Stay on track.

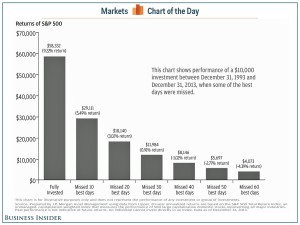

Discipline isn’t easy! A JPMorgan Asset Management study of the S&P 500 revealed that an investor who missed just the 10 best days, from 1993 to 2013, would have an annualized return of 5.49% compared to 9.22% for those who remained fully invested.

(To read more, click here.)

You are emotional and thus predisposed to making financial decisions that may not be in your best interest based on emotions such as greed or fear. A great advisor will help you mitigate emotional reactions, hold your hand (sometimes literally) through market volatility, and encourage you to stick with your financial plan.

Even though you may not realize it, you have biases toward particular types of investments. Your advisors will help you look at things more objectively, and as a result, your assets will be better invested.

Your advisor will help you develop an asset allocation plan that is right for you, educate you about the decisions, and be there alongside you every step of the way.

Ask and answer tough questions.

Your advisor will press you to answer questions you are uncomfortable with asking yourself. For example, how you plan to take care of your aging parents if the need arises, what you would do if you lost your job, how you are planning to send your kids to college, or whether your estate plan is up to date.

Additionally, you may need a qualified professional to answer questions you have, such as:

- Can I afford to retire early?

- Does my investment portfolio supplement retirement income?

- Should I rent or buy a house?

- What are my options to donate to charity?

- Should I invest in annuities?

- What are the best ways to help out my children and grandchildren?

Free up your time.

Investing is time consuming. Not only does it require a massive amount of research, it is also a tremendous hassle to stay abreast and difficult to keep your emotions in check! Monitoring your portfolio and periodic rebalancing is a necessary aspect of investing, but odds are you don’t have the time (or perhaps the desire) to keep up with your portfolio. Your advisor will create the right asset allocation plan that is comfortable for you while keeping in mind your financial goals and risk tolerance levels.