The Industrial Revolution dramatically changed on our way of life since its birth some 200 years ago, but the Internet has truly “revolutionized the computer and communications world like nothing before,” writes the Internet Society. Today, Internet-of-things (IoT) and “smart” products have pushed innovations to a whole new level. The technology behind bitcoin could, yet again, revolutionize the way we live and interact.

Blockchain technology explained

Imagine you are part of a human chain in which everyone is wearing the exact same clothes, from head to toe. When a single change takes place, the rest of the “chain” makes the identical change too. For instance, if one person changes to white sneakers from brown sandals, everyone else in this particular chain makes the very change. That, essentially, is the technology powering bitcoin, known as the “blockchain.”

Although much of the blockchain application has been related to cryptocurrencies, namely bitcoin, proponents of the technology argue that the cryptographic algorithm offers many powerful uses. For instance, blockchain is a decentralized system, i.e. no single point of storage. The same information is held by all the players in the chain, made up of independent players (computers). The lack of a single server makes hacking and data breaches extremely difficult.

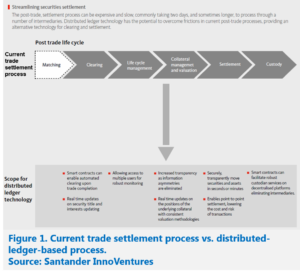

This decentralized system also creates a new way for recording transactions. Every computer on the blockchain validates and records all the transactions, and the record-keeping process is public and subject to inspection. This type of infrastructure can eliminate the need of a middleman such as a broker while significantly improve the speed, resulting in further cost savings. In places where governments and/or the financial systems are less reliable, the blockchain technology can prevent disputes from happening.1 Stock bourses around the world are also experimenting the potential of blockchain technologies (see Figure 1 for an illustration).2 Annual savings for financial institutions through the adoption of the blockchain and distributed ledger technology are projected to be in the $15-20 billion range by 2022.3 Cross-border money transfers could be free and instant.

Anonymity is another advantage offered by the blockchain technology. Stories such as last year’s massive global WannaCry ransomware attack and the demise of Silk Road, an online marketplace that kept user identity hidden when transacting (mostly illegal) substances, involved the use of bitcoin. A new report from the U.S. Drug Enforcement Administration claims that bitcoin is being used to facilitate trade-based money laundering schemes.4 These less-than-perfect examples somewhat undermine the credibility of the technology; but the pursuit of privacy will facilitate many legitimate applications in the future.

Headwinds not to be neglected

Plenty of challenges await the blockchain technology. Regulation and compliance, for example, remain the biggest burden. After New York adopted regulations and began issuing BitLicense, a permit allowing companies to conduct business in the digital-currency realm, many of these companies fled the state due to the choking requirements.5 Industry advocates compare the current development of the blockchain technology to childhood, where the technology is experiencing tremendous growth, acquiring knowledge and gaining experience. Excessive and insensible regulations, in their words, will only stifle innovation. Regulators argue that rules are needed in order to protect consumers’ interest.

That is a legitimate point. Consider what happened to Mt. Gox, a bankrupt bitcoin exchange, whose clients’ accounts were hacked and thousands of bitcoin evaporated. Because of the unique cryptographic encryption, these victims will never be able to recover their loss.6

Another lesson from Mt. Gox’s collapse hits the problem right on the head: If the blockchain technology is a trusted, decentralized, public database, why would we need a “central” marketplace such as Mt. Gox (and others) to make the information vulnerable again? In other words, if we allow the chicken to roam freely, letting them do so only in a chicken coop still makes the job easy for the fox.

I personally look forward to the blockchain technology being applied in the financial planning world to benefit clients. What if all of your important documents could be maintained and updated at multiple locations without sacrificing privacy; what if securities transactions settled much quicker, more securely, and at an ultra-low cost; what if planning could be done in a more concerted effort while maintaining data integrity; what if… Be patient, the future is exciting!

Footnotes:

1 The great chain of being sure about things. The Economist. Oct. 31, 2015.

2 http://www.nasdaq.com/article/how-stock-exchanges-are-experimenting-with-blockchain-technology-cm801802

3 The Fintech 2.0 paper: rebooting financial services. Santander InnoVentures

4 https://www.coindesk.com/dea-report-bitcoin-used-trade-based-money-laundering/

5 http://fortune.com/2015/08/14/bitcoin-startups-leave-new-york-bitlicense/

6 https://www.reuters.com/investigates/special-report/bitcoin-gox/