Financial Planning

Financial planning can mean many different things to different people: from something simple such as creating a budget or managing personal debts, to comprehensive, lifelong plans that incorporate all aspects of your life. The goal of financial planning, in a nutshell, is to create and follow a path toward achieving a single or a number of goals.

The objective of financial planning is to create a comprehensive plan that allows businesses and individuals to strategically maximize their assets to reach their financial goals. This is accomplished through analyzing the client’s current financial situation as well as evaluating the client’s financial goals, future wealth transfer plans, and future expense anticipation.

Personal financial planning includes, but is not limited to, the following areas:

- Budgeting

- Debt reduction/consolidation

- Tax planning

- Risk management/insurance planning

- Retirement planning

- Education funding

- Investment management

- Estate planning

- Charitable giving solutions

SGA follows the CFP® Board’s 6-step financial planning process when creating your financial plan.

Retirement Planning

What do you dream of doing in retirement? What is on your bucket list? How prepared are you for this ultimate, once-in-a-lifetime event? By understanding your personal retirement goals and concerns, we come alongside you to strategically draft a plan for your retirement.

We will advise you, first and foremost, by doing a financial readiness review. We also examine strategies to maximize Social Security benefits and how rising healthcare costs may impact your overall retirement picture. Other important areas of consideration include relocation assessments (moving to a different state or to a retirement community?), wealth transition and legacy planning.

We take care of you so you can enjoy every bit of the well-deserved retirement life and be confident in your retirement plan!

Wealth Management

Wealth management is more than just financial advice. It incorporates a full range of financial services and products in order to enhance your financial situation.

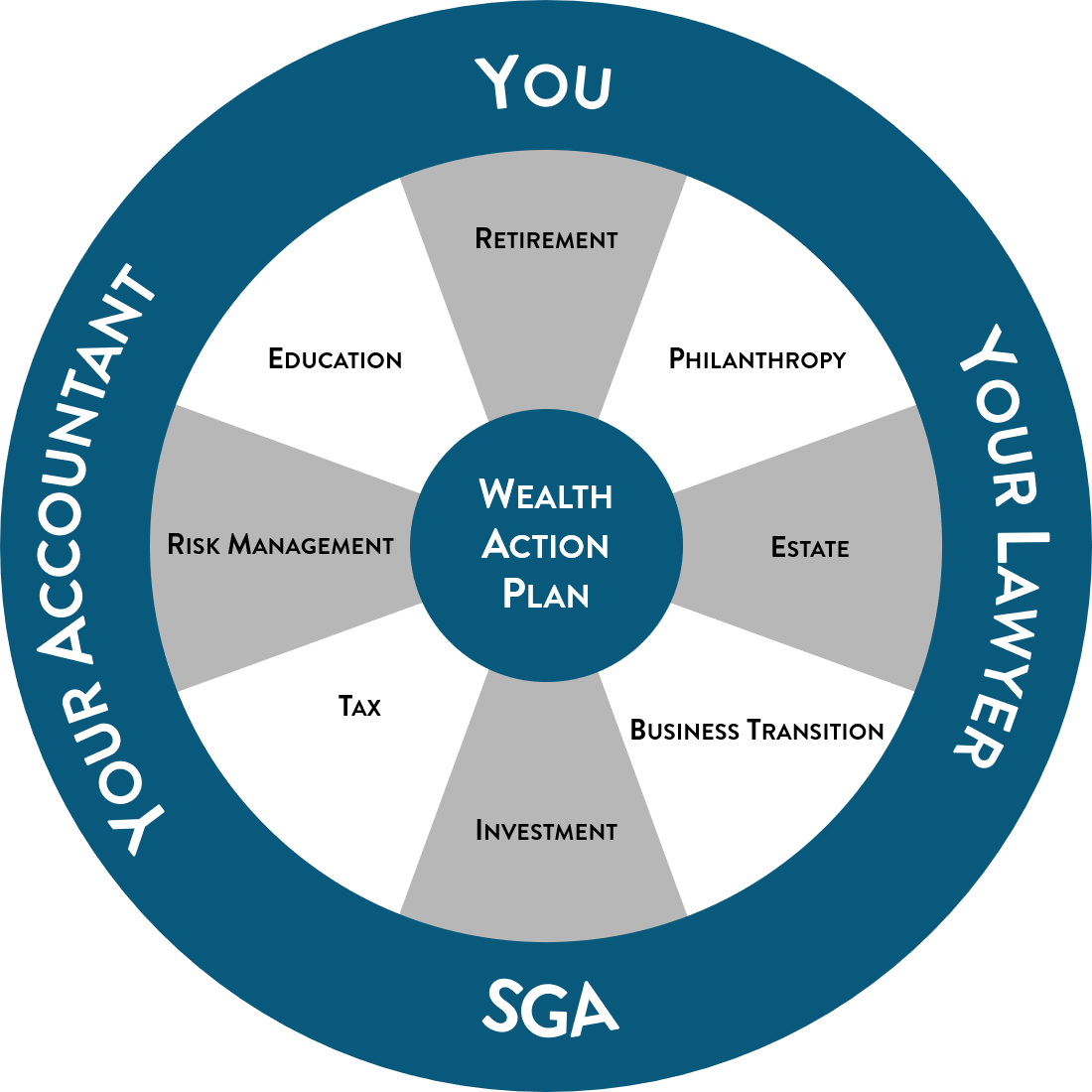

We coordinate input from you, your attorneys, and your accountants to create a personalized and comprehensive plan. Wealth management incorporates areas such as financial and investment advice, tax services, retirement planning, estate planning, and philanthropic goals in a holistic approach that benefits high net worth individuals.

More on wealth management: http://www.forbes.com/sites/russalanprince/2014/05/16/what-is-wealth-management/

Investment Management

Imagine ordering a Big Mac at McDonald’s, but there are five different options; or choosing from 20 different grades of gasoline instead of three at the pump. The financial market is notoriously good at making things more and more complicated, every day. Between stocks, bonds, mutual funds, and ETFs, there are easily tens of thousands of products to choose from – not to mention more complex offerings such as annuities. The $1 million question is: How and what to choose?

If you enjoy researching various companies and products, reading financial statements and research reports, studying price charts, and riding the volatility, you are probably better off on your own.

But do you have something else you would rather do? Hiking and camping in the breath-taking Pacific Northwest during the summer or hitting the snow in the winter; traveling and seeing the world with your loved ones; preparing for a family reunion or a holiday gathering; or simply enjoying time on your own. Leave the daunting task of managing your financial assets to us, because not only are we good at doing this, we pride ourselves on being a fiduciary (i.e. always acting in your best interest) in doing so.