![]()

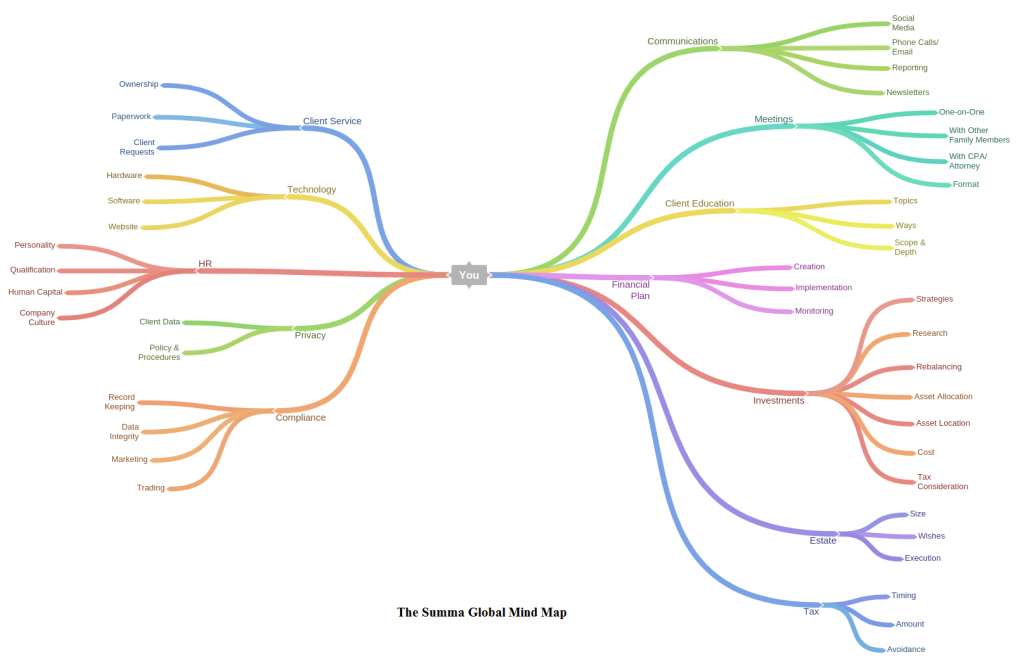

Remember this graph from last quarter: the Summa Global Mind Map? It is a graphical illustration of our service model.

This time, let us apply the process on what matters most – you. As you read this letter, it will become clear how easily your financial picture can be drawn and depicted using mind maps.

From a macro view, your financial life can be expressed in a simple mind map. The main attributes are the colorful branches below:

- Cash flow – income sources and expenditures.

- Taxes – responsibility of a taxpayer.

- Assets – things owned by you.

- Estate – how your assets are titled.

- Philanthropy – charitable intentions and plans.

- Insurance – risk management and asset protection.

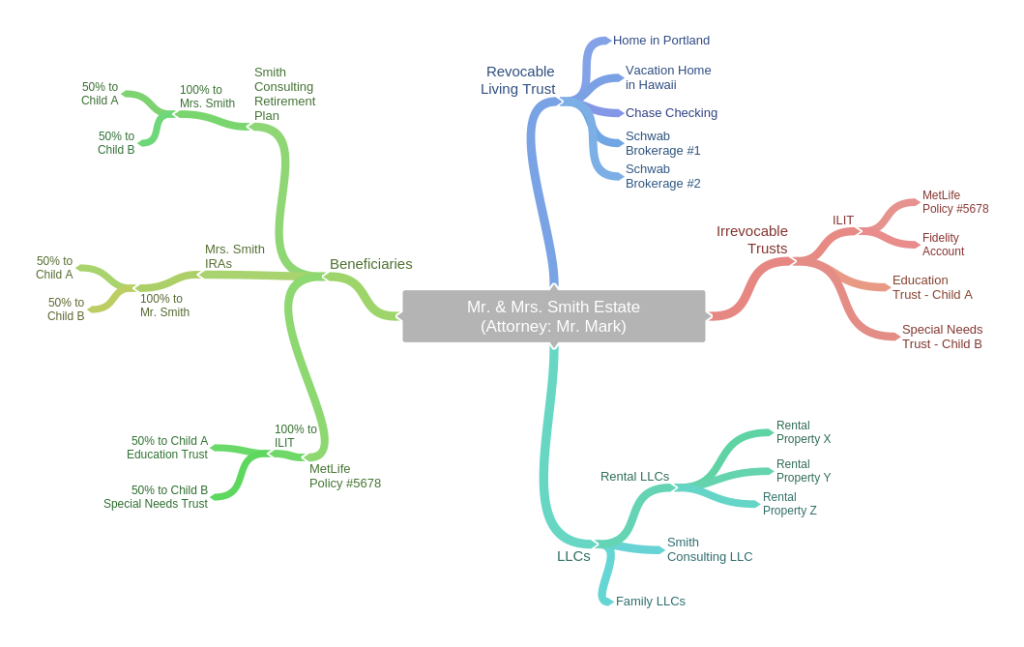

As you can imagine, each branch has “room” to grow and expand, incorporating such details as account information, asset flows, and relationships. Take a look at the “estate” branch of a hypothetical client Mr. and Mrs. Smith’s mind map.

If we were to verbally explain to Mr. and Mrs. Smith their estate, it would cause everyone’s head to spin and make them lose interest in a matter of seconds. However, by showing them a mind map, they can literally “see” how assets are titled and transferred to heirs. Dollar amounts can be included as an additional layer of information.

The same process is repeatable on every element on the mind map, and your financial life will appear right in front of your eyes (next page).

We can all agree that explaining someone’s finances such as estate matters is probably as difficult and daunting as telling your children why the sun rises in the east. Humor aside, however, mind mapping is a very powerful technique for translating concepts into meaningful (and colorful) diagrams, making them easier for everyone—from clients to advisors to children—to comprehend. If you would like to see the benefits of having your own mind map, do not hesitate to let us know.