Americans are feeling the pain of inflation – at the pump, at the grocery store, and across the board. One investment, however, is actually made more attractive by the current inflationary environment.

What Are I Bonds?

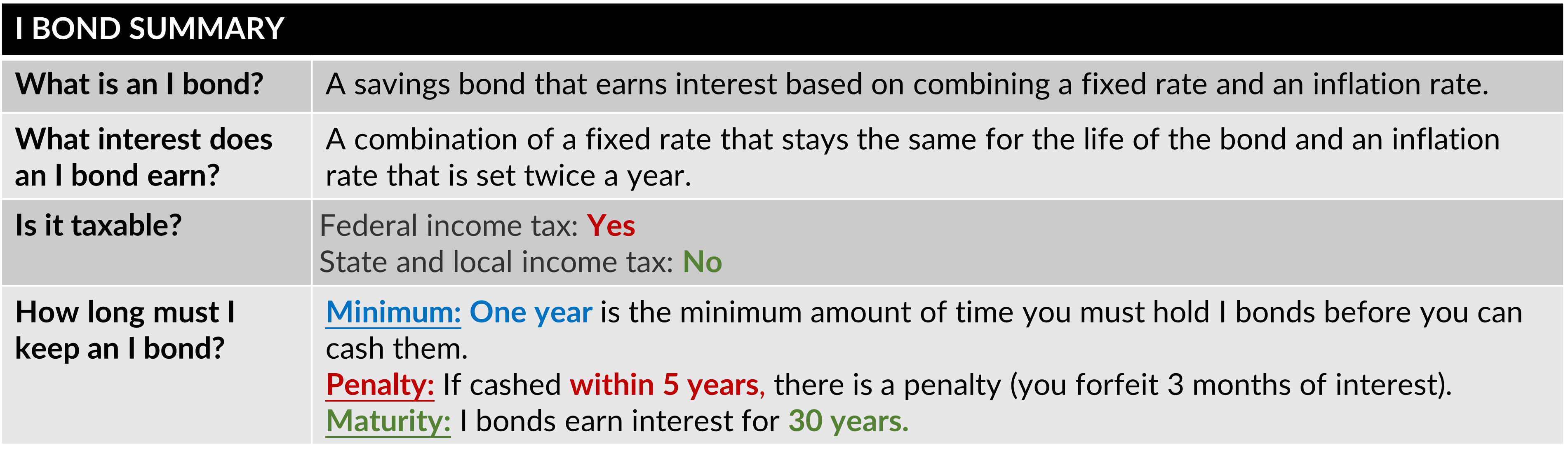

Series I savings bonds, also known as “I bonds” are backed by the U.S. government and pay both a fixed rate and an inflation-adjusted variable rate. The Variable rate is updated every six months based on the Consumer Price Index.

Why now?

Currently, investors can buy I bonds at a 9.62% interest rate through October 2022. I bonds have not been this attractive in years. **UPDATE: I bonds issued between November 1, 2022 and April 30, 2023 have an interest rate of 6.89%.

What’s the catch?

I bonds are illiquid for one year, but after that period may be cashed at any time. However, if cashed within five years, the investor forfeits the last three months of interest.

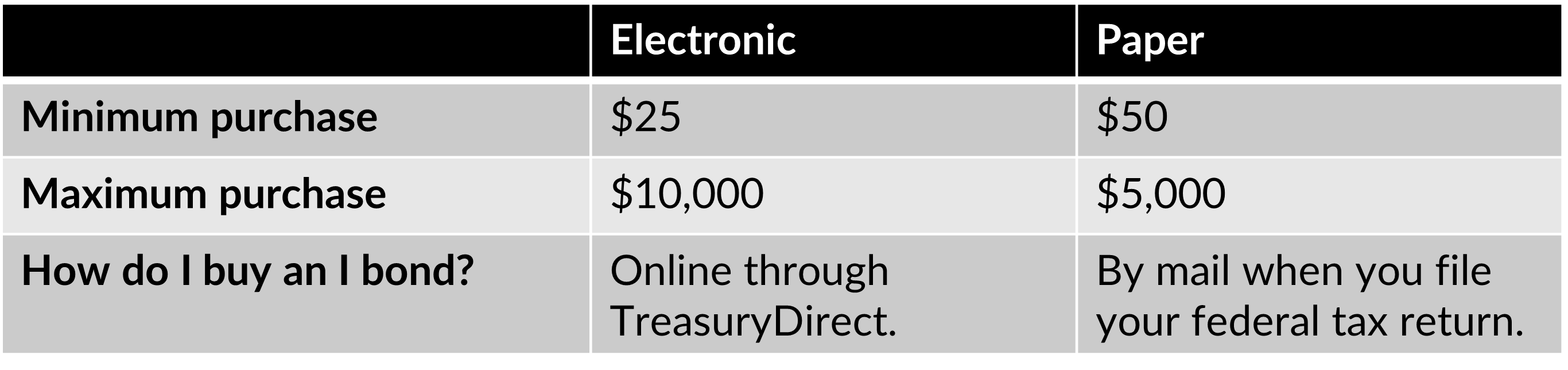

Additionally, investors are limited to $10,000 worth of electronic I bonds each year. Investors may purchase an additional $5,000 of paper bonds with their tax refund (see the TreasuryDirect website for more details).

More importantly, because the variable component of the interest rate is based on CPI, should inflation ease or disappear, I bonds will become much less attractive.

I bonds must be purchased directly from the Treasury. Therefore, we are unable to help facilitate this transaction.

How do I purchase I Bonds?

Purchase I bonds by going to treasurydirect.gov. I bonds must be purchased directly from the Treasury, and therefore we are unable to help facilitate this transaction.

Use this helpful blog post or the YouTube video below for a step-by-step guide to navigating the TreasuryDirect website and purchasing I bonds.

Questions?

Questions?