The U.S. bull market has entered uncharted territory – it is now the longest in history and is still marching higher. But this charging bull has to catch its breath someday before resumes its run.

Behavioral finance teaches us that it is during these tumultuous times when humans react emotionally (and irrationally). Although we will not be able to predict exactly when the economy will hit a speed bump, or how the stock market will react, or even how long tough times may last, we can prepare ourselves based on factors that we understand and control in order to weather the storm with confidence and comfort.

1. Build up a rainy-day fund

Many experts suggest that having between three to six months’ worth of spending set aside is a prudent thing to do. Recessions often feel much worse than reality because they impose tremendous stress and uncertainty on us, with married workers and families feeling more pressure due to greater (financial) responsibilities. [1]

How much you really need in an emergency fund depends on three factors.

- The math factor: How much is the “non-discretionary” portion of your household budget? These are items that recur on a regular basis and are essential to you and your family. Utility bills, mortgage payments and insurance premiums are the most common.

- The human capital factor: How quickly would you be able to find a new job? Is your skillset “recession-proof” or easily replaceable? Think of great athletes like Shaquille O’Neal or LeBron James. What they bring to the court is unique, hard to find elsewhere, and, therefore, in high demand. Time between jobs can be much longer than anticipated. One consultant suggests planning for as many as two years for the transition, and many job seekers underestimate how long it actually takes.[2]

- The emotional factor: How long would you and your family “feel” comfortable living on reserves? If the answer was three to six months before, how would you feel now knowing job searches could take much longer?

2. Review spending

Knowing where your money goes is the single most important key to a healthy budget. When things are bright and income is predictable, spending will seem like it is easily manageable. New appliances, home remodeling, luxurious vacation trips are merely another line item on credit card statements.

However, when an economic recession rears its head, these big-ticket items are the first things to go. That new slim TV has to stay on the store shelf, those new countertops will just have to wait, and the next family vacation takes place in the backyard instead.

What is troublesome is that sometimes, even after letting these expenditures go, you still cannot balance your budget. At that point it becomes necessary to identify other corners that can be cut. For starters, canceling cable, Netflix or both; switching to a cheaper cellphone plan; or turning in gym membership can add up to some serious savings. Ultimately, valuing and prioritizing your spending needs will make tough decisions less difficult to make when the time comes.

3. Pay down debt

Our very own Rachel’s advice on paying down debt, “it is a guaranteed return.” Indeed, as interest rate on credit cards can be as high as 24%, the only winner is the lender.

The stress associated with debt should not be neglected either. From common symptoms such as insomnia and eating disorders to more serious health problems like anxiety and depression – high amounts of debt can take a toll on our overall well-being. [3]

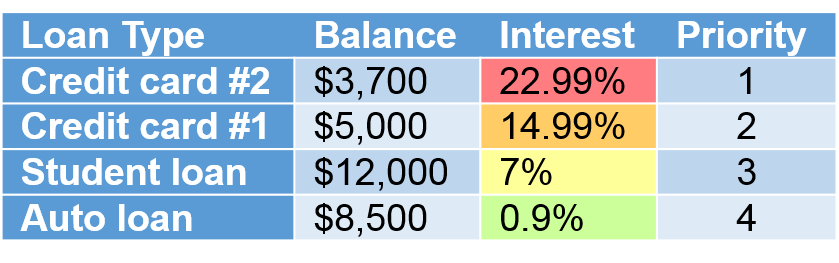

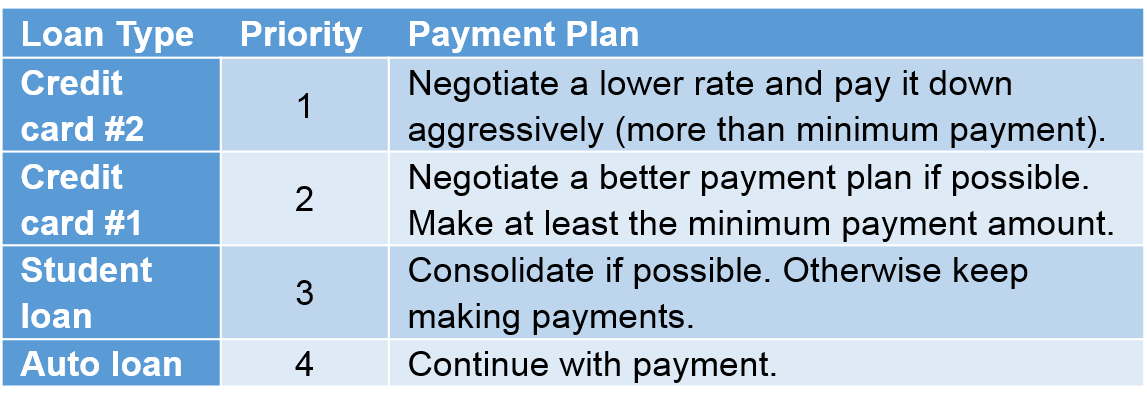

The strategy in coping with debt is quite simple. First, list all of the debt or loans you owe, along with their respective terms: type, balance, and most importantly, interest rate.

Second, rank them by interest rate, from highest to lowest.

Finally, create a payment plan, beginning with the most expensive loan.

Sometimes, you may tackle multiple loans at once. For example, by consolidating them into one or leveraging home equity to pay them off. These decisions are best reached when consulting with your financial advisor. If you don’t have one, talk to us.

4. Save for retirement

Regardless of what the media is saying about Social Security, we need to take retirement planning into our own hands. When we are enjoying the benefit of a thriving economy, it is prudent to not only participate in your workplace retirement plan such as a 401(k) plan but also increase your contribution to the best of your capability. Many experts suggest deferring between 10 to 15% of salary, which includes the match from the employer.

Of course, sometimes it may be unrealistic to begin with these double-digit contribution targets when factoring in your unique situation and various financial obligations. Taking small but incremental steps is crucial. Start with a reachable goal of 3%, for example, and that would also get you the employer match of another 3% (6% total). That is an instant 100% return of your money! Many plans allow you to set annual increase on contributions. With just a few mouse clicks, your annual savings target would go up by 1% until a maximum target would be reached.

For a graphical illustration, check out our blog on compound interest and the effects of waiting. [4]

5. Perform a portfolio check-up

While the phrase “a rising tide lifts all boats” can be applied to this historic stock market run, Warren Buffett’s quote, “Only when the tide goes out do you discover who’s been swimming naked,” comes with profound wisdom.

Reviewing your investment portfolio accomplishes two goals.

- Knowing what you own and why you own it. Is your investment portfolio a casual coincidence of hearsay, gossips and stories, or is it a product of careful, thorough research? If investing stresses you out, perhaps you should leave that to the professionals.

- Making sure your portfolio aligns with your risk tolerance. Some investors have the false impression that stocks that have outpaced the broad market are less risky. While these companies tend to lead in an uptrend market, they often can fare much worse on the way down. Now is one of the best times to evaluate your portfolio to ensure it has not “moved” out of your comfort zone. Size of holdings and diversification are two keys to a healthy portfolio. To learn about your unique risk profile, go to our website and take the Find Your Risk Number exercise. [5]

6. Invest in yourself

No one or nothing else can help if you do not continuously make yourself better and more valuable, through acquiring new knowledge, accumulating experience, sharpening your skillsets, and being a student of the world. Should your boss need to decide who to lay off, you will be either in a very favorable position or become a hot commodity in the competitive job market.

These suggestions, we realize, will never prevent the next recession from happening, nor will they make your portfolio “bullet-proof.” They are, however, meant to prepare your mind (mental readiness) so that other people’s panicked, short-sighted reactions will not lead you to jumping into the same, irrational decisions. Stay calm and carry on!

Footnotes:

1 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4844458/

2 https://careerpivot.com/2018/long-will-job-search-take/

3 https://www.creditcards.com/credit-card-news/four-ways-cope-debt-related-stress-emotions-1264.php