1. DONATE TIME

1. DONATE TIME

Do you enjoy cooking? Are you good with computers? Do you care about music or sports? Call up your favorite charities and see what use they might have for your particular skill set.

Or if you’re passionate about a certain charity – ask them where they need help – they can help you find the right opportunity for you! VolunteerMatch.org can also help you find volunteer opportunities near you.

2. DONATE ITEMS

2. DONATE ITEMS

Do you have a couch that’s been sitting in your garage for years? Or just need to get rid of some old clothes? Organizations such as Goodwill accept most household items, and allow you to take a tax deduction for items donated. Goodwill provides a “Value Guide” for donations given.

3. DONATE OLD TECH GEAR

3. DONATE OLD TECH GEAR

Recycle your old tech gear by donating it to a charity, giving it to a local school, or donating it to a local nonprofit. For example, Goodwill partners with Dell to recycle and refurbish electronics while Free Geek is a Portland charity specializing in making technology available to the community.

4. TEACH YOUR FAMILY ABOUT GIVING

4. TEACH YOUR FAMILY ABOUT GIVING

If charitable giving is important to you, teach your family about why it’s a priority. You can share some of your favorite charities or even make a gift to a charity in someone else’s name. Involving children and grandchildren in your favorite charitable organizations will empower them with hands-on, front-line experience about various meaningful causes.

5. DONATE CASH

5. DONATE CASH

This is one of the simplest ways to give. If you are over the minimum age requirement of 70½, taking a Qualified Charitable Distribution from your IRA can be a tax-effective way to give. Contact us about utilizing this feature.

6. DONATE COLLECTIBLES

6. DONATE COLLECTIBLES

Collectibles—such as artwork, antiques, and jewelry—may be prime items for donations. These items are best gifted or bequeathed to a “matching” charity, giving them a chance to benefit and educate more people. However, these gifts are complicated and require technical expertise from different aspects to work together. Click here to learn more about this.

7. DONATE APPRECIATED ASSETS

7. DONATE APPRECIATED ASSETS

This can be one of the most effective ways of giving. Say you purchased a stock 10 years ago for $1,000, and today it’s worth $10,000. Rather than selling the stock, paying capital gains tax, and giving cash to the charity–eliminating capital gains tax. Many charities will accept stock gifts – just ask or let us help!

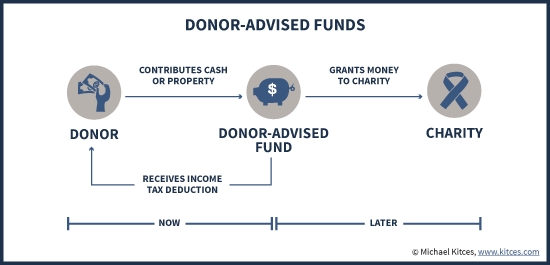

8. DONATE USING A DONOR ADVISED FUND

8. DONATE USING A DONOR ADVISED FUND

Another way to gift appreciated assets is through a Donor Advised Fund (DAF). Many DAF sponsors are capable of not only accepting cash and securities, but also complex properties like the ones mentioned above. Through using a DAF, you can take a tax deduction for the current year, even if you want to decide which charities to give to at a later time (see the graphic below).