For the first time in a decade, the 2-year Treasury yield has met and exceeded the S&P 500 dividend yield (see Figure 1).

Why is this significant? It is significant because as bond yields edge up, fixed income allocations become more attractive to investors. Thus, stock returns can be dampened by what appears to be a SUBSTITUTION effect – as yields rise, fixed income becomes a more viable investment alternative to equities.

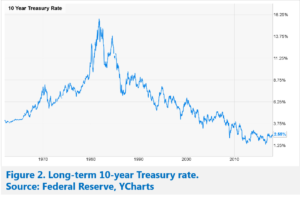

In recent portfolio construction, total return considerations have driven fixed income portfolio allocations to an all-time low. The expected returns for risk-free Treasury bonds (see Figure 2) do not warrant the traditional allocation of 60% equities and 40% bonds. Because of this, investors have been seeking yield elsewhere – real estate, utilities, dividend-paying stocks, energy MLPs, and other higher-yielding securities.

When these quasi-bond securities are included in a portfolio, they do not provide the cushion from volatility that a traditional 60/40 asset allocation does. In the current market, securities which have been purchased to obtain a higher yield often trade with equity-like (or worse) volatility. These bond substitutes, at times, experience overreactions to changes in bond yields.

As soon as treasury yields begin to reach an attractive level versus expected returns and yields for equities, investors will opportunistically move from equities and bond surrogates back into regular fixed income. This flight from equities and yield securities back into bonds will likely slow down the rush of the bull. Once again, investors will be content to build 60/40 balanced portfolios to reduce the correlations and volatility among their allocated assets.

This could be ONE factor that slows down the equity bull market!