Click here to download the PDF version of the newsletter. In This Issue: Investment Insights In 2021, the market showed strength, driven by a rebound in business and consumer spending. With the rebound came a spike in inflation created by persistent pandemic-induced supply chain problems, outsized demand, and rising wages. 2022 will be a challenging […]

Three Better Methods (than cash) to Fulfill Your Charitable Intentions

When there are so many options for how to give, how can we determine which is best? The answer is – it depends! There is a lot that varies based on your individual circumstances, which is why it’s important to seek out advice along the way. Below we’ve compiled a few common examples as well […]

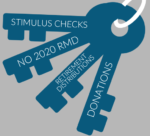

Keys from the CARES Act – What You Need to Know

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on Friday, March 27, 2020. This legislation provides relief for individuals and businesses negatively impacted by the coronavirus pandemic. Though the scope of the package is extensive, we will focus on a few key points for individuals. Below is a summary of […]

Eight Ways to Give

1. DONATE TIME Do you enjoy cooking? Are you good with computers? Do you care about music or sports? Call up your favorite charities and see what use they might have for your particular skill set. Or if you’re passionate about a certain charity – ask them where they need help – they can help […]

Simple and Smart Year-End Planning Moves

This blogpost was originally published in September of 2016. Relevant information has been updated for 2018. The “relatively” quiet period between Thanksgiving and Christmas is a perfect time to do some last-minute year-end planning, particularly those that have an expiration date of December 31. Income Tax Mitigation By this time of the year, you should have […]

This Useful Feature Could Simplify Your Charitable Donations

Thanks to the Qualified Charitable Distribution (QCD) provision, more retirees with charitable commitments are utilizing their IRAs – and often satisfying their required minimum distributions (RMD) in the process. However, the procedure can be time-consuming. The challenges include filling out the necessary paperwork for each charity, verifying the charitable organizations’ status, deciding amount (and frequency) […]