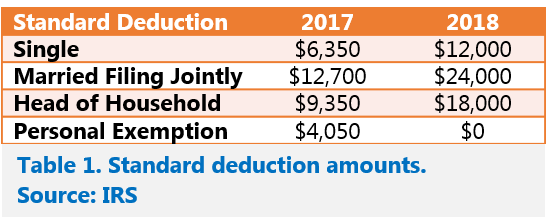

Starting this year, standard deduction will almost double (Table 1), although personal exemption is eliminated. It is estimated that only 1 in every 10 returns will benefit from taking the itemized deduction, versus 30% of all returns that itemized, based on 2013 IRS data.1 Moreover, the $10,000 ceiling on state-and-local-taxes (SALTs) further reduces the need for taxpayers to keep track of their deductions.

Many fear that public charities would bear the brunt of the Tax Cuts and Jobs Act (TCJA) as would-be donors would become reluctant to give due to the lack of the tax deductibility. However, when high-net-worth individuals2 were asked about why they gave to charities, only 10% cited tax burden reduction as the primary reason, while less than half would reduce their giving if income tax deductions were eliminated.3 With that said, certain philanthropic strategies and vehicles are worth a deeper look because they may provide tax savings that would otherwise be lost.

Charitable Giving Basics

Before diving in, let us revisit some of the key issues of giving.

- Cash donations still make up the vast majority of all giving, and the deduction limit is 60% of adjusted gross income (AGI).

- Appreciated securities are another popular and excellent choice. The deduction limit is 30% of AGI.

- Never donate securities whose market values are below their cost basis.

The following table provides a simple illustration between donating cash and donating appreciated stock.

Donor-Advised Funds More Appealing Than Ever

Donor-advised funds (DAFs) are your own little charity! Read my Ultimate Guide to Donor Advised Funds for everything you need to know about them. DAFs are best when combing charitable intent and tax planning. There may be years that you would benefit from making a sizable donation, but you do not have any charities in mind. A donor-advised fund can solve that problem. Your contribution (cash or appreciated securities) would go into your DAF first in order to secure the tax benefit, and you could then make grants at a later time (while the DAF continues to grow).

Timing and Lumping Donations

While we are not a big fan of timing the market, employing this strategy for philanthropic reasons can reap tax savings. This strategy works particularly well for taxpayers whose itemized deductions are just below the standard deduction threshold; “lumping” deductions together within the same year can help them “clear the standard deduction hurdle,” according to Michael Kitces. Charitable donations, being the most flexible deduction item, are the best means to achieve this goal.

For a more in-depth analysis including calculations and examples, visit Kitces’ blog article.4

Retirees’ BFF: QCD

The alphabet soup of abbreviations in our everyday life keeps getting bigger and bigger, thanks particularly to the popularity of texting! Even seniors are catching up on the basics as well as having their unique set of LOLs!5 I hesitate to introduce yet more but it is of significant importance—QCD.

QCD stands for Qualified Charitable Distribution, and it only applies to retirees who 1) have IRA account(s) and 2) are over 70 ½ of age and, therefore, subject to Required Minimum Distribution (RMD). QCD allows these IRA owners to donate, directly from IRA funds, to public charities up to $100,000 each year, free of income tax, and the donations will be counted toward RMD. This provision was finally made permanent by Congress in 2015 after years of eleventh-hour renewal.

Why is QCD a retiree’s BFF? (Best Friend Forever, by the way, was “invented” by Facebook’s founder.) Because these tax-free donations directly reduce the senior’s taxable income, leaving room for other tax-planning opportunities such as realizing capital gains, preventing Medicare premiums from spiking, and even Roth conversions!

It was the intention of the Tax Cuts and Jobs Act to simplify individual’s tax situation but it is a daunting task to deal with all of the changes. Because of the new complexities, taxpayers and their advisors need to look at all available options in order to minimize tax liabilities. Talk to us today about your charitable giving plans and how the tax law changes could affect you and your family!

Footnotes:

1 https://taxfoundation.org/who-itemizes-deductions/

2 Individuals with $3 million or more in investable assets

3 U.S. Trust Study of the Philanthropic Conversation. October, 2013.

4 https://bit.ly/2HoEOBx

5 https://www.cartalk.com/content/texting-abbreviations-elderly