher than today’s.

Periodic conversions, as the name suggests, are conversions done at regular intervals. For example, for a 62-year-old retiree, we may recommend performing annual Roth conversions until age 72, when required minimum distribution (RMD) begins, to reduce the pre-tax IRA pool and the impact of RMDs. We would also aim for either a specific dollar amount or a percentage of the regular IRA, depending on your tax situation. This strategy works well when other taxable income sources are relatively low and stable.

The other method to convert from a traditional (pre-tax) IRA requires a bit more attention, whether it is your personal income situation, market conditions or both. Strategic, or opportunistic, conversions focus on certain unexpected events and take advantage of them, often requiring the IRA account holder to act swiftly. Between mid-February and early April of 2020, when COVID-19 first emerged and quickly became rampant across the nation, the stock market tumbled 30% or more in response to the draconian lock-down measures. That was one of the best times to perform Roth conversions, pay taxes on much lower values of sound investments and let them grow tax-free for good. You need not wait for the next market correction either! If you hold an investment in your IRA that has dropped in value but you believe in its long-term prospects, you can convert just that holding. Yes, you can actually “time” the market when it comes to Roth conversions and you can be selective on what to convert. It truly is the best of both worlds. If your income is lowered, it may open room in your tax bracket for Roth conversions. Working with your investment and tax advisers can provide a clearer picture.

Going all in? Congress is touting the idea of doing away with Roth conversions altogether, not just for the high-income earners. This drastic proposal has received tremendous opposition. Although the prospect of that becoming a law is slim, it would be a huge blow to saving for retirement, should it become reality. Such an event may be ideal for an extreme action – a full conversion. Only you and your advisers would know if this is for you.

With so much noise in the news, it is difficult to sort out what is important and what is not. That is why it is crucial to work with an adviser who is knowledgeable, works with you and listens to you. Roth IRAs are one of the best tools for saving, but it takes knowledge to maximize the benefits available through using them.