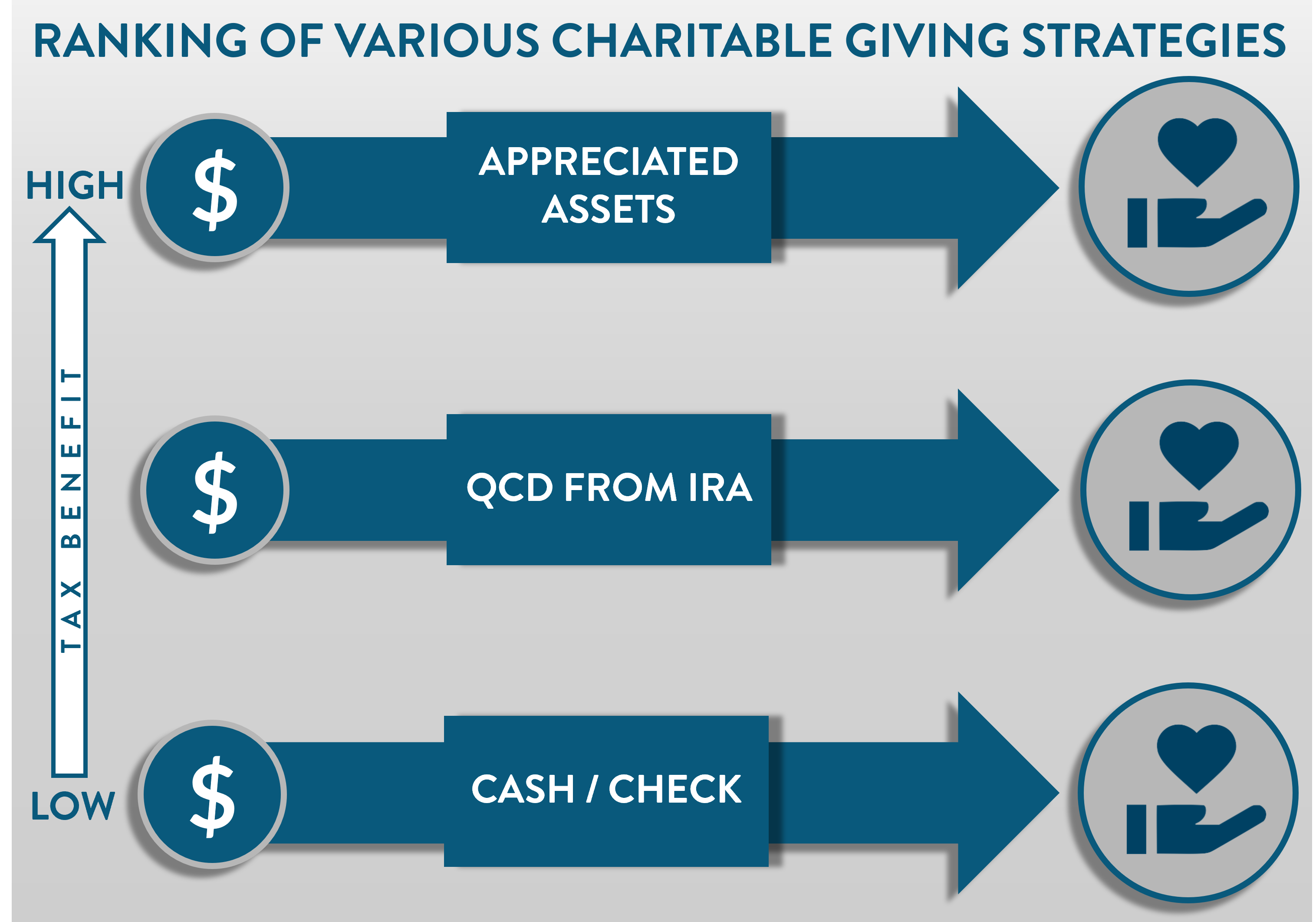

When there are so many options for how to give, how can we determine which is best? The answer is – it depends! There is a lot that varies based on your individual circumstances, which is why it’s important to seek out advice along the way. Below we’ve compiled a few common examples as well as some graphics to help you further understand the benefits and implications of various types of gifts.

METHOD 1: DONATE APPRECIATED ASSETS

Why donate appreciated assets rather than cash?

Cash donations are undoubtedly the fastest and simplest way to give – but often there are more tax-efficient ways to make donations to your favorite charities.

Let’s take, for example, Jack and Jill – a retired couple who would like to make a gift to their favorite charity.

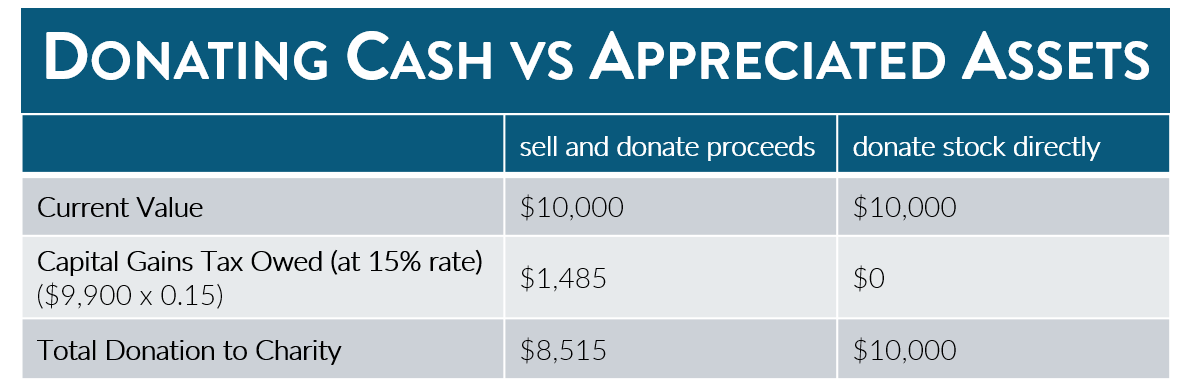

Jack and Jill have a joint taxable account comprised of stocks. In that account, they hold 100 shares of company XYZ stock that they originally purchased for $1 each. Over the course of many years, the value of the shares has increased to $100 each!

Jack and Jill could sell those shares of XYZ stock and donate the proceeds to the charity, OR they could gift the stock directly and avoid having to pay the capital gains tax. Check out the chart below to see how donating appreciated assets can be a superior way to give!

METHOD 2: DONATE USING QCDs

What is a Qualified Charitable Distribution (QCD)?

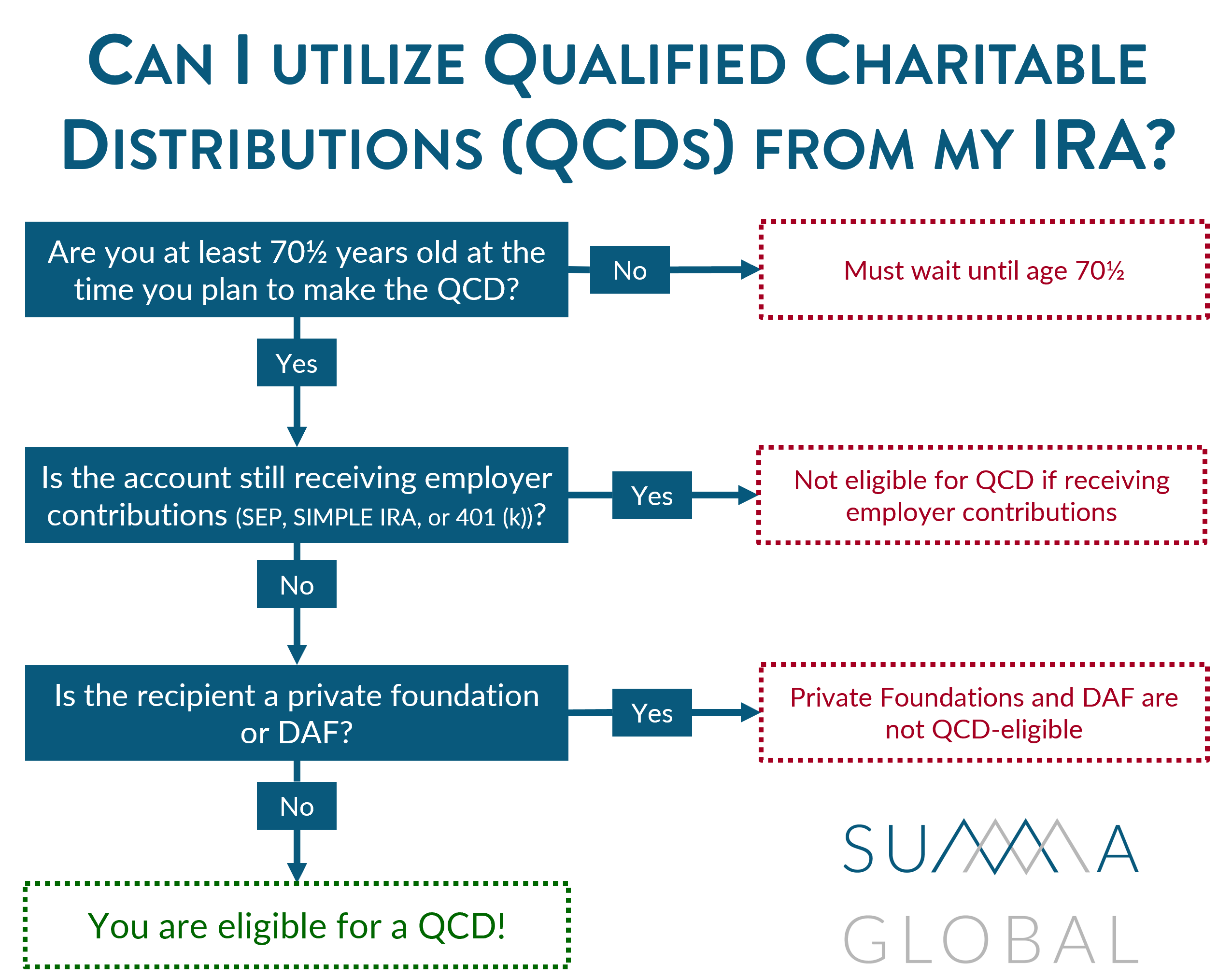

A QCD is a cash-only direct transfer of funds from your IRA made payable to a qualified charity. A QCD excludes the amount donated from taxable income, meaning that even if you don’t itemize on your tax return, you can still take advantage of the tax benefits of a QCD.

Check out the following flowchart to see if you’re eligible to use QCDs.

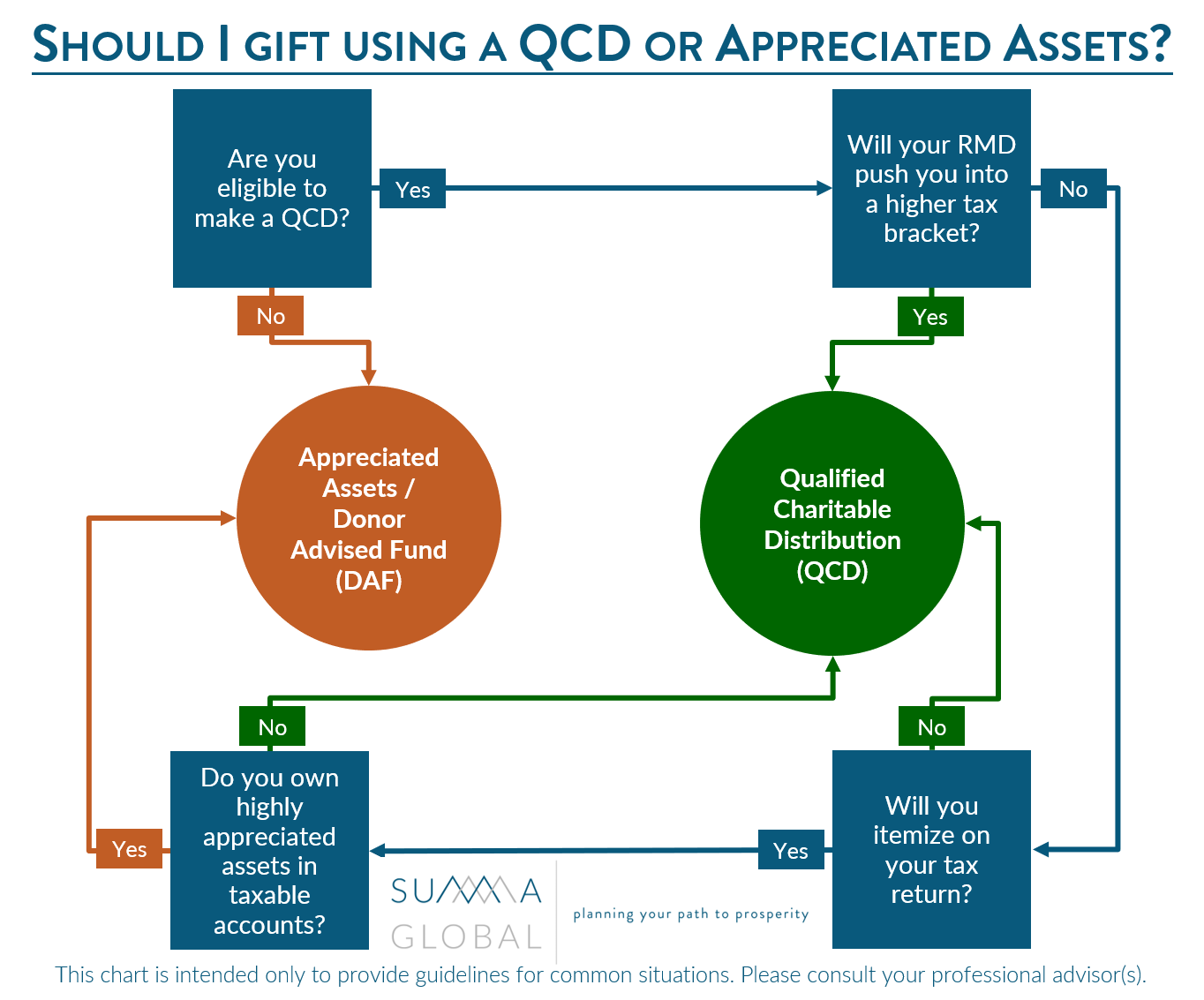

How can I determine if it is more favorable to donate using QCDs or appreciated assets?

Consider the following chart and examples.

EXAMPLE 1 (Appreciated Assets more favorable):

As an example, let’s consider Jack and Jill’s situation once more.

In addition to the QCD stock they hold in their taxable account, Jack has an Individual Retirement Account (IRA). Since he is over the age of 72, he is required to take Required Minimum Distributions (RMD), which is approximately $10,000 for this year.

Jack and Jill are trying to decide if it would be of more benefit for them to make Qualified Charitable Donations (QCDs) from Jack’s IRA or to gift the XYZ stock in their taxable account.

Though there are several factors to take into consideration, given the relatively small RMD that Jack has to take and the significant capital gains tax savings Jack and Jill would enjoy from gifting their XYZ stock and the fact that they intend to itemize on their tax return, it would likely benefit them more to give the stock in this scenario.

EXAMPLE 2 (QCD more favorable):

As we’ve seen, gifting appreciated assets can be an incredibly effective way to give. In what situations, then, might it make sense to use a QCD to gift instead?

Let’s take, for example, Anne, an eighty-year-old widow whose assets are primarily held in an IRA. Anne’s RMD for this year is $65,000. She does not plan to itemize on her tax return, and, when combined with her other income, taking her entire RMD will push her into the next tax bracket.

Anne has a list of ten charities she likes to support with gifts each year. She decides to gift $2,000 to each of them using QCDs. Since she is utilizing QCDs, the $20,000 she donates will not count toward her taxable income. She is still required to take the remaining $45,000 out of her IRA, but since she was able to decrease the amount of her taxable income by making QCDs, she will not be pushed into the next tax bracket.

METHOD 3: DONATE USING DAF

What is a Donor Advised Fund?

Let’s return to Jack and Jill and their charitable donation. In the above example, they know exactly which charity they wish to gift to, and thus it makes sense to gift the stock directly.

Suppose, however, that they knew that they wanted to make a gift, but were still working out exactly which charities they wanted to donate to. This is where having a Donor Advised Fund (DAF) comes in handy. With a DAF, Jack and Jill can transfer the stock into their DAF now and decide later which charities they would like to benefit.

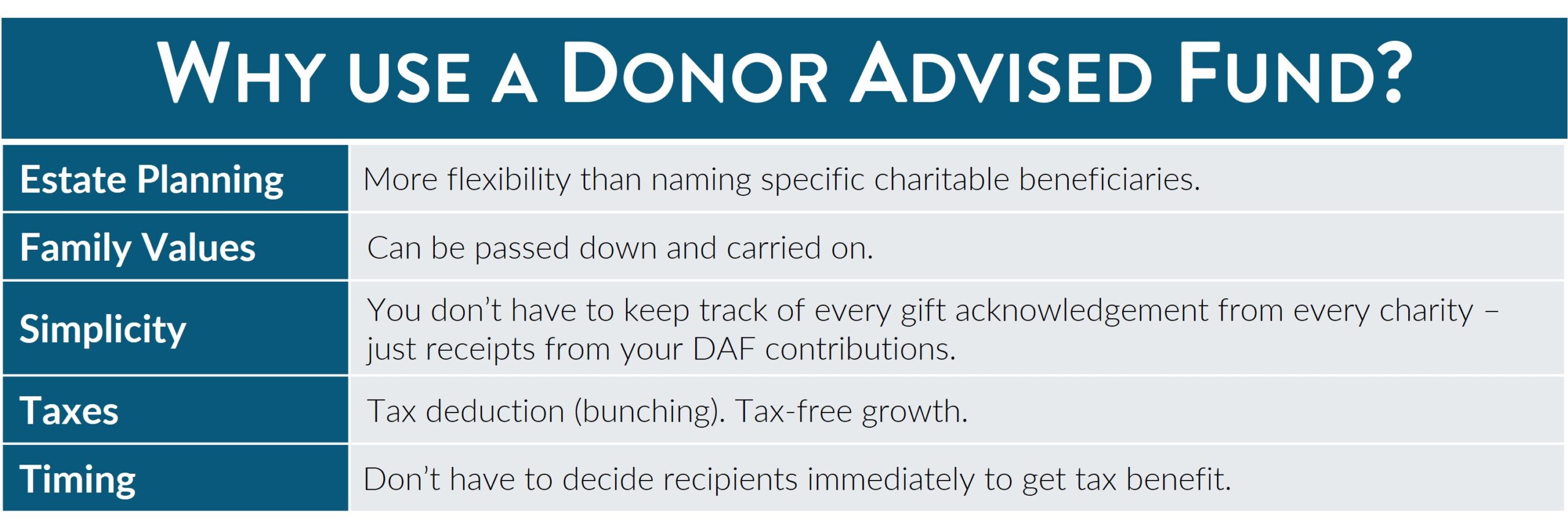

Why use a Donor Advised Fund?

Is a DAF right for me?

Take this six-question quiz from Fidelity Charitable.

WHICH OF THESE THREE METHODS IS BEST FOR ME?

In short – it depends! We’d love to talk with you about what’s best for your unique situation.